Update | China stocks extend rally as CSRC denies cashing out

Recovery in home prices and regulator’s pledge on rescue funds power market momentum

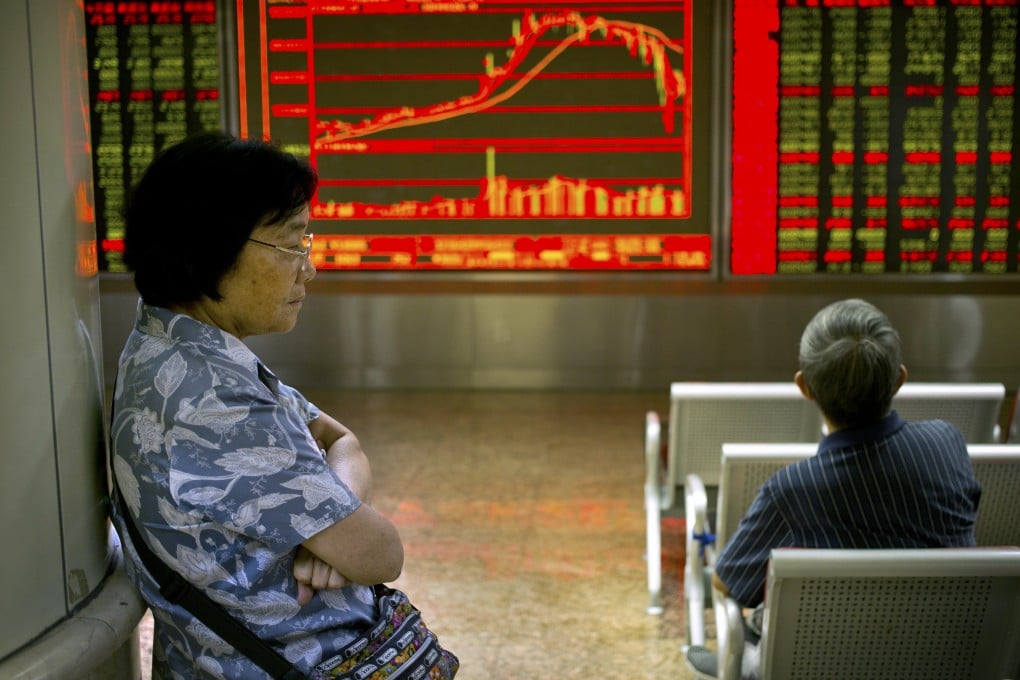

Mainland Chinese stocks rose on Monday for the third consecutive trading day, led by technology and property shares, as fresh data showed improvement in the property market and the securities regulator reiterated there was no plan to withdraw funds pumped into the market in recent days.

The Shanghai Composite Index swung between gains and losses in volatile trade before ending in positive territory.

Profit taking ensured it stayed below the psychologically important 4,000-point level, even after a China Securities Regulatory Commission spokesman denied a report by Caijing magazine that Beijing was mulling plans to pull out capital it had injected into the market over the past two weeks.

The Shanghai index rose 0.88 per cent to close at 3,992.11 points, while the CSI 300 Index of the largest listed companies in Shanghai and Shenzhen finished 0.22 per cent firmer at 4,160.61 points.

The Shenzhen Composite Index jumped 1.82 per cent to 2,230.29 points and the ChiNext Index closed 2.33 per cent higher at 2,848.3 points.

The valuation gap between mainland Chinese A shares and their Hong Kong counterparts H shares continued to widen, with the Hang Seng AH Premium Index showing mainland Chinese shares are now nearly 44 per cent more expensive than their H shares.

The Hang Seng Index slipped 0.04 per cent to 25,404.81 points and the H-share index lost 0.64 per cent to 11,773.92 points.