New | Huishan says it’s lost contact with cash officer, gets creditors’ reprieve

A week before the meeting with creditors that led to Huishan’s March 24 stock plunge, chairman Yang Kai pared his stake in the company, avoiding HK$170 million in losses when the stock’s price tumbled 85 per cent.

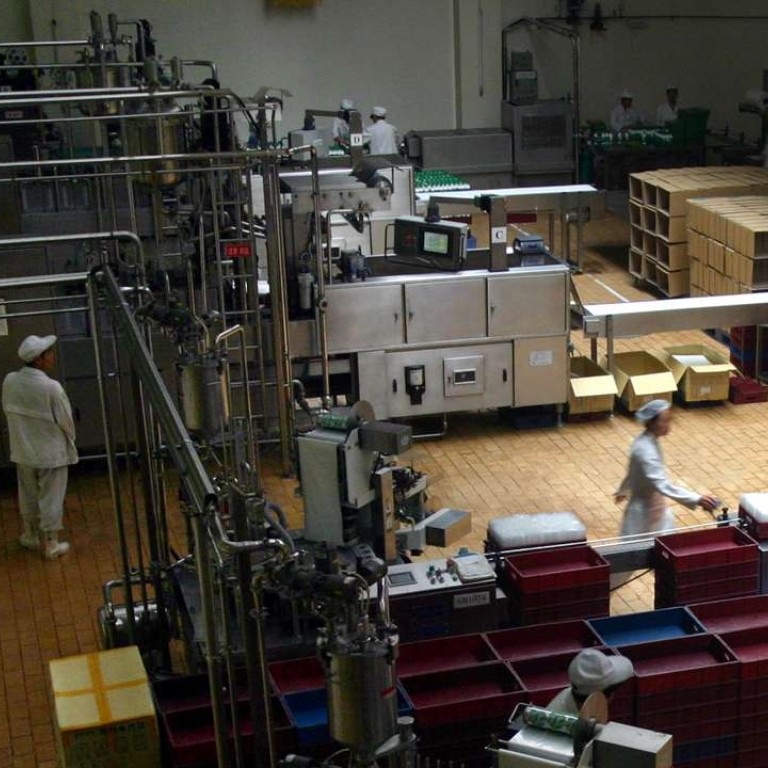

China Huishan Dairy Holdings, whose 85 per cent stock price plunge on Friday wiped out US$4.1 billion in value, said it’s lost contact with an executive in charge of treasury and cash.

Huishan’s shares had been trading in a 15 per cent range between HK$2.18 and HK$3.18 since August 2015, until Friday’s crash. Trading in the stock had been suspended.

Muddy Waters Research Group, the California-based short-selling firm, claimed in a December report that Huishan had inflated the expenditures on its dairy farms by as much as 1.6 billion yuan (US$232.3 million) and that its business was “worth close to zero.”

Huishan, based in the Liaoning provincial capital of Shenyang, said the report was “groundless,” and cited it as the reason for Ge’s intensified work. Ge, 42, had said in a letter than recent work stress had taken a toll on her health, according to the filing.

The company denied media reports that it had issued forged invoices, and that its chairman Yang Kai had misappropriated 3 billion yuan to invest in the real estate market.

“The company categorically denies having approved the issue of any forged invoices and does not believe there to be any misappropriation,” Huishan said.

Huishan has two unsecured loans totalling 1.374 billion yuan due in October 2018.

The company did admit to being “late in some bank payments,” and said it’s met with 23 creditor banks last week to ask for a rollover of its overdue loans.

During a March 23 meeting with the Liaoning provincial government, the state proposed that Huishan consider an action plan to remedy its overdue interest payments within two weeks, and improve its liquidity within four weeks.

Three of Huishan’s creditor banks -- Bank of China, Jilin Jiutai Rural Commercial Bank and Zheshang Bank -- indicated they would “continue to have confidence” in the diary company, Huishan said.

Huishan’s shares will continue to be suspended until the board further clarifies the company’s financial position, the statement said.

Huishan chairman’s decision to sell some of his shares before the stock plunged has also drawn market attention.

On March 16 and 17, the chairman sold 68.25 million shares at an average of HK$2.91 each, reducing his holdings to 9.9 billion shares, or 74 per cent of the issued capital.

The transactions helped him avoid a loss of HK$170 million when the stock price plunged to HK$0.42 following his meeting with bankers. The company didn’t disclose the meeting until Tuesday.

“The fact that he sold heavily for the first time a week prior to meeting the company’s creditors will attract more scrutiny,” Robert Halili, managing director of Asia Insider, wrote in a column for the Post.

In an interview with mainland news portal Netease, the chairman Yang said he was “not at all prepared” to see the share plunge.

Also in media spotlight is Dutch dairy producer FrieslandChampina, which has been operating a China venture since 2014 with Huishan to produce baby formula. The Dutch company, which produces the Friso brand, said it’s unaware of speculation that it was considering buying a stake in Huishan.

Each company owns half Friesland Huishan Dairy, which is managed by the Dutch firm.

“The joint venture continues to be in operation,” a FrieslandCampina spokesman Jan-Willem ter Avest said in an email, responding to a query by the South China Morning Post. “FrieslandCampina is closely monitoring the situation and will, if necessary, take appropriate action to ensure successful continuation of the joint venture’s activities in the Chinese market.”