Monitor | Oil price heading for US$200 as China's imports set to surge

With the mainland’s voracious demand, World Bank consultant projects steady climb in prices, and that will hurt global economic growth

Last month, China passed another milestone in its economic development, although not an auspicious one.

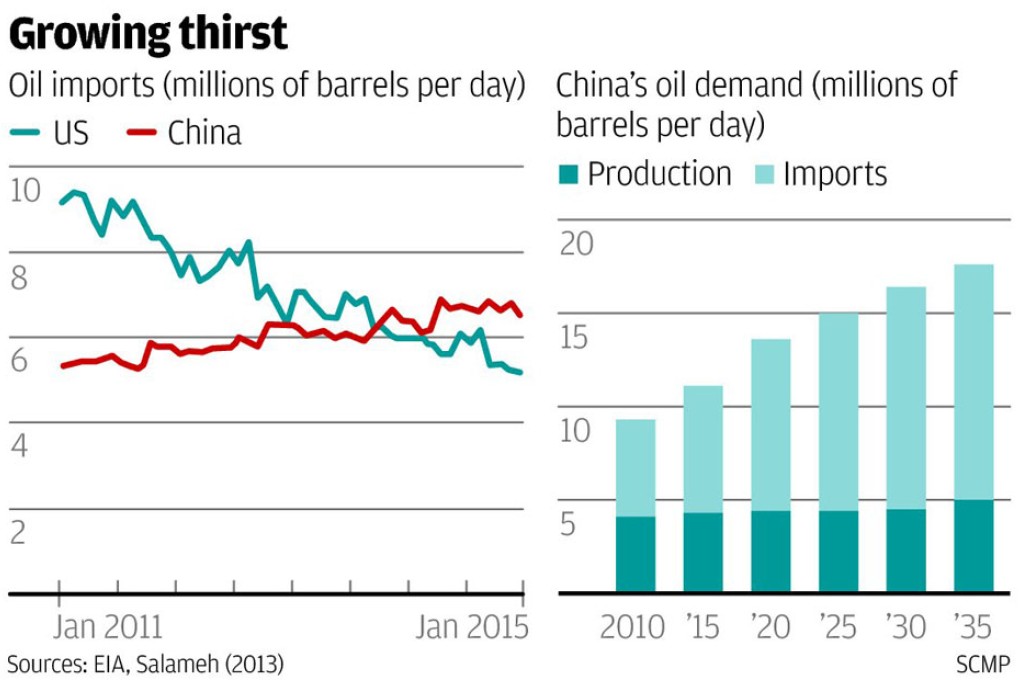

In September, China overtook America as the largest buyer of oil on the international markets.

According to the Energy Information Administration of the US government, last month China's net oil imports hit an average 6.3 million barrels a day, surpassing the US, which imported 6.2 million barrels a day (see the first chart).

China has long boasted the world's fastest growing thirst for oil. In 1996, it accounted for just 5 per cent of the world's demand. By last year, thanks to years of double-digit growth, China's share of global oil demand had more than doubled to 11 per cent.

That trend isn't going to change direction any time soon. Although China's overall growth rate is set to slow over the next few years, it is likely Chinese consumer demand will continue to grow rapidly as household incomes rise. And it is consumer demand, in the form of ballooning sales of private cars, that is driving China's demand for oil.

According to Simon Powell, the head of oil and gas research at brokerage house CLSA, 10 million new cars will hit China's roads each year for the next 10 years. What's more, the fastest growing sector of the market, with sales accelerating by 25 per cent a year, is for fuel-guzzling four-wheel drive monsters.