HNA Group’s fate hangs in the balance as coronavirus lockdowns scupper the Chinese asset buyer’s debt workout plan

- Hainan Airlines could be taken over and its aviation assets dispersed among three of Chinas biggest state-owned carriers, Bloomberg reported

- Executives at Hainan Airlines and its parent HNA Group declined, but posted a blog on HNA Group’s website showing the airline’s co-founder and chairman Chen Feng visiting flight and cabin crew

The fate of the HNA Group, one of the biggest global asset buyers to emerge from China in the past decade, hangs in the balance as its debt workout plan has been scuppered by a business slump caused by the coronavirus outbreak.

A seizure of Hainan Airlines, if true, would place the Haikou-based conglomerate – with 525.6 billion yuan (US$75 billion) in debt at the end of June 2019 – in peril as it is barely halfway through its debt workout.

HNA Group grew out of Hainan Airlines, which began in 1989 as a regional carrier flying between the provincial capital of Haikou with mainland China. The airline grew quickly, enabling the HNA Group to be established in 2000 around the aviation assets, which by that time had bought Shanxi Airlines, Chan An Airlines and China Xinhua Airlines.

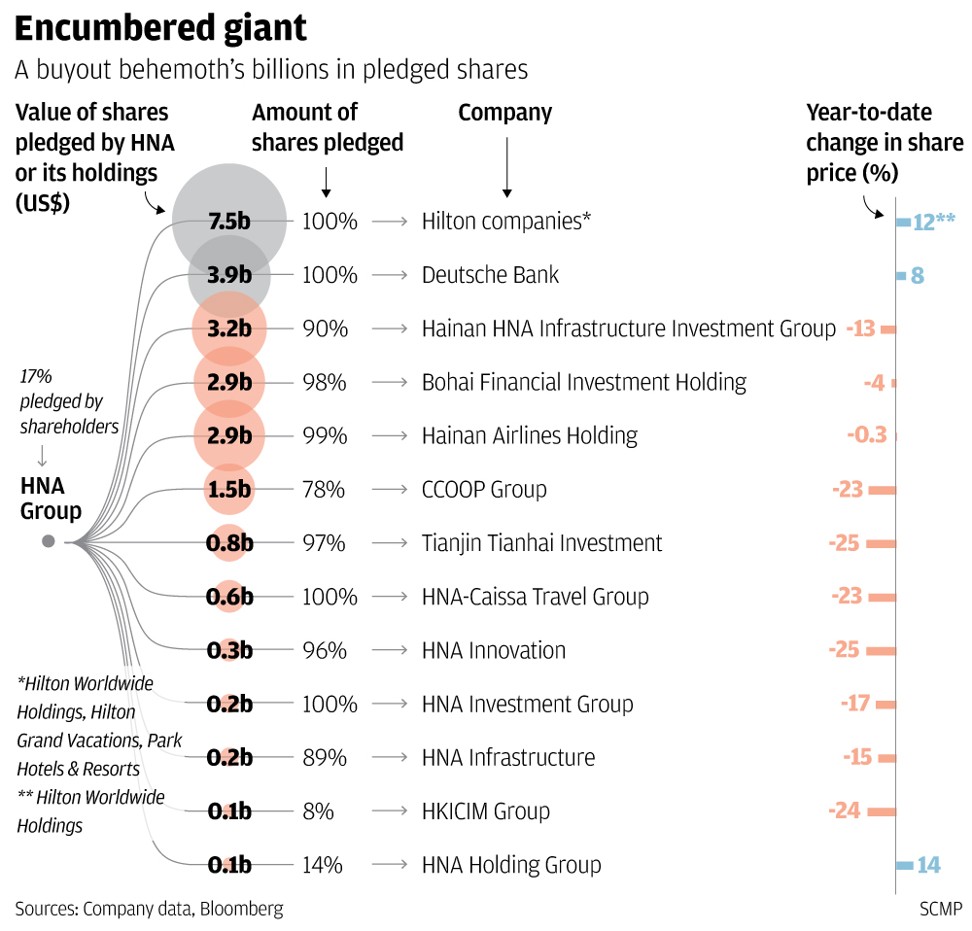

From its core aviation business, HNA quickly expanded, going on a global shopping spree that added a myriad range of companies and brands to its portfolio, from golf courses and a stake in Deutsche Bank to Manhattan office towers and waterfront land parcels in Hong Kong.

