Sale of missing CEFC Chinese oligarch’s Manhattan pad, Hong Kong office and global real estate triggered by bond default

Unit 78B of the 90-storey Trump World Tower in Manhattan offers breathtaking views of the East River and the United Nations plaza through floor-to-ceiling windows in its living and dining areas.

The two-bedroom apartment, available for rent since early May, is decorated with a mix of chinoiserie and minimalist chic. Half a dozen taishiyi, or Ming dynasty-style grandfather chairs, are spread around a home office in the 2,870 square feet (267 square metres) apartment, while a gold-on-black calligraphy scroll adorns the dining area.

Ye, who just turned 41 last month, has been missing from public view since the start of Lunar New Year celebrations on February 16. Although he hasn’t yet been charged with any crime, Ye is believed to be under detention to help Chinese regulators with unspecified investigations into the debt incurred by his China Energy Finance Corp (CEFC).

Fall from grace: China’s acquisitive conglomerates under a cloud axed from Fortune 500 list

A creditors’ committee led by China Development Bank (CDB), China’s biggest state-owned policy bank and CEFC’s biggest creditor, has taken over the decision-making, stripping it bare to service 98.3 billion yuan (US$14.5 billion) of outstanding debt, including 30.8 billion yuan of bonds.

The list of assets, valued at a combined 21.64 billion yuan (US$3.19 billion) as of March 1, include the Upper East Side apartment, a mountainside villa in Lisbon, Wan Chai offices, luxury flats at Hong Kong’s Cyberport and CEFC’s corporate headquarters in the former French Concession in Shanghai, according to an inventory obtained by the South China Morning Post.

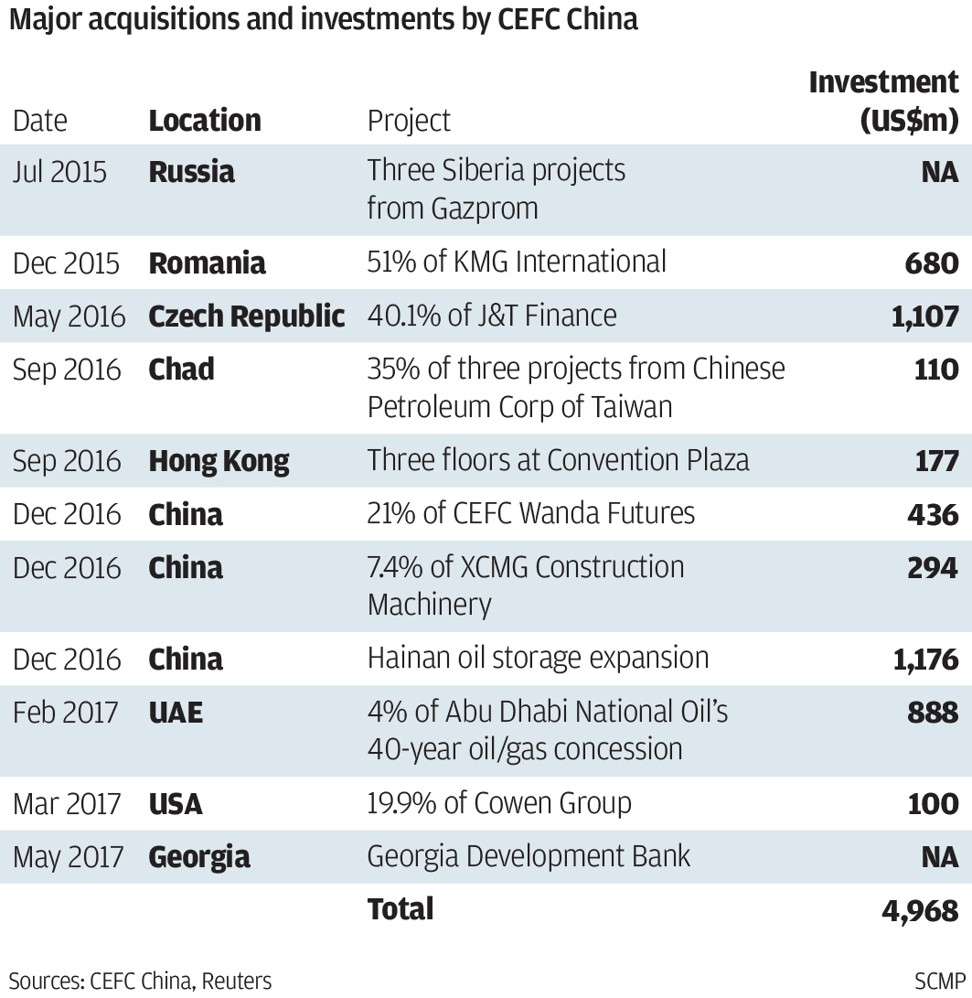

Bought for a combined 16.82 billion yuan over a decade, the properties were the results of CEFC’s global shopping spree, which only ended in 2017 when Chinese financial regulators brought the boom down to crimp runaway borrowings and stem capital flight in the country.

