Hong Kong M&A activity jumps fivefold in 20 years as Chinese firms use city to go global

Growth also fuelled by western multinationals buying into Hong Kong companies to deepen their penetration in the region

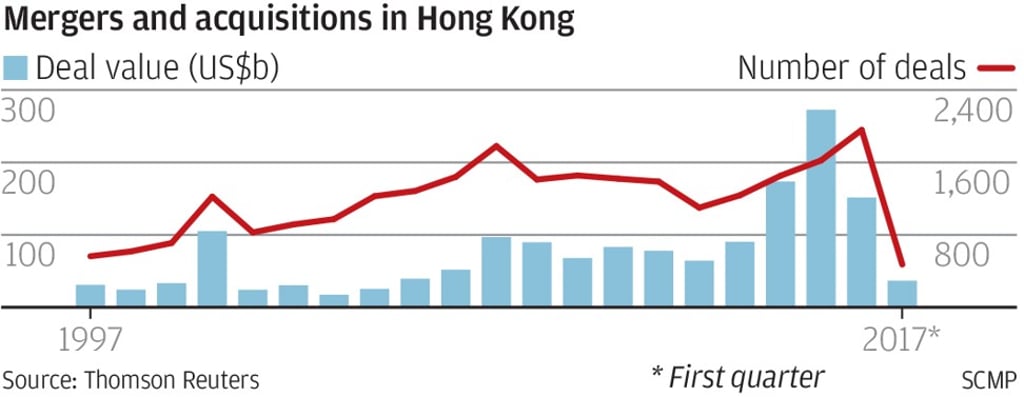

Mergers and acquisitions activity in Hong Kong has increased by a factor of almost five in the past 20 years as international firms use the city as a gateway to expand in Asia and mainland companies use it as a platform to fulfil their global ambitions.

The value of deals involving Hong Kong companies climbed 387 per cent from US$31.06 billion in 1997 to US$151.59 billion in 2016, according to Thomson Reuters.

In total, there have been 7,699 M&A deals worth US$368.15 billion in Hong Kong since its handover from Britain to China. By sector, telecommunications took the top spot with 25.6 per cent of all transactions, ahead of real estate with 22.6 per cent and the financial industry on 20.1 per cent, the Thomson Reuters data shows.

“Many Chinese state-owned and private sector corporates frequently use Hong Kong as the domicile for establishing their international platform,” Gallagher said. “The well developed capital markets and strong legal, regulatory and financial regimes in Hong Kong provide an ideal backdrop for establishing and supporting international activities and expansion of Chinese entities.”

The well developed capital markets and strong legal, regulatory and financial regimes in Hong Kong provide an ideal backdrop for international activities and expansion of Chinese entities