HNA Group reported a net loss of 1.08 billion yuan in the first-half of 2019, its second consecutive interim deficit. Operating profit, which strips out some non-cash expenses, fell 11 per cent to 11.8 billion yuan – the lowest since the end of 2016. While long-term borrowings fell to the lowest level since December 2016, short-term debt rose 9.7 per cent to 187.1 billion yuan.

That makes HNA Group more dependent on Hainan Airlines, China’s biggest non-state carrier by fleet which once counted American financier George Soros as a major shareholder, as the biggest income earner for the group.

The airline, with a route network of 110 destinations and a fleet of 233 aircraft, was expected to play a pivotal role in helping the HNA Group chart a course back to profitability. Third-quarter revenue at the carrier rose 10 per cent to 21.44 billion yuan according to its latest available financial results, making it the biggest quarterly turnover since 2009.

Hainan Airlines shares jumped by their 10 per cent daily limit on the Shanghai exchange to a five-week high of 1.76 yuan on news of the pending seizure of the carrier’s assets.

During the company’s 20th anniversary in 2013, HNA Group’s co-founder Chen and his five partners pledged to pass all their HNA stakes to the Cihang Foundation, established under the Hainan provincial government. Chen and Wang were directors of the foundation.

This year was meant to be the “decisive year” for HNA Group, Chen said in his new year message to employees, as company approaches a key turning point in its workout strategy.

But his best-laid plans ran into China’s coronavirus outbreak over the peak travel season of the Lunar New Year holiday, as dozens of cities and provincial authorities enforced lockdowns that prevented citizens from travelling either domestically, or overseas. The virus has sickened more than 75,000 people globally and killed, ore than 2,000 patients, most of them in mainland China.

In Hainan province, where HNA Group is based, 163 confirmed cases had been reported, with 14 deaths, according to the World Health Organisation’s February 19 Situation Report, ranked 20th out of 34 Chinese regions including Hong Kong and Macau.

Still, that has not spared Hainan Airlines from the travel slump, as 82 global destinations barred Chinese travellers from crossing their borders. The carrier flew 4.6 million passengers in January, 35 per cent fewer than a year ago, while its passenger capacity fell 21.2 per cent to, according to data released on February 17.

