ICBC, China Construction Bank score the biggest gains in years after PBOC cuts reserve ratio

Shares of Chinese banks soared in Hong Kong on Tuesday, with ICBC rising the most in seven years, after the People’s Bank of China cut the reserve requirement ratio for some banks to support the development of “inclusive” financial services, a move that analysts say will boost the net profit of big lenders.

ICBC, the country’s biggest lender by assets, surged 7.9 per cent to close at HK$6.26, the best gain since December 2011.

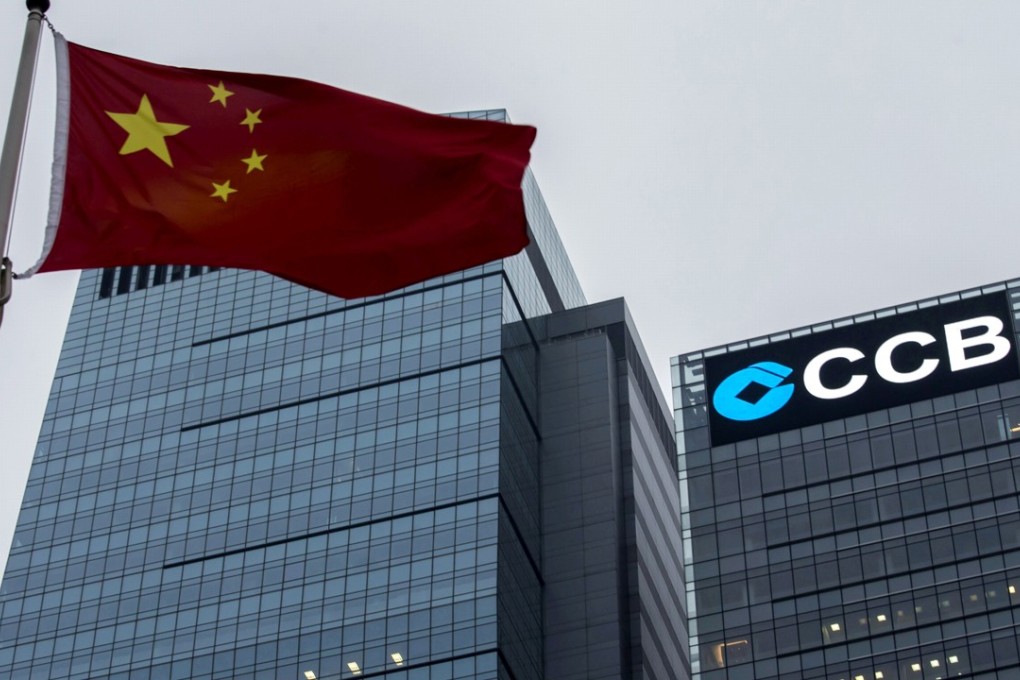

China Construction Bank (CCB), the second-largest bank in China, gained 5.9 per cent to end at HK$6.86, the biggest one-day advance since April 2015.

China Merchants Bank leapt 8 per cent to HK$29.65, Bank of China climbed 4.9 per cent to HK$4.04, Agricultural Bank of China (ABC) gained 3.7 per cent to HK$3.63, and Bank of Communications swung higher by 3.3 per cent to HK$5.89.

The surge in the sector boosted the Hang Seng Index to its biggest daily percentage increase in 17 months.

On Saturday, the PBOC announced it would cut the reserve requirement ratio (RRR) for some banks that meet certain requirements for lending that supports small businesses, agricultural production, entrepreneurship, and education, effective 2018.