Hong Kong’s bourse taps Alibaba’s vice-chairman, HSBC’s ex-CEO and former SEC chair for advice in its growth

- HKEX’s newly established International Advisory Council will provide insights to board of directors

Hong Kong Exchanges and Clearing Limited (HKEX) has tapped a trio of high-powered executives as advisers to help steer the operator of Asia’s third-most valuable stock market in its growth into a global bourse.

Alibaba Group Holding’s vice-chairman Joe Tsai, HSBC’s former chief executive officer Stuart Gulliver, and the US Securities and Exchange Commission’s former chairperson Mary Schapiro were named as members of the HKEX International Advisory Council for three years, according to a statement by the operator.

The council, led by HKEX Chairman Laura Cha Shih May-lung, is a move by the exchange to grow out of China’s long shadow into a global financial marketplace to rival New York and London. It is also part of the reform pushed by chief executive Charles Li for HKEX to diversify the composition of its listed companies to keep up with technological change and new fundraising needs.

“I would love to see a day when a Silicon Valley company going public on the Nasdaq, having very little business in China, feels the need to come to Hong Kong to tap into some Hong Kong funds,” Tsai said. “If that were to happen, that means those funds sitting in Hong Kong are really looking globally.”

Alibaba owns South China Morning Post, and Tsai is chairman of this newspaper’s board.

Gulliver and Schapiro could not be reached to comment. Gulliver was HSBC’s chief executive and executive director from 2011 until 2018. Schapiro, a lawyer by training, was the US SEC’s chairwoman from 2009 until 2012 during the Barack Obama administration.

The HKEX advisory board meets at least twice a year to provide advice to the 13-member board of the exchange.

Could there be any potential conflict of interest in Alibaba – one of China’s largest technology companies, with businesses that range from cloud computing to online payment, sports and movie production – acting as adviser to the HKEX? The group’s businesses could potentially tap the Hong Kong market for funds.

The council, which will eventually comprise five members, including HKEX chairman Cha, does not deal with operational issues and has no input into the listing committee that approves or rejects fundraising plans and initial public offerings (IPOs), Tsai said.

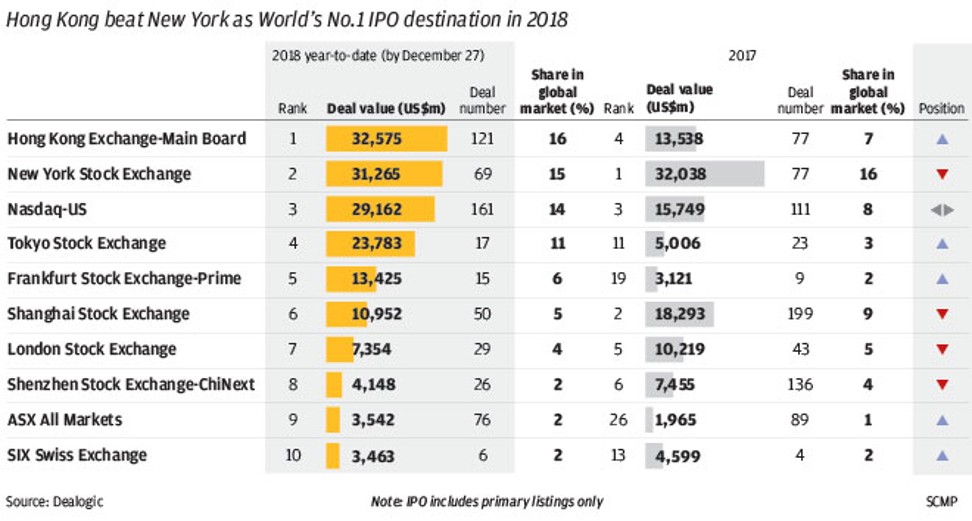

A total of 208 companies went public in Hong Kong last year, raising HK$286 billion (US$36 billion) in funds together, helping to catapult the city past New York and Shanghai as the world’s IPO capital. The amount of funds raised more than doubled from the previous year, spurred by an overhaul in the listing rules of the exchange – the biggest amendments in three decades – pushed forward by the exchange operator and Hong Kong’s securities regulator.

Dozens of technology companies including smartphone maker Xiaomi, and food delivery service Meituan Dianping listed in Hong Kong, as did biotechnology firms such as BeiGene and Ascletis Pharma, attracted by new listing rules that removed previous hurdles for new-economy and pre-revenue companies to raise capital.

Still, Hong Kong has struggled to attract major overseas companies from raising capital on its exchange.

Nearly half of the 2,324 companies listed in Hong Kong has a mainland Chinese shareholder, or is based in China. These companies, including games publisher Tencent Holdings and carmaker Geely Automobile Holdings, make up 80 per cent of the Hong Kong market’s turnover and 68 per cent of the market capitalisation.

Hong Kong can solve the lack of overseas listings by allowing more funds from mainland China to come into Hong Kong for investing in foreign companies, Tsai said.

“If you look at the Hong Kong-registered mutual funds and the funds effectively ran by people living in Hong Kong, it pales in comparison to New York,” he said.

New market for dual-class shares garners momentum after watered down listing reforms

The net assets of US-registered open-end funds, which include mutual funds and exchange-traded funds, stood at US$22.1 trillion in 2017, making up 45 per cent of the world’s overall fund assets, data from trade association Investment Company Institute shows. The assets of such funds based in Asia-Pacific were only US$6.5 trillion.

Still, the HKEX has more to do to respond to advances in technology, which blurred the physical boundaries in stock exchanges. Euronext, the pan-European operator, already runs stock exchanges in five European Union cities.

“The basics of an exchange as a marketplace to buy or sell something doesn’t change,” Tsai said. “Whether it is a physical or a virtual exchange is beside the point.”

HKEX said on Wednesday it would buy a 51 per cent stake in Shenzhen-based fintech company Ronghui Tongjin Technology, evidence of its latest effort to stay competitive as technology increasingly transforms the financial world.

Shares of HKEX, which are themselves listed in Hong Kong, rose 1.54 per cent to HK$264.00 on Thursday.