Is Victor Li the next Superman, and can he outdo his father Li Ka-shing as he leads CK Asset into a new era?

- Victor Li, who took over from his father Li Ka-shing last May, has been busy announcing one property project after another

- Projects being undertaken by Victor Li include the redevelopment of Hutchison House in Central and Harbour Plaza Resort City in Tin Shui Wai

After 35 years in the shadow of his illustrious father Li Ka-shing, Hong Kong’s richest man and fondly called “Superman” for his extraordinary entrepreneurial achievement, Victor Li Tzar-kuoi is finally coming into his own.

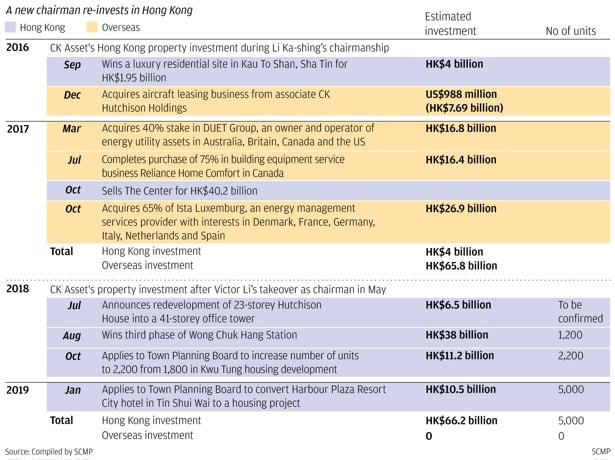

Victor, who took over as chairman of CK Asset Holdings and CK Hutchison from his father last May, is turning the focus of Hong Kong’s second largest developer by market capitalisation back to the city’s property market after the elder Li indicated in 2016 that the group would spread its net globally because of the challenges it faced in identifying investments with reasonable returns in the local property market.

“The group will also pursue other global investments to extend our reach to new business areas,” Li said during the interim results announcement in 2016.

To reflect its global expansion in non-property interests, in August 2017 the group even changed its name to CK Asset Holdings from Cheung Kong Property Holdings.

It has since invested HK$64 billion (US$8.1 billion) in aircraft leasing, infrastructure and utility assets in Europe, Australia, Canada and the UK, while steadily selling down assets in the city.

One of the company’s most notable transactions was the sale of its 70 per cent stake in The Center, the tallest building in the company’s portfolio for a record HK$40.2 billion to the mainland group C.H.M.T Peaceful Development Asia Property.

Now, with Victor Li calling the shots, CK has announced a major property project nearly every other month in Hong Kong.

In the past six months alone, it announced four property projects, either through acquisition, redevelopment or increased building density, that would require a total capital commitment of more than HK$66 billion over the next six to seven years.

CK Asset plans to convert hotel into Hong Kong’s biggest housing estate of the last decade

On January 9, CK Asset proposed building what could be Hong Kong’s biggest private housing project in the last 10 years. It will redevelop its Harbour Plaza Resort City hotel in Tin Shui Wai, New Territories, into a housing project comprising 5,000 flats.

The proposed HK$10.5 billion redevelopment project is its second after the company’s HK$6.5 billion redevelopment of Hutchison House, in Central, announced last July.

On top of these two major redevelopment projects, it also won the MTR Corp tender last August for phase three of a residential plot next to Wong Chuk Hang Station that could require an investment of HK$38 billion.

Two months later in October, CK Asset applied to the Town Planning Board to increase the number of units from 1,800 to 2,200 at its proposed residential development in Kwu Tung in the northern New Territories. That project could cost about HK$11.2 billion.

It is worth noting that all the proposed investments are estimates from industry consultants.

The three housing projects will provide around 8,400 units in the next six to seven years.

But what prompted the shift in strategy in the first place?

“The change [in strategy] was not made in a fortnight, it must have been in the works for [at least] six months or so,” said Raymond Cheng, head of Hong Kong and China research at CGS-CIMB Securities.

“Father and son must have made a critical comparative analysis of the rate of returns in each of the local and international sectors that the group has established a presence, and identified specific areas where its money will earn the most.”

Historically, the return on investment on infrastructure and utilities is between five to eight per cent, while it averages between 15 to 20 per cent in Hong Kong’s property development market, said Cheng.

“Developing property in Hong Kong is profitable but bears higher risk. For Victor, he will go where he can make more profit,” he said.

Victor Li to push ahead with Hutchison House redevelopment into 41-storey office tower

Lung Siu-fung, an analyst at China Merchants Securities, said CK Asset’s plans to redevelop Harbour Plaza Resort City hotel and Hutchison House would not only increase its asset valuation but also lift its output of flats without the need to engage in a bidding war with rivals in government tenders and in the private market.