Revenue at CEFC Shanghai International Group, Ye’s flagship company, surged 700 times in seven years, catapulting from 335 million yuan in 2009 to 247.3 billion yuan in 2016, even as its gross margin hovered at between 2 and 3 per cent, according to its bond prospectus.

A March 1 news report on the Caixin website offered a glimpse into how CEFC inflated its revenue through buying and selling assets within a network of interconnected companies, beginning in 2009. After 2012, the network expanded to include Chinese state-owned enterprises, culminating in CEFC’s explosive growth.

Related-party transactions were valued at 8.2 billion yuan in 2012, making up 27 per cent of CEFC Shanghai’s total revenue. Even so, the group managed to secure a 2.4 billion yuan loan from China Development Bank for the construction of its first and only oil project, a storage facility on Hainan island in southern China, the news website reported, before subsequently removing the story without explanation.

Ho, employed by CEFC’s cultural foundation, was charged with offering US$2.9 million in bribes to the president of Chad and foreign minister of Uganda in exchange for oil rights for CEFC China Energy, a unit within the conglomerate.

A US federal judge yesterday rejected Ho’s application to drop most of the charges against him, which means he would face all eight counts of bribery and money laundering charges at a trial in November.

Part of Ho’s bail conditions requires him to live under house arrest at a corporate apartment on the Upper East Side of Manhattan, a half-mile walk from the Trump World Tower property that is registered to CEFC’s Hong Kong unit.

The Trump World Tower apartment is valued at 34.53 million yuan on CEFC’s inventory. A doorman declined to say if Ho had frequented the apartment. Avi Alkotzer, the agent handling the apartment’s lease, declined to comment when reached by phone.

CEFC’s September 2017 announcement of its Rosneft investment may have touched a nerve with US policymakers, which probably set off the chain of events that ultimately led to the undoing of the Chinese conglomerate, according to a finance official at the company in Shanghai, speaking on condition of anonymity.

“The debt crisis of CEFC was caused by US pressure, after CEFC began extensive cooperations with Rosneft,” according to a memo in May that summarised the Chinese company’s debt levels for creditors, obtained by the Post. “Media reports led to panic among investors, which ultimately led to a break in the credit line that has been extended to the group.”

The Qatar Investment Authority stepped in after Ye’s disappearance and Ho’s arrest to take over the CEFC stake in Rosneft in May.

CEFC defaulted on three bonds in May and June worth a total of 6.5 billion yuan, with another 374 million yuan in interest charges. The company has up to 98.3 billion yuan of debt, including 30.8 billion yuan of bonds due by 2021.

CEFC’s corporate headquarters in the former French Concession in Shanghai comprises a cluster of villas and buildings arranged around Ye’s office, which is dubbed the Chairman’s villa. Bought for 850 million yuan, the entire compound was valued at 1.9 billion yuan.

Citic Group, China’s biggest state conglomerate and a major CEFC creditor, stepped in to take over the assets in the Czech Republic, Reuters reported in May.

CEFC appealed for creditors’ support, urging creditors to take “a united stand,” according to a memo written by CEFC’s president Chan Chauto, also known as Chen Qiutu, during a meeting with creditors in early May, obtained by the Post. “Banks should not suspend their loans, and no creditor should file a lawsuit alone. The priority is to solve the sensitive debts first.”

The creditors committee appears to be making progress, with CEFC making US$7.4 million in interest payments on a US$250 million notes that are due to mature in November. That implies that CEFC’s administrators are treating overseas debt as priority, according to a source close to the creditors' committee, declining to be named.

Still, selling assets to raise funds may be a challenge, as most CEFC’s property portfolio has been pledged as collateral for up to 12.4 billion yuan of loans, according to the company’s inventory. That means only about 9 billion yuan could be retrieved, even if all the assets are sold at their market valuation.

“Overseas debts payment should be taken as a priority because the size is smaller and should be backed by assets,” said an overseas investor, who did not want to be named. “We made the decision to invest in CEFC bonds partly because it is so strongly backed by state creditors like CDB.”

With additional reporting by Robert Delaney in New York