Analysis | HKEX’s bid for London Stock Exchange is no big deal amid the flurry of worldwide big-ticket mergers and acquisitions

- Hong Kong operator’s US$36.6 billion takeover bid is the largest ever

- 2019 has seen deals and proposals totalling US$66.08 billion – by far the most on record

Hong Kong Exchanges and Clearing’s surprise bid for the London Stock Exchange highlights two significant changes afoot: consolidation in the world’s stock markets and the tougher challenge Hong Kong faces in selling itself as the needed gateway to China, as increasingly violent protests ratchet up questions about its future.

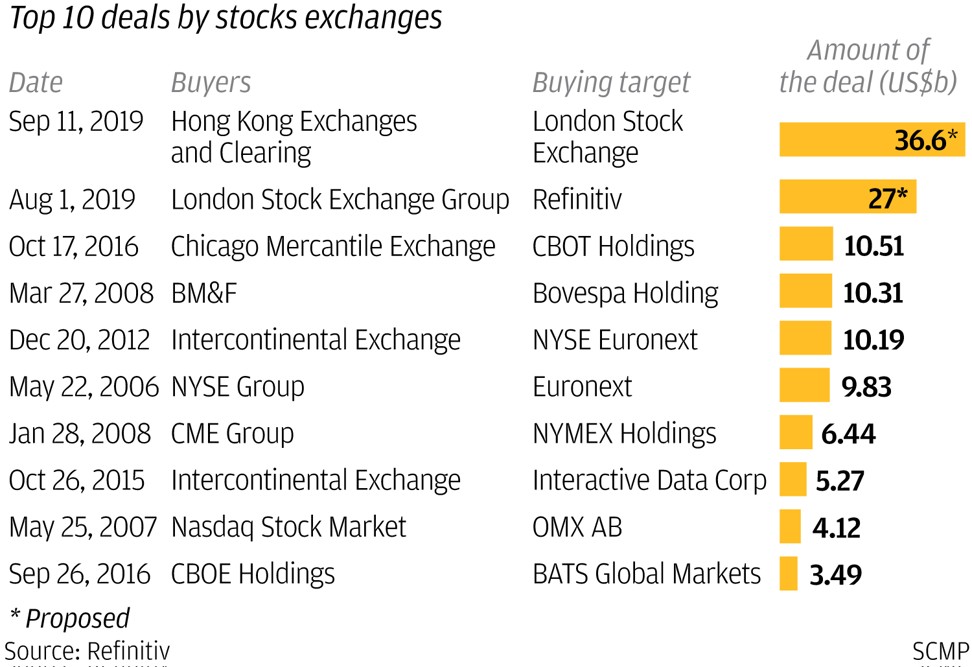

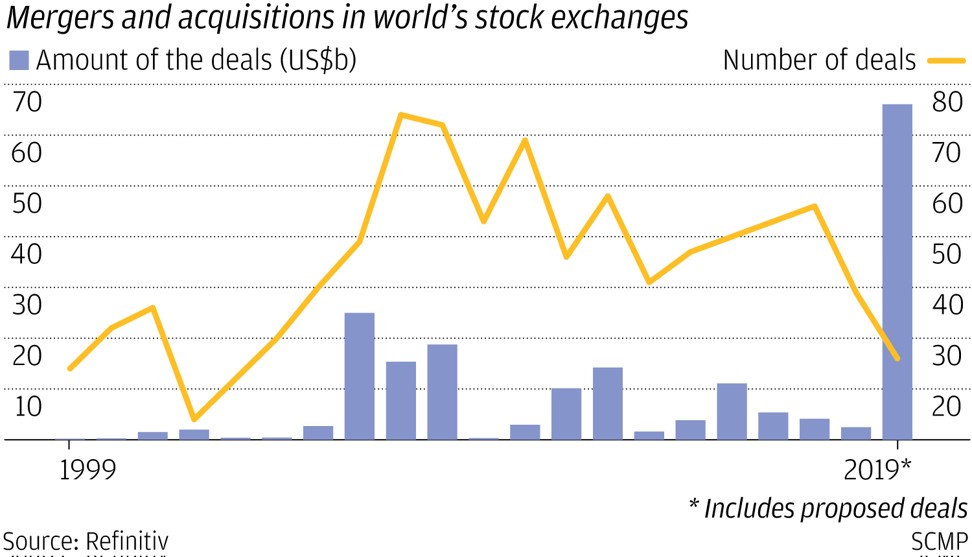

HKEX’s US$36.6 billion takeover bid – which it continues to push despite the London exchange’s quick and sharply worded rejection – would be one for the history books. If it came to be, it would make 2019 by far the biggest year ever in the amount of money spent on M&A deals by the world’s stock exchanges.

Adding in the HKEX proposal, 2019 has seen a record US$66.08 billion in such proposed or successful deals, according to data company Refinitiv, which is itself a target of an acquisition pitch by the London exchange. That is 25 times more than the value of deals last year – US$2.45 billion – and almost three times the amount in 2006, which at US$24.98 billion has held the record as the top year of M&A activity at exchanges.

“Consolidation has been, and will continue to be, the trend for global exchanges worldwide to achieve their future growth of businesses,” said Xavier Rolet, former chief executive of LSE in a telephone interview with the South China Morning Post.

“Eventually, there may be only about three to six major global players that survive, with at least one anchored with the Shanghai Stock Exchange and the other with US,” he added.

In addition to gaining data and technology, exchanges are hungry for benefits from consolidation in risk management and settlement, as well as initial public offerings and other capital formation, Rolet said.

As part of its offer made on Wednesday, HKEX said the London bourse would have to drop its acquisition offer of Refinitiv, which was only made on August 1.

The London bourse wants Refinitiv to make it stronger in data and technology. And it says the deal is on.

For HKEX, a successful deal would mean geographical expansion, marrying one of the biggest stocks markets in Asia (Tokyo is the largest by market capitalisation, followed by Shanghai) with Europe’s second-largest stock market (Euronext is larger).

As HKEX chief executive Charles Li Xiaojia said in a teleconference on Wednesday about the bid, “It is time to bring in one of the largest exchanges in Asia and in Europe together for a marriage to create a global exchange.”

LSE and Refinitiv “would be too large for HKEX to consider. Hence the merger preconditioned on the Refinitiv deal being dropped,” according to a research note of Citi, which rating HKEX a “sell” after the deal, which it does not expect will be approved.

Nomura, however, sees merits to the proposal.

“The proposed combination will be a value-add for both HKEX and London Stock Exchange group in our view, as their businesses are highly complementary in terms of geography and product services,” said Donald Tang Shengbo, head of China Financial and fintech research of Nomura International in a research note.

“But there is limited visibility on the success of the transaction as of now as it is at a very early stage,” Tang said, added the HKEX would need to get shareholders of both exchanges to approve the deals while it would also face multiple regulatory approvals in the UK, US and Europe.

“(W)e do not believe HKEX provides us with the best long-term positioning in Asia or the best listing /trading platform for China,” LSE chairman Don Robert wrote to his Hong Kong counterpart Laura Cha Shih May-lung and Li.

Robert also raised Hong Kong’s protests and its future in the bid’s rejection.

“We see the value of your share consideration as inherently uncertain. The ongoing situation in Hong Kong adds to this uncertainty. Furthermore, we question the sustainability of HKEX’s position as a strategic gateway in the longer term,” he wrote.