China to scale up wind and solar recycling to tackle environmental impact of decommissioned hardware

- China will introduce technical standards and policies for the wind and solar industries to recycle their decommissioned equipment by 2030

- China is set to retire about 250GW of solar panels and 280GW of wind turbines by 2040, according to Greenpeace

The National Development and Reform Commission (NDRC) and five other state agencies on Thursday jointly released guidelines that seek to accelerate the recycling of old wind and solar equipment.

China’s new energy sector, which covers wind, solar, battery and other emerging energy technologies, will face a problem of “mass decommissioning of equipment” as industry upgrades accelerate, the state agencies said.

A set of technical standards and policies will be introduced for the wind and solar industries to recycle their decommissioned equipment and form dedicated industry clusters across the nation by 2030.

Wind and solar manufacturers should design equipment that is lightweight and easy to disassemble and recycle, according to the NDRC’s guidelines. Renewable energy generators will also be responsible for decommissioning end-of-life equipment and will not be allowed to discard or bury the waste in landfill sites, it added.

The NDRC said it also encouraged equipment producers to provide recycling services or work with third-party service providers and metal recycling companies to reduce the environmental impact of retired equipment.

Why China will dominate green energy supply chain for the next decade

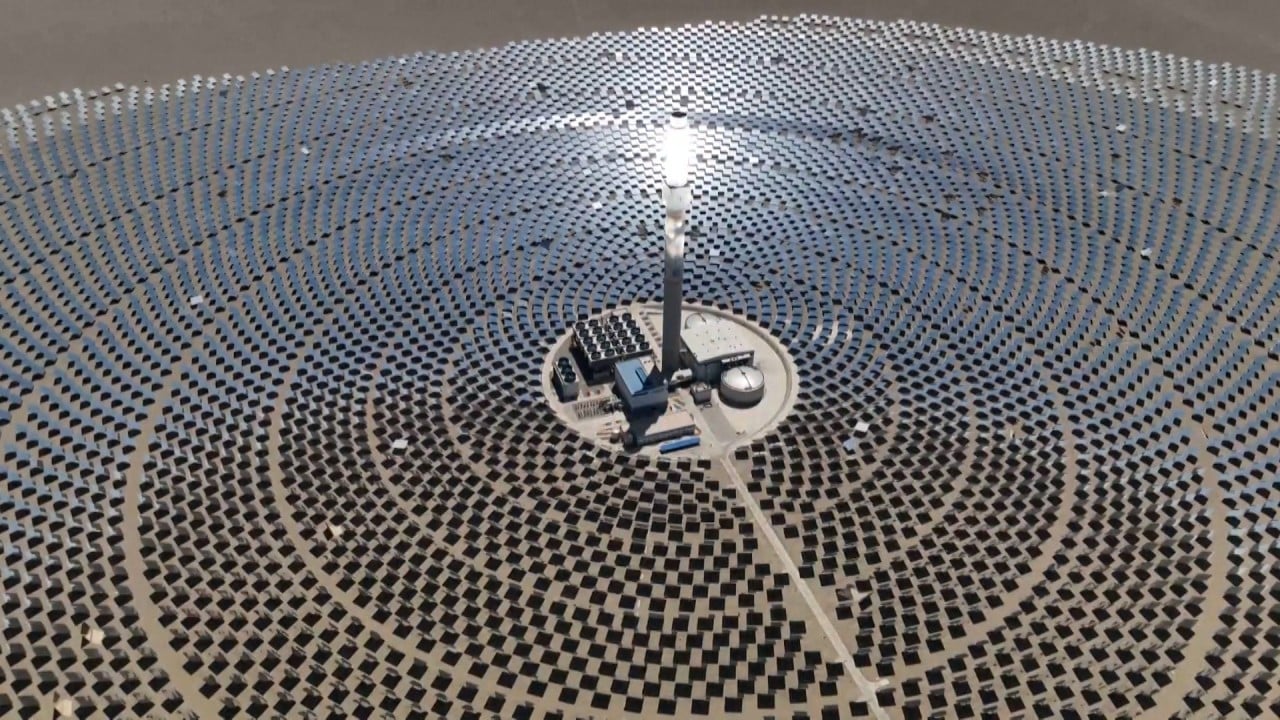

Alongside the growth in renewable energy, China faces mounting challenges as solar and wind power installations from the early 2000s approach retirement age.

“Wind and solar first grew at scale in China in the early 2000s, and the average lifespan for solar panels and wind turbines is about 20 to 25 years,” said Li Jiatong, a campaigner from Greenpeace East Asia. “So China is now seeing the first wave of decommissioned parts.”

The equipment retirement issue in the wind sector is more urgent than solar, as solar development took off later in China, according to Zhu Yicong, a senior analyst at Rystad Energy. An estimated 16GW of solar projects could encounter equipment retirement issues over the next five years versus 70GW of wind farms by 2030, said Zhu.

About 250GW of China’s solar capacity and 280GW of wind turbines are estimated to be retired by 2040, and if all of them are recycled, it could save a combined 220 million tonnes of emissions, according to the environmental group.

The retired equipment poses not only environmental risks but also financial ones, according to Li.

The millions of tonnes of wind turbines and solar panels could end up contaminating soil and groundwater if they end up in landfill, while incinerating them could release toxic substances and add to carbon emissions. The production of new renewable equipment could also cause more emissions.

The financial risks include the cost of components, manufacturing and mining, as well as the financial impact of pollution, she said.

As new entrants eye China solar sector, overcapacity and price war concerns mount

The NDRC guidelines are expected to open up opportunities for companies looking to enter the recycling business.

The value of silicon, silver, copper and glass waiting to be recycled just from retired solar panels could be several hundred billion yuan by 2040, according to Li.

“Guidance on how to effectively recycle parts is key since we’ll be seeing bigger waves of parts in the future,” said Li. “We need to start developing circular economies for renewable energy parts now, if we’re to be ready for the future.”