Higher interest rates after HKMA intervention stoke property and stock worries

The HKMA has bought up to US$6.5b of the local currency over the past week to shore up the Hong Kong dollar, which hit its lowest level in 35 years

With the gap between the cost of money in Hong Kong and the US closing after the Hong Kong Monetary Authority’s recent intervention to shore up the local currency, the city is bracing for a regime of tighter liquidity and higher interest rates.

For the past three years, even as the HKMA increased its base rate six times in lock step with the US Federal Reserve, local commercial banks have managed to keep lending rates low, thanks to the abundant inflows into the city’s assets.

So much so that some market watchers are worried about the potential impact of higher borrowing costs on the city’s red hot property and equity markets.

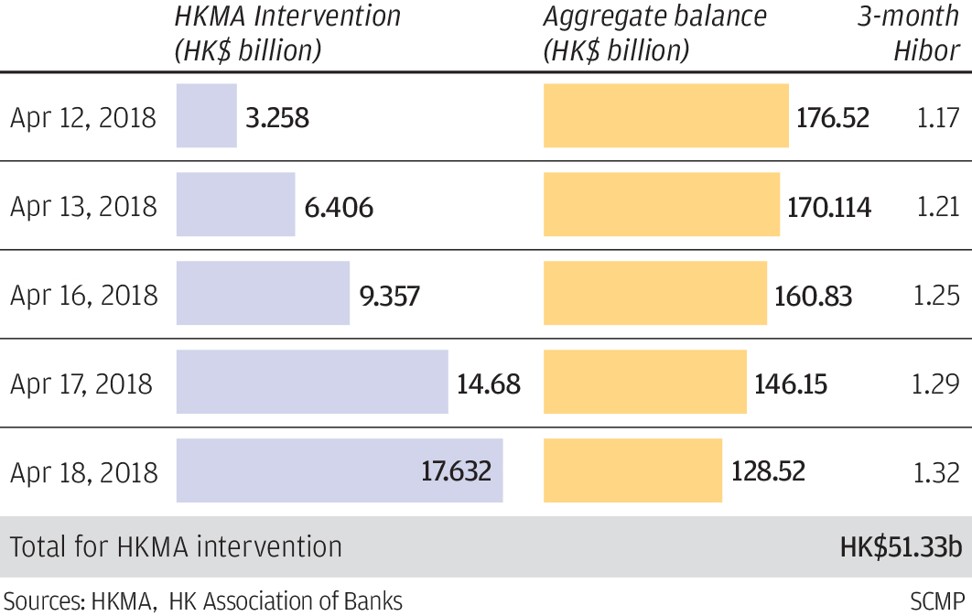

Hong Kong Monetary Authority bought HK$51 billion to stabilise currency

The HKMA has used HK$51 billion (US$6.5 billion) of its US$440 billion in foreign reserves over the past week to purchase the local currency, mopping up cash from the banking system, which could finally compel commercial banks to raise rates to be in sync with their US counterparts.

