Asian private equity firm PAG weighs US$2 billion Hong Kong IPO plan

- The firm could aim to raise around US$2 billion if it decides to go ahead, according to people with knowledge of the plan

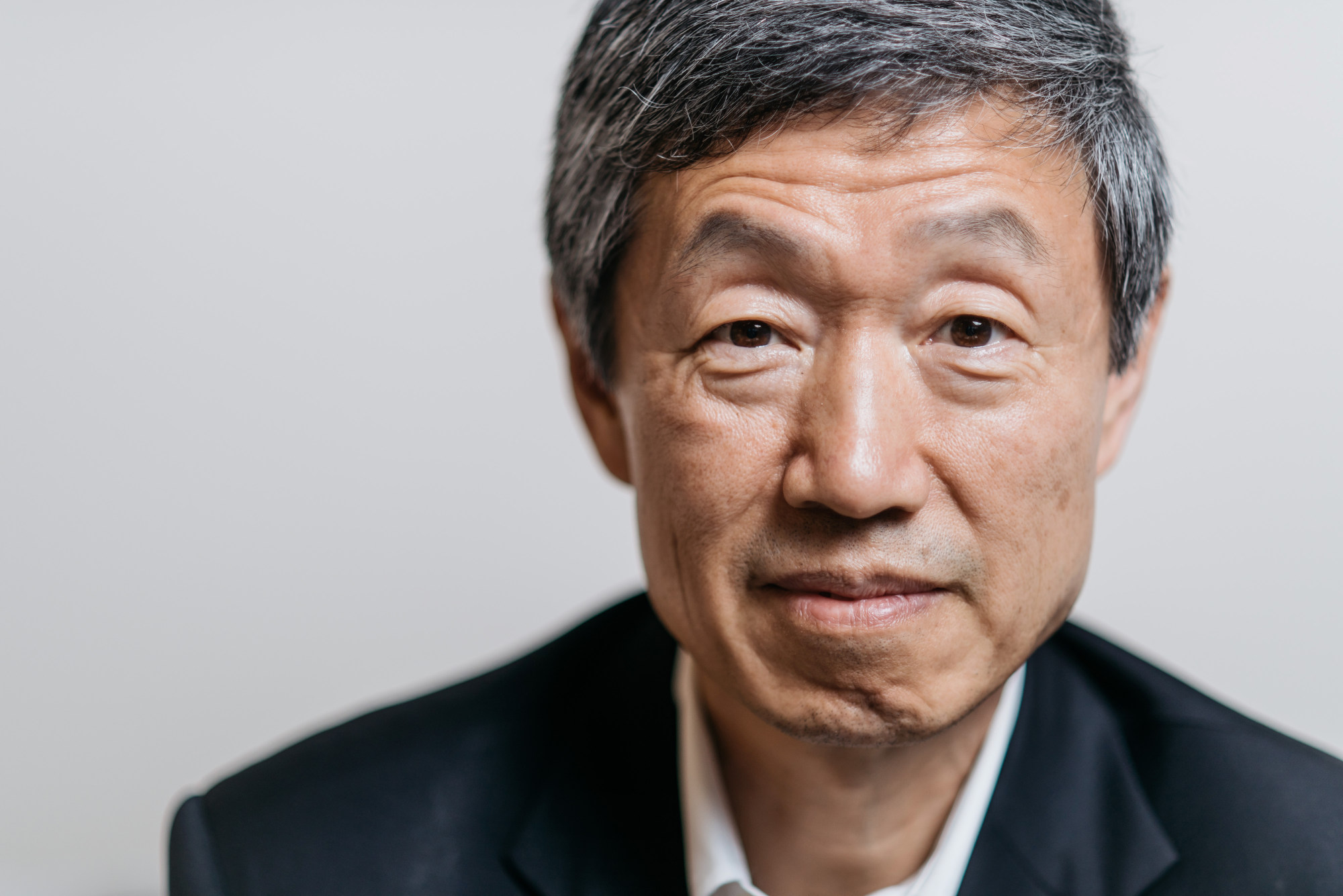

- PAG, led by Chinese deal maker Shan Weijian, manages about US$45 billion across absolute return, real estate, private equity and buyout funds

PAG has been speaking with advisers about a potential listing, the people said, asking not to be identified as the information isn’t public. It could aim to raise around US$2 billion if it decides to go ahead, the people said.

The firm could list as soon as this year depending on market conditions, the people said. No final decisions have been made and there is no certainty it will proceed with an offering, the people said. A representative for PAG did not respond to phone calls seeking comment.

The Hong Kong-based alternative asset manager would join a number of global rivals seeking public listings. TPG raised US$1 billion earlier this month in the US, while CVC Capital Partners has lined up banks for a London share sale in the second half of the year that could value it at more than US$20 billion.

Led by Chinese deal maker Shan Weijian, PAG manages US$45 billion across absolute return, real estate investments and private equity and buyout funds, according to its website. It’s currently in the process of raising US$9 billion in what would be its largest buyout fund, Reuters reported last year.

PAG was seeking US$700 million in December for a fund that will target opportunities in China’s distressed real estate sector, which has been roiled by defaults and a government clampdown on excessive leverage.

Hong Kong’s IPO market has stagnated for th past six months as China’s regulatory crackdown on vast swathes of its private companies has dragged down stock prices. The prospect of rising interest rates has also put a damper on equity capital markets activity.

Just two first-time share sales have started trading in the Asian financial hub this year, raising about US$575 million combined, according to Bloomberg data. The biggest of the two, JL MAG Rare-Earth, has slumped 19 per cent from its offering price since listing a week ago.

The muted start compares with what was a stellar beginning for 2021, with 13 companies fetching US$1.3 billion by this time last year as rallying stock markets and a surge in retail investor trading pushed up valuations.