Hongkongers should expect ‘gradual softening of energy prices’ as CLP Holdings returns to profit

- International energy prices have been softening since the beginning of the year, which will filter down to customers’ bills, company says

- CLP Holdings reported a net profit of US$648 million for the first six months, reversing a record loss in the first half of 2022

Hongkongers could expect a “gradual softening of energy prices” as international fuel prices stabilise, according to power provider CLP Holdings, which returned to profitability in the first half of the year after a record loss a year earlier.

“We have seen a softening of international energy prices since the beginning of this year,” Richard Lancaster, CEO of CLP Holdings, said at a media briefing on Monday afternoon. “Over time, we would see a gradual softening of energy prices.”

Factors behind the company’s return to profit include “the dependable performance of our core businesses in Hong Kong and mainland China [and] a one-off income in India adding to a sound operational performance and progressive normalisation in Australia”, which led to a slight gain in the fair value of EnergyAustralia’s forward energy contracts, compared with a significant loss a year earlier, CLP’s filing said.

Swire, CLP among Hong Kong companies putting price on carbon to cut emissions

The fuel cost adjustment is expected to decline further, which will ease tariff pressure on customers, the company said in the filing.

The reopening of Hong Kong after more than three years of relative isolation, as well as hotter weather in May and June, drove a 3.7 per cent year-on-year increase in CLP’s electricity sales to 16,319 gigawatt hours.

Meanwhile, increasing economic activity, particularly in the catering, hotel and retail trades, lifted sales to the commercial sector by 6.6 per cent. Sales to the infrastructure and public-services sector rose 6.5 per cent as government activities and schools returned to normal.

Operating earnings from CLP’s Hong Kong energy business dropped 1.6 per cent to HK$4.05 billion, compared to the same period a year earlier, led by “higher interest expense despite slightly higher permitted return driven by the continuous investments in infrastructure to support decarbonisation and growth”, according to its filings.

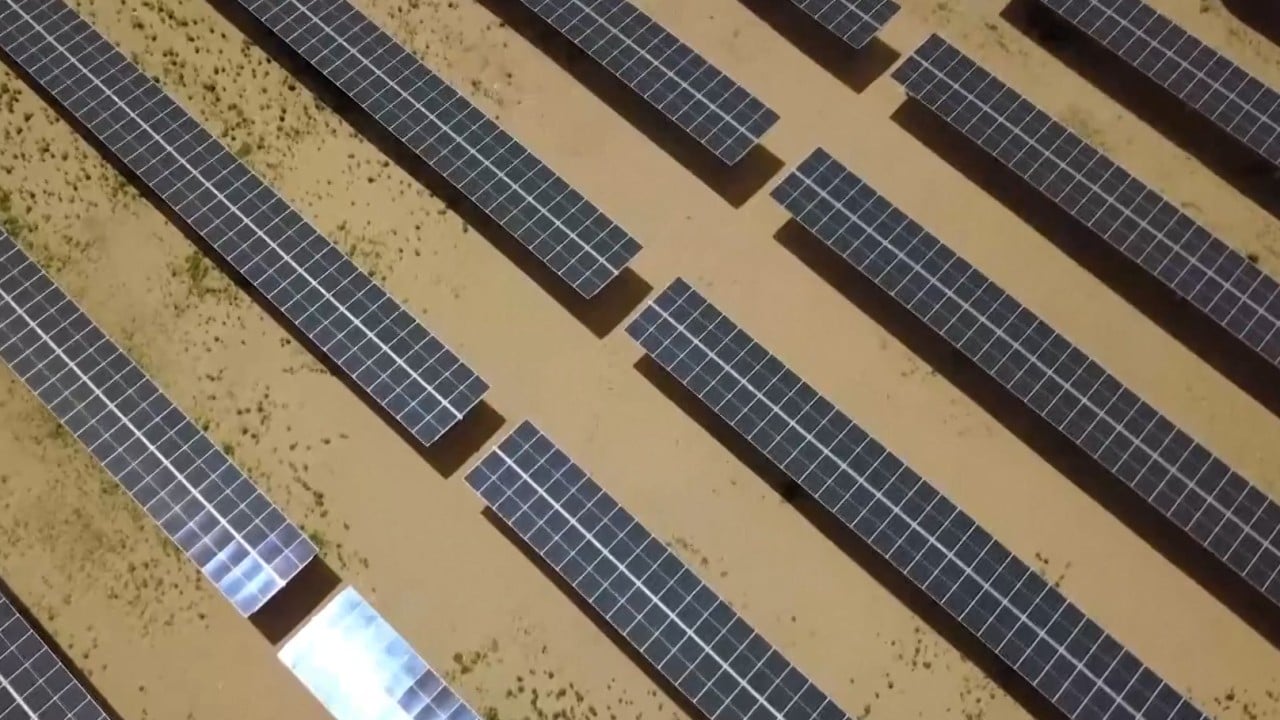

Meanwhile, operating earnings from mainland China grew 10.6 per cent to HK$1.37 billion, driven by higher output from nuclear power stations in Yangjiang and Daya Bay, which maintained steady power supply to Guangdong province and Hong Kong. The start of commercial operations at CLP’s Xundian II wind farm in Yunnan province in the first half of the year also contributed to the company’s bottom line.

“Ongoing global uncertainties, stubborn inflation and rising interest rates serve to remind us to stay cautious of the volatile external environment,” Michael Kadoorie, CLP chairman, said in the filing.

CLP declared an interim dividend of HK$0.63 per share, unchanged from the previous year.

“The Hong Kong business is the company’s cash cow, sustaining its dividend payment ... despite CLP’s volatile earnings from overseas, though with slow increments,” Citigroup analysts said in a note on Monday.

Drones, crawler robot at Hong Kong’s CLP Power cut inspections from 12 days to 1

“The improvement from the Australian business looks slower than expected, though the company guides the performance there to pick up in the [second half of 2023].”

Shares of CLP rose 1.2 per cent to HK$62.75 on Monday after the results were announced.