New | Asia’s private equity funds lose steam as valuations soar beyond reach, Bain survey says

The days of buying low and selling high are over for Asia’s private equity funds, according to Bain & Co’s January survey of 120 general partners

The days of “buy low, sell high” have ended for private equity funds in Asia-Pacific as funds are pushed to identify new sources of value amid inflated valuations, slower economic growth and rising interest rates, an industry report said yesterday.

Price mismatch is the biggest issue that keeps the general partners of private equity funds awake at night, and the discomfort is increasing as more respondents, more than 70 per cent, quoted “high” and “very high” on their perspective of valuations, consultancy Bain & Co said in a report, citing its January survey of 120 general partners and direct investors in the region. It was up from 60 per cent in a similar survey a year ago.

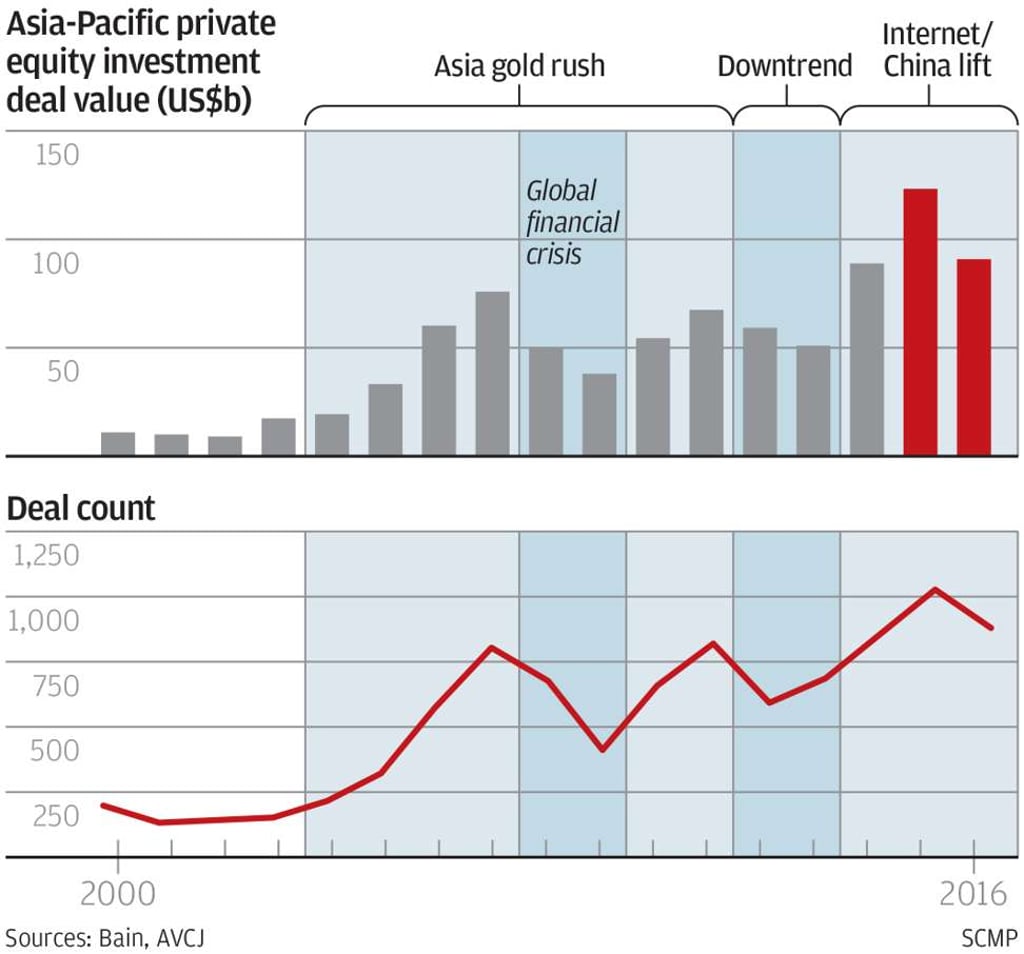

The momentum of private equity investments had already slowed in Asia-Pacific as deal value dropped to US$92 billion last year from the 2015 record of US$124 billion, Bain said. It was still deemed resilient – the second-best year on record though. Deal volume dropped to 892 after peaking at more than 1,000 in 2015, Bain said.

The deal multiples in Asia rose to 17 times, compared with 10 in the United States.

“Wringing greater value from [private equity] investments is much more of a priority than it has been in the past,” said Kiki Yang, a Bain partner. “It’s also not as straightforward as it once was.”

In the survey, 31 per cent of respondents cited multiple expansion as a top source of returns for deals exited five years ago, but only 7 per cent expected that to contribute much value five years from now.