Hong Kong fashion house Esprit says protests to blame for 40 per cent drop in customer traffic

- Company posts better-than-expected results for year ending June 30, sees net loss of HK$2.14 billion

- Rents ‘simply too high’ for retailers, executive chairman says

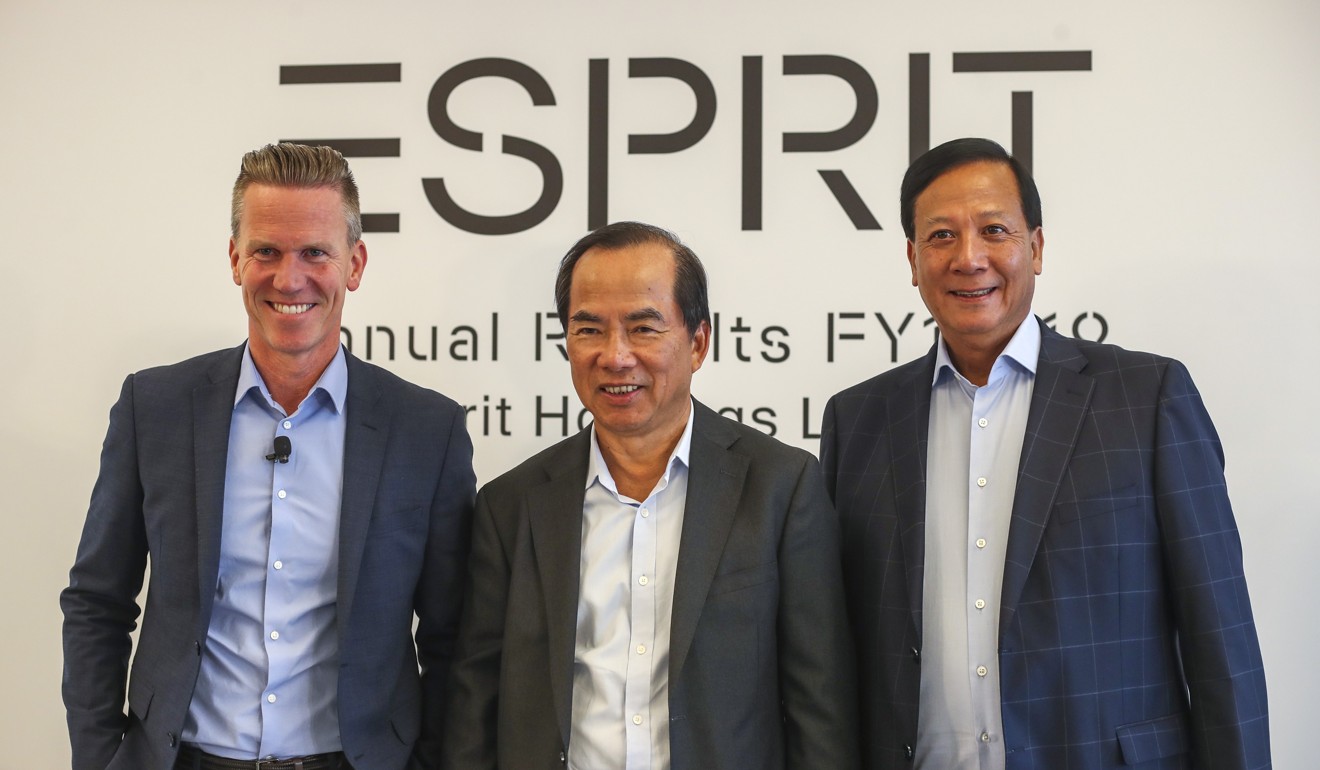

Hong Kong and Germany-based fashion house Esprit Holdings said on Wednesday that customer traffic at its shops in the city had dropped 40 per cent because of protests over the now-shelved extradition bill that began in June.

“What we are seeing in Hong Kong is abnormal,” Anders Kristiansen, the company’s chief executive, said during an earnings presentation. “You don’t see a reduction in traffic anywhere in the world of 40 per cent. This is massive and, clearly, it is linked to what is happening here.”

Esprit posted better-than-expected results for the year ending June 30. Its net loss stood at HK$2.14 billion (US$273.3 million), 16 per cent less than the last financial year, while revenue stood at HK$12.9 billion, down 12.9 per cent but above estimates by analysts polled by Bloomberg.

The company said its sales were down purely because of the protests, rather than a decline in the number of tourists from mainland China. Paul Chan Mo-po, Hong Kong’s Financial Secretary, said in his blog on Sunday tourist numbers had declined by about 40 per cent in August.

The company has already shut many shops in Hong Kong, including a more than 10,000 sq ft flagship in Tsim Sha Tsui that closed last year, as part of a restructuring plan. Just 9.5 per cent of its revenue comes from Asia.

But if rents remained high and the protests continued, the company said it could close more shops. “I don’t think it will … drive our decision to close down stores, but of course if it continues, nobody can sustain having a massive drop in sales,” Kristiansen said.

“At some point in time, if we don’t get substantial subsidies from the landlord … that is what will happen. I don’t know how long [the protests] have to go on for, that is the debate we need to have with the landlords.”

Kristiansen did not reveal if rents for Esprit’s Hong Kong shops had already been lowered.

Esprit’s revamp to cost US$255 million as fashion retailer axes stores, staff

“In Hong Kong, we are quite well positioned because we have closed stores anyway,” said Raymond Or Ching-fai, the company’s executive chairman. “To be honest, the rental level is simply too high for retailers, they simply can’t afford it.

“I have heard many shops will see a big drop in rental level. When rental drops, it presents opportunities,” he said. If prices could be negotiated down with landlords, Esprit could expand in Hong Kong in the future, Or added.

The company’s restructuring plan, announced last year, cost it a one-off HK$1.49 billion this year, according to its filing with the stock exchange.

Esprit has closed a total of 169 loss-making shops, with more planned, and reduced office space in Hong Kong and Germany. It has also cut its non-store staff by 31 per cent.

Meanwhile, some new shops are being opened, and its product choice has been reduced and less discounts are being offered. The company said it expects to be profitable in two to two-and-a-half years.

The protests have deterred locals from coming out to shop and put many tourists off visiting Hong Kong, harming retailers across the city. One in every 10 shops in Causeway Bay – the world’s most expensive shopping district – now stand empty, according to real estate agency Midland IC&I.

Struggling Esprit to close more than 40 shops in Europe

Much of the service industry has been similarly hit. On Tuesday, Fulum Group Holdings, which runs 55 Chinese restaurants across Hong Kong, said it expected to report a loss before tax for the six months through to September 30, compared with a profit before tax of HK$15.9 million (US$2 million) in the same period last year.

The company has already recorded a 13 per cent decrease in revenue for the four months ending July 31, it said in a filing to the Hong Kong stock exchange.

The losses, Fulum said, were due to “more cautious spending of the general public affected by the continuous weak economic environment and sentiments of the society”.