HSBC corporate clients in 24 markets offered use of facial recognition technology

Largest lender in Europe and Hong Kong to push facial recognition while Citi focuses on voice, as major players embrace latest fintech

HSBC is to introduce facial recognition technology for its corporate clients in 24 markets worldwide, including Hong Kong and mainland China, instead of them having to use passwords to log onto their mobile accounts.

The bank said the latest move will improve efficiency as well as add further security against fraud.

The largest lender in Europe and Hong Kong, HSBC said on Friday that corporate customers can use the new technology on mobiles, using its HSBCnet mobile app, claiming it will speed up log in times to less than a second.

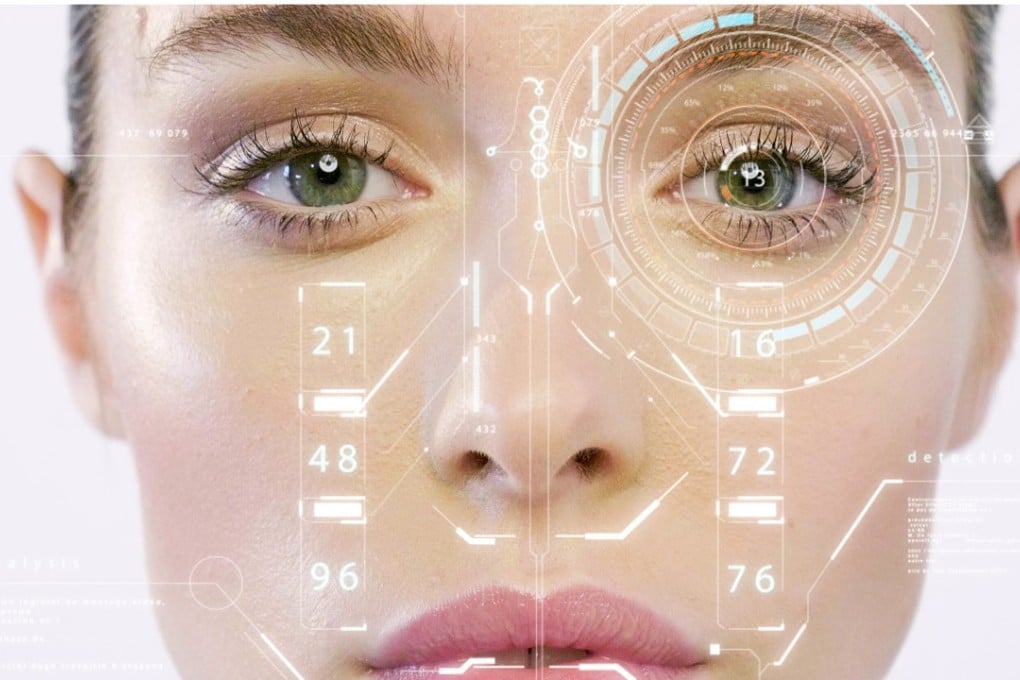

Facial recognition technology works by analysing over 30,000 reference points on a person’s face to create what’s called a “depth map” of their features.

HSBC’s new system connects securely to the bank’s “mobile application programming interface” (API) – software which authenticates the user – which claims less than a one-in-a-million chance of mistaken identity.

Diane Reyes, global head of liquidity and cash management of HSBC, said its customers are benefiting from using the convenience of HSBCnet, and now they can enjoy the added security of the introduction of facial ID technology.