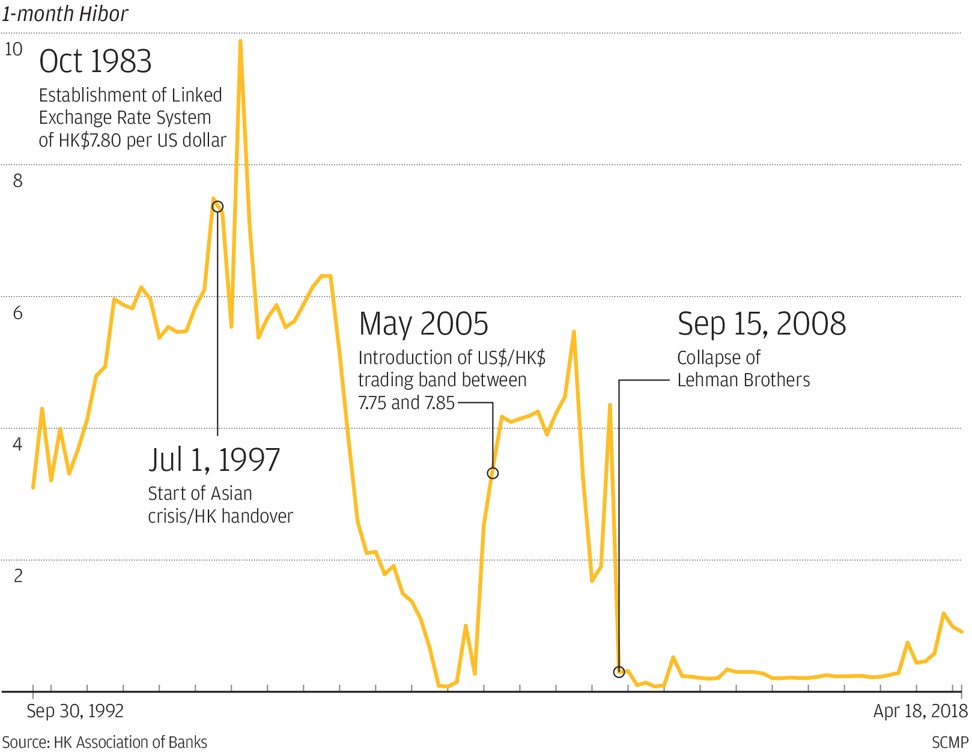

Higher borrowing costs will translate to higher mortgage repayments for homeowners while other debtors may also need to roll over old debt into higher interest rates that will add on new loans, analysts said. Banks may also shrink lending, which could force investors to liquidate their stock holdings, playing out a domino effect that hit Hong Kong in the Asian financial crisis in 1997 when the overnight Hibor rate soared to 280 per cent.

Hong Kong’s property prices, rising with no sign of letting up, are already among the highest in the world. Property-related lending accounted for 45 per cent of the banking sector’s loans in Hong Kong as of December 2017, according to S&P.

The city’s benchmark Hang Seng Index remains about 9 per cent lower than its all-time record high of 33,484 points hit at the end of January.

I believe the day of reckoning is soon. Because your debt is at excessive levels, once your interest rates go up then you get into deep trouble

“The full extent of this (interest rate) risk does not appear to be priced into the equity market,” said George Efstathopoulos, portfolio manager at Fidelity International.

“Real estate stocks in Hong Kong appear at risk of underperforming the market while downward pressure remains on the Hong Kong dollar.”

Others, like Henry Chan, head of research at Caitong International Securities, expects a bigger stock market correction this year as foreign investors are likely to reduce their holdings on the relatively expensive Hong Kong dollar-denominated assets in property and stocks, on expectations that corporate profit growth will slow.

HKMA intervenes for a third day amid persistently weak currency

Chan said the 20-per cent growth in bank loans was poised to slow sharply as the current credit-to-gross domestic product ratio of over 400 per cent was unsustainable.

“I believe the day of reckoning is soon,” Chan said. “Because your debt is at excessive levels, once your interest rates go up then you get into deep trouble.”

Hong Kong was given the red signal for its credit-to-GDP gap and debt service ratio by the Bank of International Settlements in the latter’s March quarterly report that suggested a looming banking crisis.

The Hong Kong dollar has been slumping for a long while, as foreign exchange traders piled into arbitrage called the carry trade, which sells low-yielding Hong Kong dollar assets to buy higher-yielding US-dollar ones, to take advantage of the price difference between the rates.

The city’s dollar has been pegged at 7.8 to the greenback since October 1983, with a trading band of 7.75 to 7.85 introduced in 2005. Under this mechanism, the HKMA is obliged to intervene in the interbank market to prevent the currency from trading beyond that range.

