Gallium: China tightens grip on wonder metal as Huawei works on promising applications beyond 5G

- China accounts for 95 per cent of the global supply of the soft, bluish metal

- Huawei has filed for more than 2,000 patents related to gallium nitride

The chipsets that generate powerful bursts of high frequency radio waves are not made with silicon, but gallium nitride.

They consume little electricity, produce little heat and can function comfortably at 800 degrees Celsius (1,472 degrees Fahrenheit), making bulky equipment for power supply and air conditioning redundant.

Gallium is one of the 35 technology-critical elements listed by the US government as a national security concern. Like rare earths, the global supply of gallium is under Chinese control.

China produced 390 tonnes of raw gallium last year, or more than 95 per cent of the world output, according to the United States Geological Survey.

China has become a super power in rare earth, rare metals and other dispersed elements, with increasing dominance over a wide range of sectors from ore to technology.

Qualcomm, a US-based company and major supplier of 5G-based chipsets, had less than 1,000 patent filings.

“As the semiconductor industry shifts from silicon to gallium, China is preparing to take the lead position,” said professor Hao Xiaopeng, functional material researcher at the State Key Laboratory of Crystal Materials in Shandong University, Jinan.

Alexandra Feytis, an associate consultant at London-based industrial minerals consultancy Roskill Information Services, said although China’s dominance in gallium was not yet a major source of concern for other countries as the market was adequately supplied, it was likely to change in the long term.

“While China has kept increasing its primary gallium production, most other producing countries have reduced it,” she said, noting Kazakhstan had ceased production in 2013 owing to low prices, followed by Germany in 2016.

Rare earths are found in everyday items, from TVs to smartphones and fridges

“Therefore, gallium will certainly become of more interest over the next few years and it remains closely monitored by Europe and by the US, which both listed it as a critical mineral,” she said.

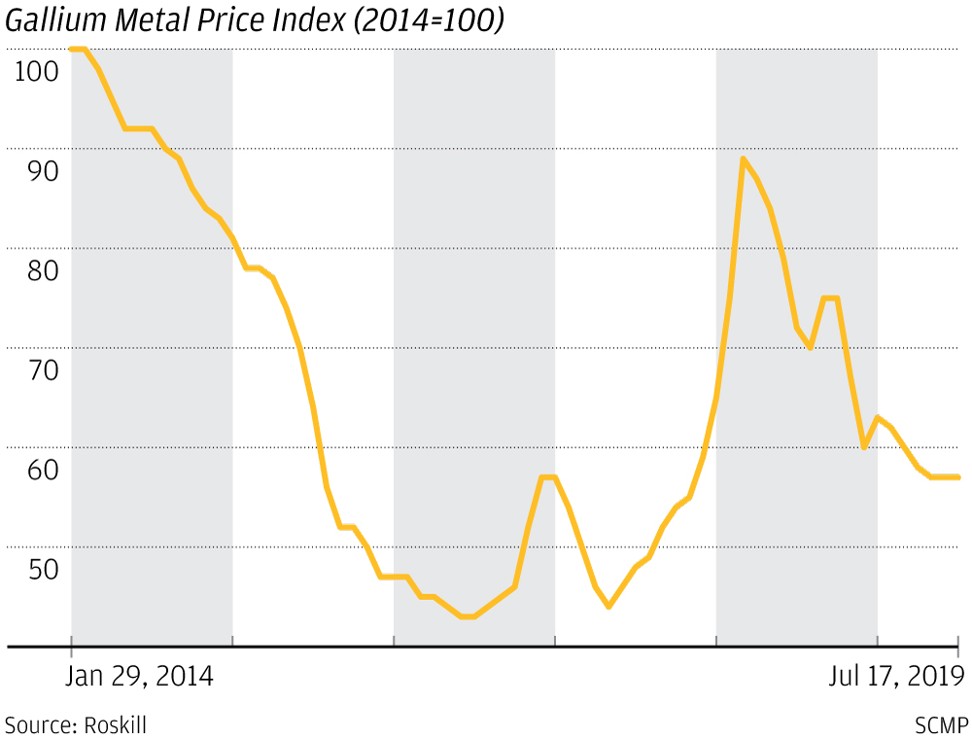

After a five-year decline until the end of 2016 because of oversupply, gallium prices in China started to recover in 2017. The following year global prices surged by 40 per cent, as a result of restocking by consumers.

Meanwhile, the military sector has been using gallium nitride in radars, high-power laser and spy satellites.

Rare earths a matter of national security, rather than economics

According to Hao, Chinese telecommunication companies such as Huawei are coming up with innovative technology to make the “wonder material” work for mass civilian applications.

5G is just the start.