HNA’s chief executive to skip 2018 Davos meeting amid staff memo urging for austerity

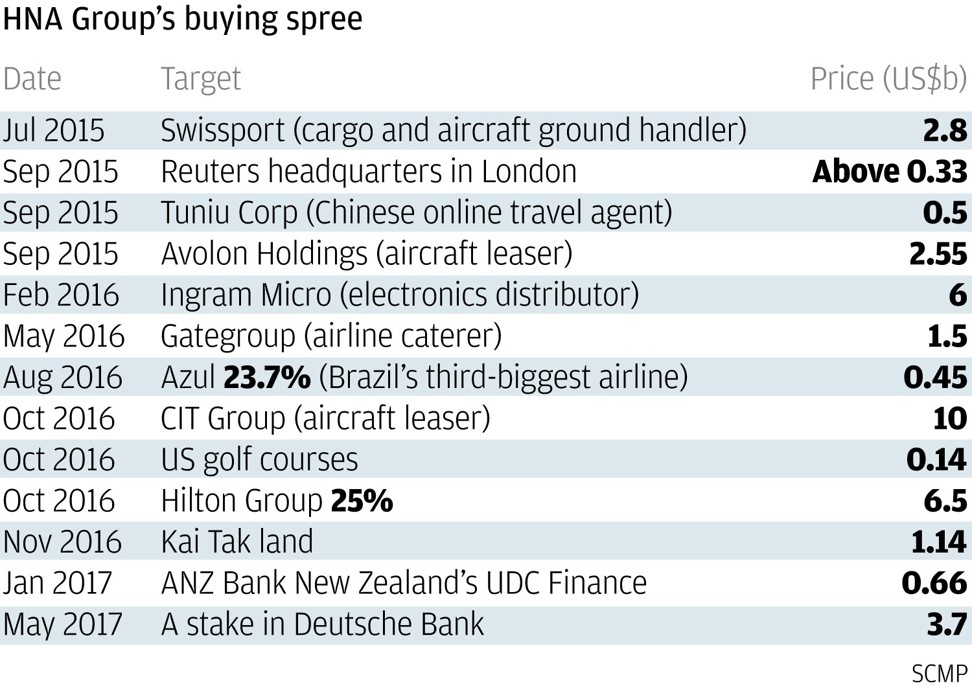

The chief executive officer of HNA Group Co., the Chinese conglomerate that’s under scrutiny because of its debt-fuelled acquisition spree and ballooning financing costs, has cancelled plans to attend next week’s World Economic Forum’s annual meeting, people familiar with the matter said.

It wasn’t immediately clear why Adam Tan, who’s on the list of attendees for the summit to be held January 23 to 26 in Davos, Switzerland, decided to pull out. The people asked not to be identified discussing a private matter and declined to provide further details. An HNA representative couldn’t immediately comment when contacted by Bloomberg News on Thursday.

The Chinese delegation to the WEF this year will be led by President Xi Jinping’s top financial and economic adviser, Liu He. Other Chinese executives scheduled to attend the summit include Alibaba Group Holding Ltd. Chairman Jack Ma, Baidu Inc. President Zhang Yaqin and Guangzhou Automobile Group Co. Chairman Zeng Qinghong.

The four-page memo urged top managers to lead the effort and laid out four categories by which employees can help the initiative:

- Have a prudent working attitude

- Spending on conferences and events: costs should be limited to 3,000 yuan (US$469) per person a day

- Travel: Avoid unnecessary trips, use video, phone and email

- Strictly control gifts for public affairs

Tan also provided 10 specific ways various departments can cut costs. Among them:

- Investment banking: work with finance department to cap fees to third parties

- Human resources: cut unnecessary staff expenses, control training costs, limit bonuses

- Social responsibility team: control spending on improving group’s image

- Innovation team: control purchases of hardware, promote HNA’s cloud usage internally

- General administration: Monthly stationery expenses will be limited to 20 yuan per person, print less, conserve water and electricity