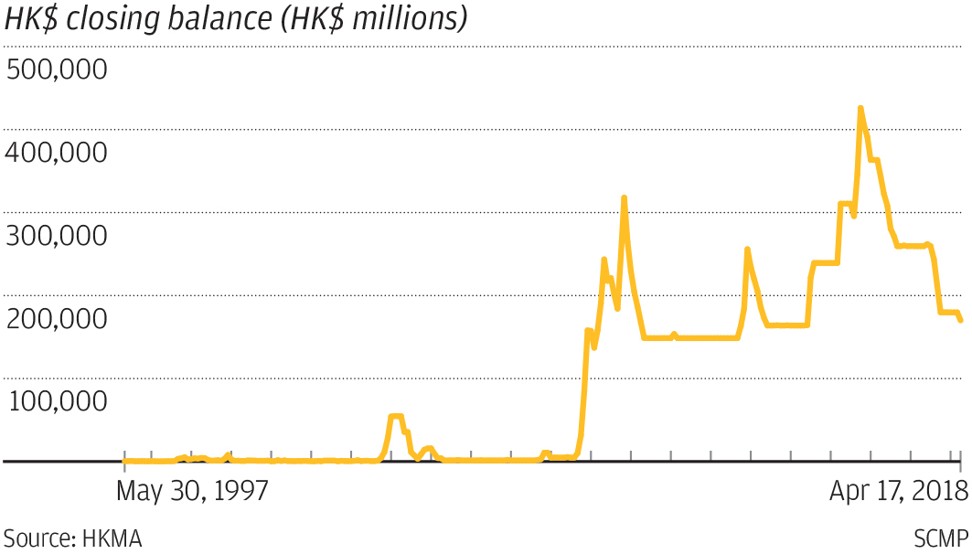

The HKMA’s purchases cut the aggregate balance of liquidity to HK$128.52 billion from around HK$180 billion last Thursday, but analysts expect that to drop further to between HK$50 billion and HK$100 billion in the next two months.

Analysts pointed out that the HKMA should take a more pro-active approach to shore up the currency amid the prevailing risks of a US-Sino trade war, which could fuel outflows and the pressure to not only depreciate the currency, but also to increase lending to support economic growth.

As such, the People’s Bank of China has already announced this week that it will cut banks’ reserve requirement ratios to ease liquidity, ahead of a potential worsening of trade tensions, analysts said.

“You do not really have unlimited ammunition,” said Frances Cheung, head of macro strategy, Asia, at Westpac Banking Corp. “The market can become panicky when reserves run down quickly and you find yourself with much bigger outflows than expected.”

Hong Kong dollar spikes as short positions cut on higher rate expectations

Instead of passively waiting for outflows that will push the currency to hit the weak end of the peg, Cheung said the HKMA should issue extra exchange fund bills and notes (EFBN) or conduct foreign-exchange operations, or do a combination of both before it hits HK$7.85 per dollar.

The market can become panicky when reserves run down quickly and you find yourself with much bigger outflows than expected

Bill issuance means shifting liquidity from the interbank market to the bills market, with no change in the monetary base.

Cheung said they were a pre-emptive and more flexible policy option that allowed the regulator to redeem the bills and release funds back into the banking system under stressed market conditions.

HKMA chief executive Norman Chan Tak-lam said last December there were no plans to sell additional EFBN and the regulator was not aiming to curb depreciation pressure. His comments could have reflected an underlying worry that any bill issuance would be seen to contradict Hong Kong’s laissez-faire practices and currency board system.

The HKMA was harshly criticised for its decision to squeeze interbank rates up to 280 per cent to drive out currency speculators in the 1997 Asian financial crisis.

Carie Li Ruofan, economist at OCBC Wing Hang Bank, forecasts Hong Kong banks will raise their prime lending rates twice by 25 basis points this year starting in June, after keeping them unchanged at 5 per cent for large banks since 2008.

HKMA ensures Hong Kong assets are a safe bet despite weak dollar

“The Hong Kong dollar has stabilised in recent days, but may soon be retested at the 7.85 weak end again,” Li said.

The Hong Kong dollar traded at HK$7.84 per dollar on Friday evening.