Mainland China banks embrace preferred shares but investors are left guessing

After Beijing's nod, mainland banks are preparing to issue 310b yuan in preferred shares, but complex rules add to the confusion in the market

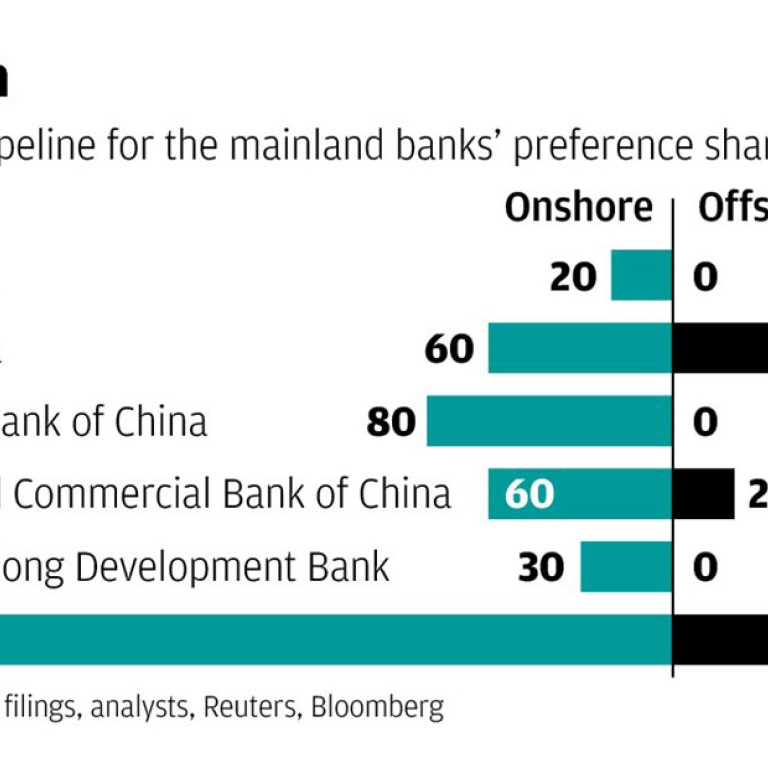

These are transformational times for the mainland banks as they line up about 310 billion yuan (HK$387 billion) of preferred share issuance, including a 20 billion yuan offer from Ping An Bank announced on July 15.

Industrial and Commercial Bank of China (ICBC) has mandated book runners for its offshore offer (said to be Bank of America Merrill Lynch, BNP Paribas, China International Capital Corp, Deutsche Bank, Goldman Sachs, ICBC and UBS) and Bank of China is expected to soon invite banks to pitch for its own offshore deal.

Citic Bank and Guangfa Bank are also sizing up plans for their own preference share offerings.

Preference shares are a kind of wonder security for the banks. They provide quasi-equity funding that can be applied against their tier-1 capital without diluting their return on equity. Furthermore, they let the bank raise this capital when a straight equity issue might not be possible because of rules prohibiting new share issues from banks trading below book value.

There are many complicated issues, [making it hard to price] these securities

However, investors and bankers are already complaining that such instruments are too inflexible.

After the China Securities Regulatory Commission (CBRC) was asked to approve a structure for tier-1 capital raising that would be compatible with Basel III guidelines, which China adopted in January last year, it came up with a preference share template in April this year that could be used to replenish the top tier of capital that banks use to protect against failure. It was the first time mainland banks were allowed to raise such capital except from equity or retained earnings.

But preference shares come with a requirement that the securities be priced in yuan, that all dividend payments be priced in yuan, and that the securities are placed to no more than 200 investors. The yuan restriction was introduced to protect issuers from foreign exchange risk, and the investor limit was designed to restrict issuance to deep-pocketed professional investors.

Nevertheless, the restrictions add layers of complexity to an already challenging programme. Some are questioning, for example, whether banks will be able to issue at the size they intend if only 200 investors can participate.

The restrictions are also, in a way, self-imposed, because the CBRC guidelines to banks allowed for a much wider range of instruments banks could use to raise tier-1 capital. For example, banks could issue US dollar perpetual bonds that, with the right structuring, would qualify comfortably as a Basel III-compliant tier-1 instrument.

Indeed, Citic Bank issued such bonds in April. It did not have to use preference shares because it was exclusively an offshore transaction - it was issued offshore and the proceeds stayed offshore.

"What has happened in China is, through confusion or momentum, when people now talk about preference shares, they mean tier-1 capital," said a Hong Kong-based debt capital markets head with a global bank.

Investors see preference shares as more equity-like than perpetual bonds, which means they may trade with greater price volatility and be more exposed to write-downs.

Jamie Grant, the Hong Kong-based head of Asia fixed income for First State, said that while perpetual bonds were not required to have a fixed coupon, they mostly did, while preference shares usually had a discretionary dividend rate. Preference shares also traditionally ranked only ahead of equity in the case of a liquidation.

"The further you get down the capital structure the more correlated it will be with equity … most [fund] mandates would not allow pref shares," said Grant, adding: "Pref shares in a fixed-income fund doesn't seem right."

Grant said that while First State did not take part in Citic Bank's perpetual bond offer in April, he would be open to investing in the structure if the price was right.

When mainland banks bring out their first tier-1 preference shares, investors will have a lot to comprehend.

They will have to understand how equity-like the instrument will be. They will have to understand the conditions under which the regulator may force investors to take a loss on the instrument - a feature common to all Basel III instruments, but one made more complicated on the mainland given the capriciousness of it market regulators and the lack of transparency on banks' balance sheets.

ICBC is expected to be the first mainland bank to bring an offshore preference share issue, just as it was the first mainland bank to issue an offshore Basel III-compliant subordinated bond, in October last year. ICBC is the most profitable and best capitalised mainland bank, so failure is highly unlikely.

"There are many complicated issues and investors will have difficulty pricing these securities," said Moody's analyst Christine Kuo Su-tsen.