Evergrande’s woes: investors take opposite sides as they size up the potential impact ahead of looming repayment deadline

- BCA Research warned that investors should not underestimate the “determination” of Chinese policymakers to clamp down on property

- Taking a more sanguine view is Ray Dalio of Bridgewater Associates, who said the developer’s debt is “manageable”

“The near-term response in the equity market is likely to be very negative,” BCA Research’s strategist Sima Jing wrote in a September 21 note to clients. “China-related asset prices will not stabilise until policymakers decisively and significantly dial-up their reflationary response.”

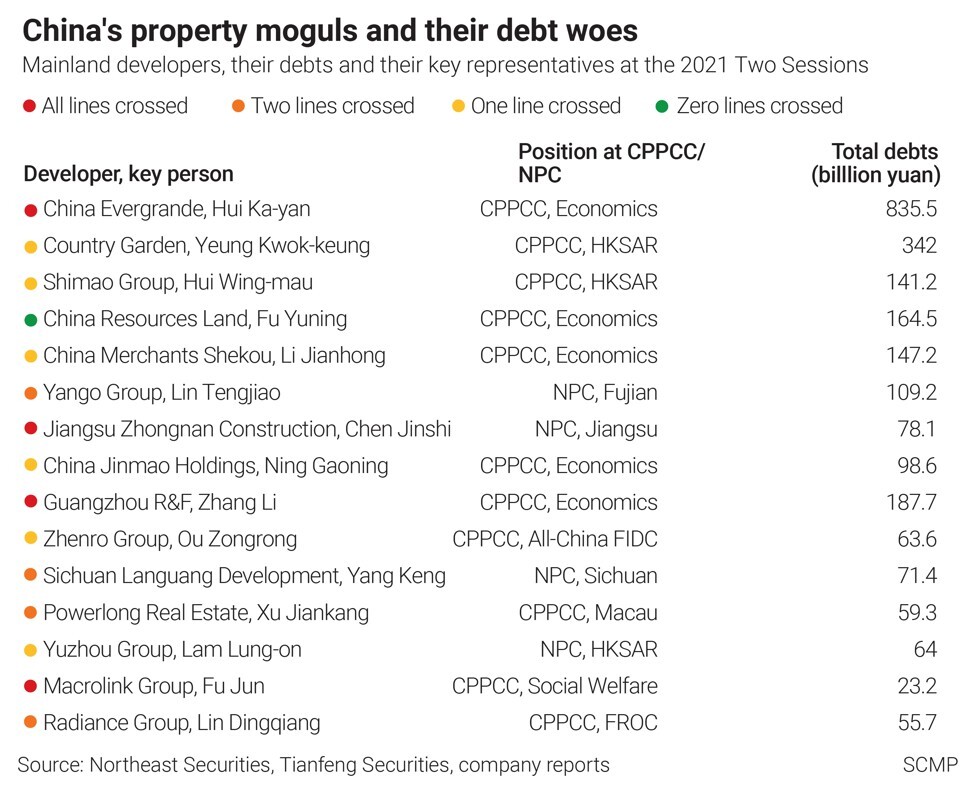

The divergent views underscore how global investors are sizing up whether the financial viability of Evergrande, with US$300 billion of outstanding liabilities, is tantamount to what has been dubbed China’s “Lehman moment,” referring to the potential collapse of a large financial institution that requires a state bailout. Evergrande, which faces a US$119.4 million liquidity test this week when interest payments are due on two notes, said it has reached an agreement with bondholders to pay at least the smaller, renminbi-denominated part of the obligation valued at 232 million yuan (US$36 million).

Evergrande shares have collapsed by 84 per cent this year, while its dollar-denominated bonds crashed to distressed levels of about 30 cents on the dollar. The Hang Seng Index fell 3.3 per cent on Monday to near a one-year low following a sell-off in bank and property stocks. Markets in Hong Kong are closed on Wednesday for a holiday.

The Shenzhen-based developer, whose liabilities are estimated at 2 per cent of China’s gross domestic product, is roiling the market as it started asking lenders for reprieve this week. Losses in the firm’s equity and bonds have accelerated this month, without any significant intervention from regulators.

BCA Research remains “underweight” on Chinese equities, even if valuations have fallen, after downgrading their ratings in January as regulatory tightening and economic slowdown combined to temper the outlook. China’s crackdown on private businesses and the latest drive for “common prosperity” have also dented sentiment, the research firm said.

“Investors should not underestimate Chinese policymakers’ determination to clamp down on the property sector, as well as other industry leaders that fall under the ‘disorderly expansion of capitals and market shares’ category,” Sima wrote. “We do not rule out the possibility that policymakers will be overconfident in their capability to stabilise the financial markets as they balance structural reforms against market volatility.”

Holding the opposing view is one of Wall Street’s most famous investors, one who has been investing – and stayed bullish – in China since 1984.

“If your debt is your own currency, you can work it out,” he said in a Bloomberg interview on Tuesday, even if his investments have taken a beating during the last quarter. “We have seen it happen over and over again, and it’s a good thing that lenders get stung or that the borrowers get stung. That’s how the system works.”

Since there is no sign that policymakers will relax their tight restrictions on the sector’s leverage and business practice, real estate developers will refrain from taking on more leverage and the banks will not expand lending to the sector, BCA Research said.

“[Chinese authorities] may choose to wait until there are signs of a significant spillover to other segments in the economy before backtracking the deleveraging campaign in the property sector and lending more support to the market,” Sima said.

For now, the uncertainties and a lack of transparency associated with the policy response will continue to curb global investors’ appetite for Chinese assets, she added.