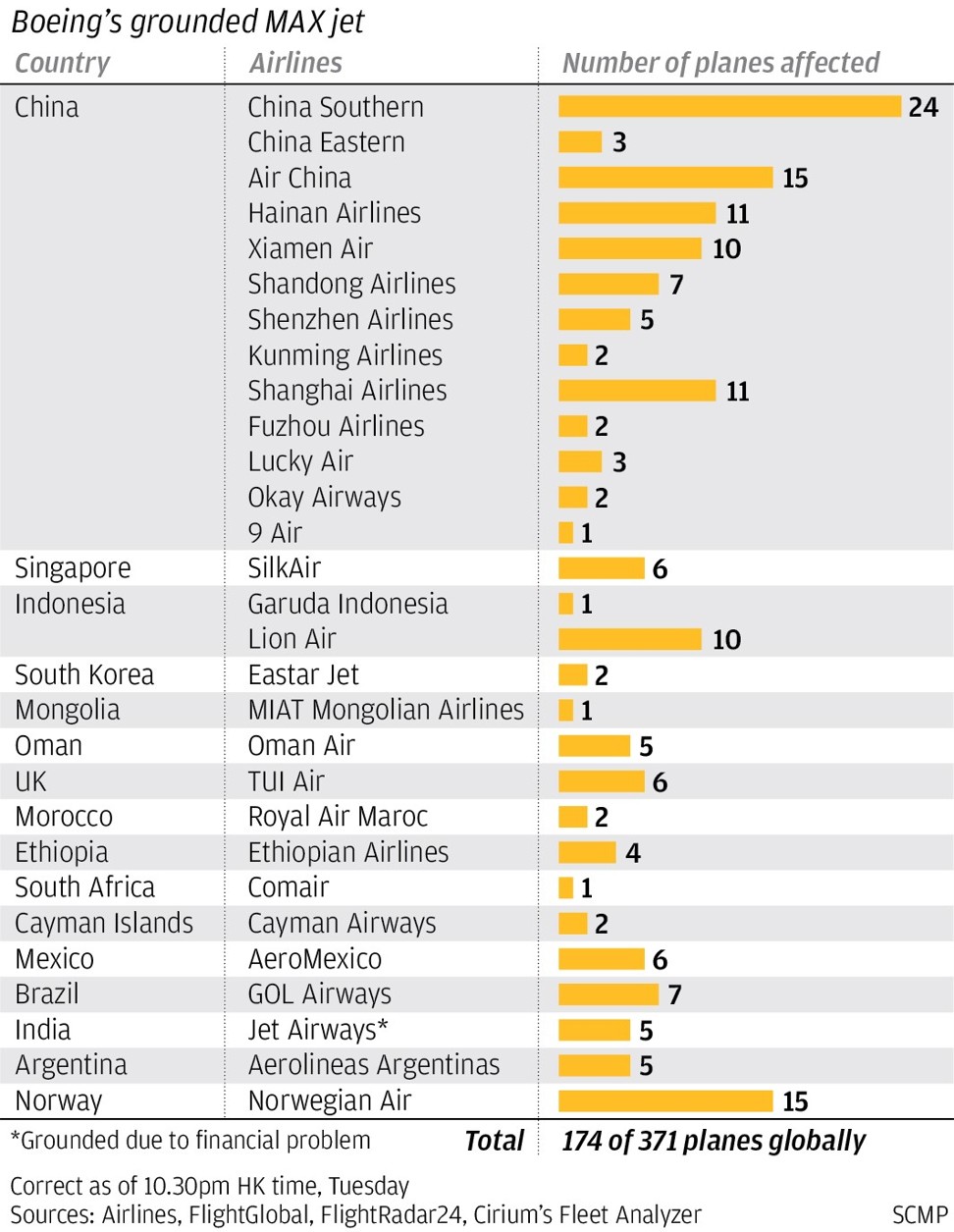

Further adding to its woes, Hainan Airlines was the third-biggest operator among Chinese fleets of Boeing’s ill-fated 737 MAX aircraft, which had to be grounded after back-to-back crashes in Ethiopia and Indonesia of the same model.

The triggers for the Chinese government’s decision to seize the HNA Group can be “short-term financial pressure on the aviation industry, the group’s heavy debt despite a series of asset sales and political reasons, similar to what happened with Anbang,” said Gao Feng Advisory chief executive Edward Tse, a former corporate adviser to HNA Group. More corporate takeovers can be expected as more companies, not just HNA, come undone because of the business slump related to the coronavirus outbreak.

Under the emerging plan, China would sell the bulk of HNA’s airline assets to the country’s three biggest carriers – Air China, China Southern Airlines and China Eastern Airlines, according to the people. Discussions with the airlines are continuing, according to the report.

“If these three big state-owned airlines were to further consolidate the sector, this could be positive for them, as it would help them gain market share and reduce competitive pressures,”” Goldman Sachs wrote in a report. “Together, these largest three airlines had a 63 per cent market share by capacity in 2019.”

Shares of the Chinese airlines that are poised to take over Hainan Airlines’ assets were mixed. China Southern Airlines, the country’s largest carrier by fleet, closed down 0.9 per cent in Hong Kong but rose 2.6 per cent in Shanghai. Air China, the country’s flag carrier, advanced by 0.6 per cent in Hong Kong, gaining 3.3 per cent in Shanghai. China Eastern, fell 0.5 per cent in Hong Kong and gained 2.4 per cent in its home base Shanghai.

Purchase the China AI Report 2020 brought to you by SCMP Research and enjoy a 20% discount (original price US$400). This 60-page all new intelligence report gives you first-hand insights and analysis into the latest industry developments and intelligence about China AI. Get exclusive access to our webinars for continuous learning, and interact with China AI executives in live Q&A. Offer valid until 31 March 2020.