Adding to the urgency was CK’s slumping property sales in Hong Kong, which dropped by 72.3 per cent to HK$13.97 billion from the sale of 433 flats in 2018 compared to a record high of HK$50.6 billion in 2017, according to Dataelement, a data provider which monitors sales of new flats.

CK Asset, which topped the property sales chart in 2017, dropped to fifth place in 2018, Dataelement figures showed.

Sun Hung Kai Properties, which generated HK$41.97 billion in sales in 2018, replaced CK Asset as the top seller last year.

CGS-CIMB Securities’ Cheng partly attributed CK Asset’s comeback to Hong Kong because of its frustration in acquiring assets overseas.

“Its investment abroad faces rising political risks, making it difficult to move forward,” he said.

One of the major setbacks came in November when CK Group’s A$13 billion (US$9.3 billion) bid for gas pipeline operator APA Group was rejected by the Australian government on national security grounds.

CK Asset had joined CK Infrastructure Holdings, and Power Assets Holdings to pursue its largest overseas acquisition.

Victor Li, in his first speech as chairman of CK Asset and CK Hutchison’s annual dinner gala on January 15, voiced his frustrations on why his companies could not freely pursue overseas investments.

“The rise of protectionism, the unceasing trade disputes, the Brexit uncertainties, the various national election outcomes, and the reappearance of rate hikes … all such issues have caused ripples in the global environment and to some extent our group’s businesses,” he said.

He also pointed out that the company’s “deliberate strategy of increasing stable recurrent income” had borne fruit, and the group enjoyed a very strong cash flow.

If you’re going to buy a house in Hong Kong, live in it, warns Li Ka-shing

Speaking at the same event, Li Ka-shing, now senior adviser to the group, did not answer directly whether CK Asset would be more aggressive in Hong Kong’s property market.

“The city has its own advantages. But there are some businesses we cannot pursue in the city, such as oil and energy,” said Li Ka-shing.

Cheng noted that while CK Asset was busy expanding overseas, its Hong Kong residential land bank had dwindled and was now the smallest among the top seven developers.

“CK’s residential land bank is only enough to sustain development for 2.9 years, compared to [the industry] average of 4.1 years,” he said.

CK Asset, the second largest Hong Kong developer by market capitalisation, owns just six million square feet of land bank in the city, according to its 2017 annual report.

Sun Hung Kai Properties and Henderson Land by comparison hold 21.4 million sq ft and 14 million sq ft respectively.

Taking into account the plot next to Wong Chuk Hang MTR station, which could yield a total gross floor area of 1.5 million sq ft, its land bank increases to 7.5 million sq ft.

On the mainland, it has 107 million sq ft, and some 4 million sq ft overseas.

“These recent announcements will ensure that the developer has an adequate development pipeline moving forward, especially with respect to residential sales,” said Denis Ma, head of research at JLL.

With housing prices starting to slide, the risk of developers finding themselves in a situation where their future development is priced below surrounding comparable projects is increasing, said Ma who has forecast home prices to fall by 15 per cent this year.

“Under this scenario, it is probably more prudent to redevelop older buildings already under their ownership,” he said.

The prices of lived-in homes in Hong Kong have fallen by 7.2 per cent since August 2018, but are still 2.2 per cent higher than in January 2018, according to the city’s Rating and Valuation Department.

Ma believes undertaking redevelopment or refurbishment opportunities in a soft market allows developers to be better positioned to capitalise on the eventual market recovery down the road.

Even Hannah Jeong, head of valuation and advisory services at Colliers International, felt that redevelopment is a far cheaper option compared to obtaining new land sales from government tenders.

As land prices have increased significantly in the past two years, she said developers’ margins will be higher from redevelopment.

Thomas Lam, executive director at Knight Frank estimated the total investment cost of Harbour Plaza Resort City hotel would be HK$8,000 to HK$9,000 per sq ft inclusive of construction cost, government land premium and interest expenses.

He estimated that the whole redevelopment project will cost about HK$10.5 billion, adding that the sale of 5,000 flats could bring in sales of close to HK$20 billion assuming an average selling of HK$4 million, or HK$13,000 per sq ft, when it goes on pre-sale five to six years from now.

In addition, the proposed housing project in Tin Shui Wai will have 980 car parking spaces.

CK Asset reports 20 per cent gain in core profit for first half of 2018

Lam said the sale of these car parking lots will contribute an estimated HK$900 million to CK Asset, assuming the group sells some of these parking spaces for around HK$1 million each.

The HK$29 billion sales projection from the redevelopment of Harbour Plaza hotel was six to seven times higher than just the sale of the hotel itself for about HK$4 billion to HK$5 billion.

“In the current market condition, it is hard to get a buyer for the hotel. And CK was unlikely to offload its asset at below market rate” said Lam.