China cuts taxes, simplifies code to kick start a stalling economy, stem capital flight to America

China’s top tax rate of 45 per cent, and its myriad of fees and tariffs had been blamed for driving home grown companies to set up shop overseas

China’s government will cut taxes on companies and individuals to kick start growth in a stalling economy, and match the biggest reform in the US tax code in three decades to help stem any capital flight to America.

The government will forego as much as 800 billion yuan (US$126 billion) in tax income this year, equivalent to 5.2 per cent of 2018 receipts and 5.5 per cent of last year’s revenue, to help the economy transform and upgrade, as well as “activate the market and boost people’s creativity,” Premier Li Keqiang said during his annual work report on Monday.

“We will further alleviate companies’ tax burdens,” Li said to an audience of 5,000 attendees of China’s legislative bodies in the capital. “We will also reduce companies’ non-tax burdens by clearing up administrative fees and charges.”

The latest cuts are an extension of China’s tax reforms since 2013, when the government alleviated more than 3 trillion yuan in taxes and fees on companies, a process Li cited as vital to improve the country’s competitiveness and protect entrepreneurship.

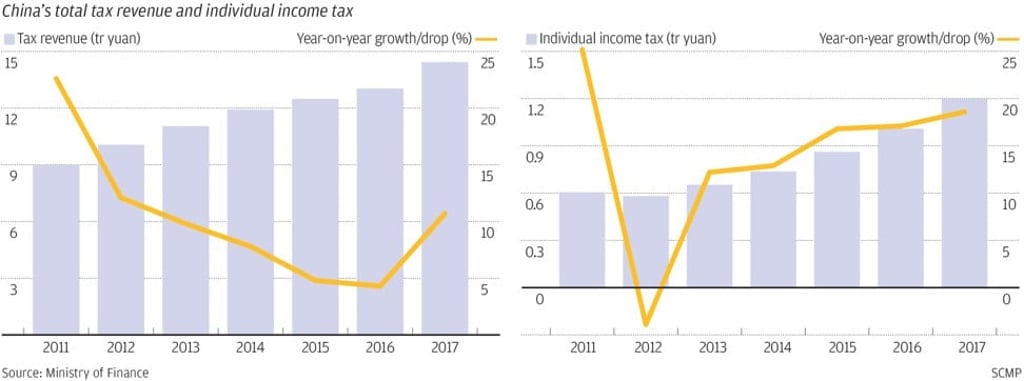

China’s 2017 total tax revenue increased 10.7 per cent to 14.4 trillion yuan, resuming double-digit growth for the first time in five years, according to the Finance Ministry’s data. Tax revenue from individuals grew by 18.6 per cent to 1.2 trillion yuan.