Majority of rich Hongkongers are planning to live beyond 100, survey finds

Nearly six in 10 wealthy Hongkongers expect to live to the age of 100, making them the most confident about their longevity in Asia, according to a survey released on Thursday by UBS Investor Watch.

The confidence could be due to Hong Kong having the highest life expectancy in the world, with women on average living to 87 years and men 81 years, according to 2016 data calculations by Japan’s health and welfare ministry.

The UBS survey revealed 59 per cent of Hong Kong’s wealthy investors believe they will become centenarians, higher than 46 per cent of Singaporean investors and 47 per cent in Taiwan.

The survey polled 5,000 high net worth individuals worldwide in 10 markets, including more than 400 individuals in Hong Kong. To qualify, individuals must have at least US$1 million in investible assets.

But Hong Kong’s wealthy investors were not alone in their expectations for a long and prosperous life – as 76 per cent of affluent Germans expected to reach age 100, while the figure for rich Swiss investors was 68 per cent. Meanwhile, only 30 per cent of American millionaires expected to live to 100.

Meanwhile, more than 90 per cent of ultra-wealthy Hongkongers said that protecting their health was more important to them than growing their wealth. These attitudes also affect their investment choices.

“As Hong Kong’s high net worth individuals expect to live longer lives, they need to adopt the right investment strategies to support these extra years,” said Adeline Chien of UBS Global Wealth Management.

“Maintaining a diversified portfolio and staying invested can help investors hedge against market risks, uncertainty and volatility.”

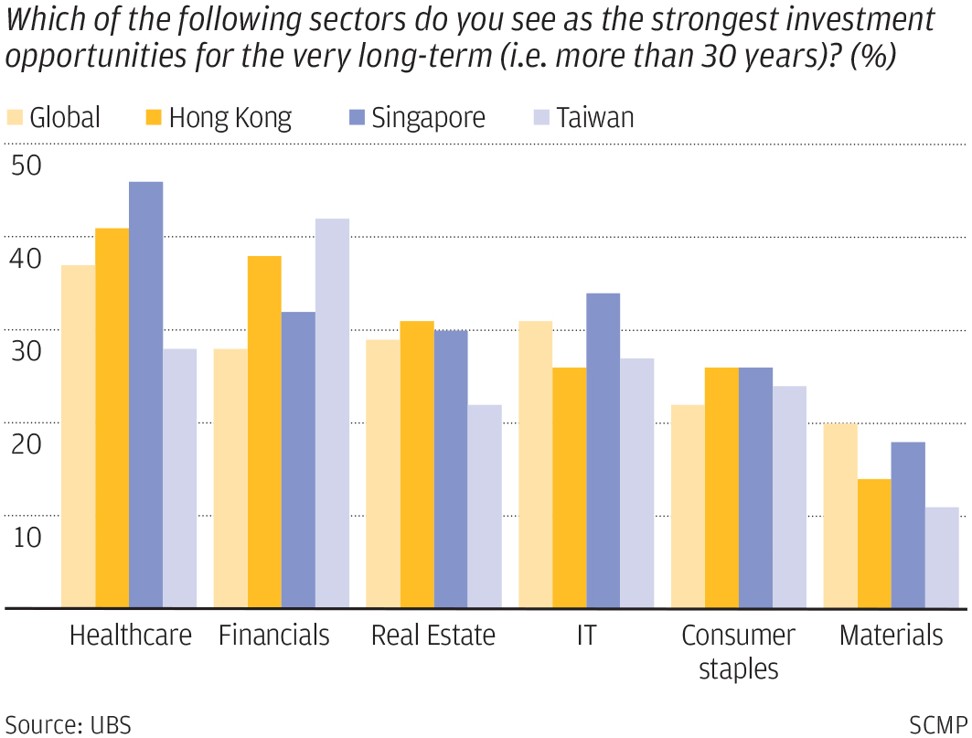

Over 40 per cent of Hong Kong investors said that the health care sector was a stronger long-term investment option than financials. Half of these investors have channelled their savings into health care insurers.

Among different asset classes, the most popular investment choices were equities and bonds over property.

Longer life expectancies also mean added pressure on pension reform as well as growing concerns over the rising cost of health care for Hong Kong investors. It is widely expected that the citywide MPF pension scheme will not be enough to cover the cost of retirement.

The average Hong Kong professional would need to save HK$3.1 million (US$394,973) by retirement to maintain the same standard of living in old age based on current living costs, according to a survey by the Hong Kong Investment Funds Association (HKIFA).

Hong Kong has a rapidly ageing population, with the number of seniors over 65 expected to double to 2.35 million in the next two decades, according to the latest government population projection.

Even for wealthy Hongkongers, the increasing lifespan has changed their long-term financial succession plans, with more than 70 per cent planning to give their wealth away during their lifespans, according to the survey.

Half of the investors polled worried their wealth will not be able to support them until the age of 100, while more than two thirds of Hong Kong millionaires said they would be working past the traditional retirement age of 65 to maintain their current lifestyle.

But wealthy investors also care about the health of wider society, as 77 per cent said they had invested resources to help fight a significant public health issue in Hong Kong.