Analysis | Hong Kong’s nearly HK$2tr fiscal reserves should be spent, to benefit the people who own them

It’s the Hong Kong people’s money – but is it wise or insane to hold onto so much of it?

Thanks to land purchases made largely by mainland Chinese developers, who have been paying eye-watering prices, Hong Kong’s latest budget forecast total fiscal reserves to stand at HK$952 billion (US$122.52 billion) by the end of March 2018.

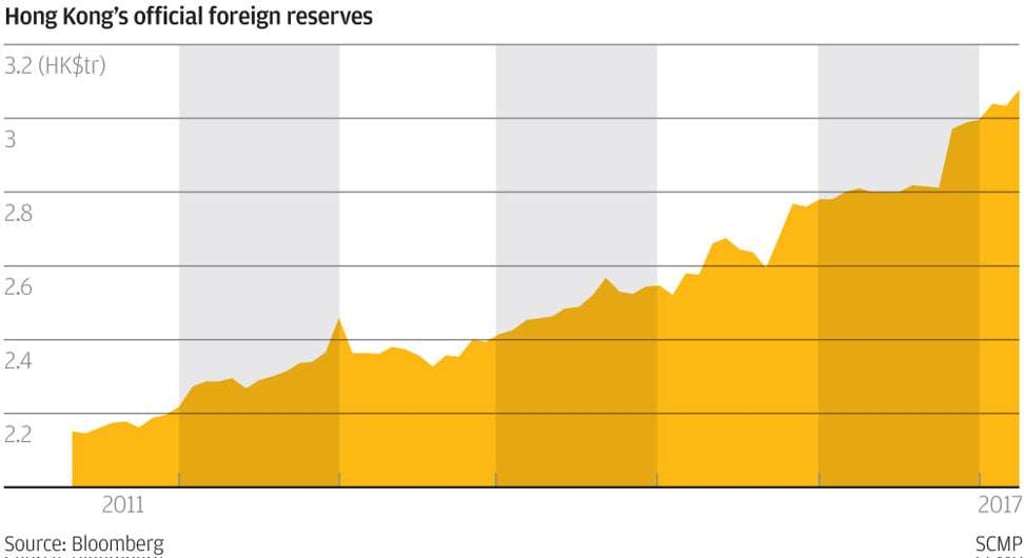

Add in various piles of cash the government has scattered about and it’s closer to HK$1.8 trillion, and none of this includes reserves held separately by the Hong Kong Monetary Authority.

Sir Hamish Macleod, who served as Hong Kong’s financial secretary from 1991-95, used to refer to a surplus of 18 months’ spending as the “golden rule”.

So how much in reserve is enough, or too much? Is keeping it lying around unspent the best use of it? What would you spend it on? And whose money is it, anyway?

The answer to the last question is easy – it’s the Hong Kong people’s money. The others are harder to answer.