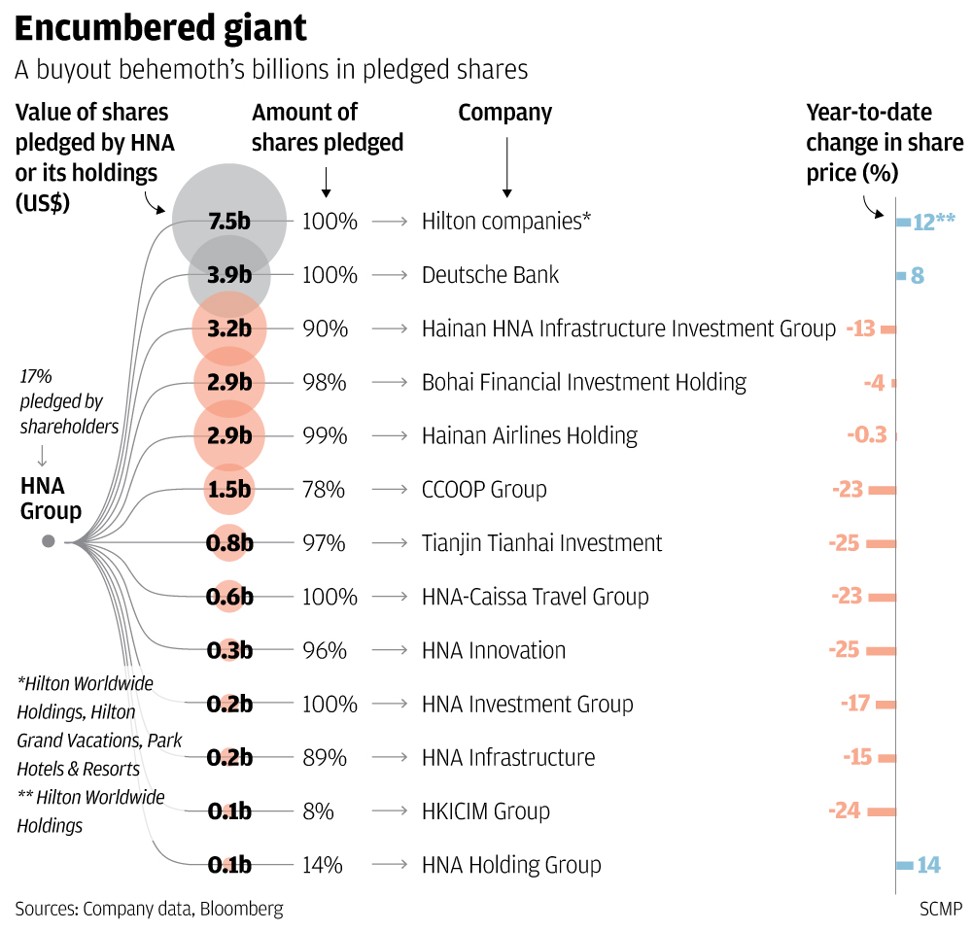

The move comes as the conglomerate is facing rising debt pressure after it has been on debt-fuelled acquisition spree to snap up trophy assets including stakes in Deutsche Bank AG and Hilton Worldwide Holdings Inc.

The group’s HNA-Caissa Travel Group unit halted its shares from trading in Shenzhen ahead of a “major” announcement, becoming the Chinese conglomerate’s fourth unit to do so since last week. The announcement may have an impact on the shares, according to a statement to the Shenzhen Stock Exchange on Friday.

HNA-Caissa joins Bohai Capital Holding, Tianjin Tianhai Investment and flagship Hainan Airlines Holding in suspending their stock. Tianjin Tianhai and Hainan Air have said they’ll provide updates on the situation in the coming weeks.

HNA has been facing increasing pressure -- some banks are said to have frozen some unused credit lines to HNA units after they missed payments -- after a debt-fuelled acquisition spree that left it with global assets ranging from hotels and refrigerated trucks to aviation and car rentals.

One of them sold by HNA Group International, maturing in 2019, slid as much as 4.2 cents this week -- the biggest weekly fall in six months -- to a record low of 84 cents on the dollar. Its bonds due 2021 shed 3.3 cents this week to 79.5 cents, also near the lowest ever.

With uncertainties lingering around the conglomerate, some subsidiaries missed payments due to several Chinese banks in recent weeks, according to people with knowledge of the matter this month.

“Its debt problems are mounting,” said Warut Promboon, managing partner at credit research firm Bondcritic. “When it rains it pours.”

Boies Schiller & Flexner LLP will no longer represent Guo, said a representative at the law firm that Boies founded, confirming court filings this month. Former federal prosecutor Duncan Levin of Tucker Levin PLLC is also severing ties with Guo on three cases, according to court documents. Levin confirmed he no longer represents Guo and declined further comment. A spokeswoman for Guo declined to comment on the reason for the change.

Boies, who fought for Al Gore in the famous Bush v. Gore dispute, and more recently now-former client Harvey Weinstein, will be replaced by New Jersey-based Cohen & Howard LLP in defending Guo against a defamation case lodged by HNA. The law firm will represent Guo in three other cases, and will work with Washington-based Ward & Berry, said Aaron Mitchell, a lawyer with Cohen & Howard. The change doesn’t represent a shift in legal strategy, he said.

The reshuffle is the latest twist in Guo’s legal saga -- he’s sought by Chinese authorities through Interpol and is facing around 10 lawsuits in the US The dissident has also been seeking asylum in America. Guo, who frequently posts his allegations on social media, has said he’s a whistle-blower motivated to change China.