Hong Kong’s bold bid for London Stock Exchange faces scrutiny of global regulators, adding kinks to its arduous approval process

- The LSE’s clearing house unit, LCH, serves 13 government debt markets around the world and is the second-largest clearing house for bonds and repos

- That subjects a takeover of the LSE to the scrutiny of regulators in France, Germany, Italy and the US, not to mention the UK’s government

Hong Kong’s financial marketplace operator faces an uphill battle to obtain regulatory approval for its unsolicited takeover bid for the London Stock Exchange (LSE), said the former chief executive of the United Kingdom’s 300-year-old bourse.

That is because the London Clearing House (LCH), 82.6-per cent owned by LSE, clears half of the world’s interest rate swaps, and is the second-largest clearing house for bonds and repos that serve 13 government debt markets.

Founded in 1888, the LCH clears commodities, securities, exchange traded derivatives, credit default swaps, energy contracts, freight derivatives, interest rate swaps and foreign exchange.

While the broad range of financial assets attracted the attention of Hong Kong Exchanges and Clearing Limited (HKEX), their geographical span also gives the regulators of France, Germany, Italy, and the US Commodity Futures Trading Commission (CFTC) the sway to weigh in on Hong Kong’s bid, adding to the requisite approval by the Bank of England and the UK’s Financial Conduct Authority, said the LSE’s former chief executive Xavier Rolet.

“HKEX is taking a very ambitious and aggressive move to propose the offer, but it would not be easy,” Rolet said in a telephone interview with South China Morning Post. “It is not just the UK, but the HKEX will need to get approval from the US and many other regulators on the takeover the LSE.”

The potential role by the additional regulators, particularly amid heightened tensions between the United States and China, could complicate the lengthy approvals process needed for the HKEX’s US$36.6 billion bid.

Shareholders of the London bourse would need to vote down their own US$27 billion take over of the Refinitiv financial data service for the Hong Kong offer to proceed.

The LCH’s website shows regular filing to the CFTC, which has an agreement with the Bank of England to regulate the clearing house.

The Trump administration, which has been fighting a year-long trade war with China, has also stepped up the scrutiny of Chinese corporate investments and acquisitions in America, through the Committee on Foreign Investment in the United States (CFIUS). US allies around the world have also raised their bars on Chinese investments and corporate action.

In this global environment, a bid by Hong Kong - the special administrative region of China - would be subject to the same heightened scrutiny as Chinese corporate entities, analysts said.

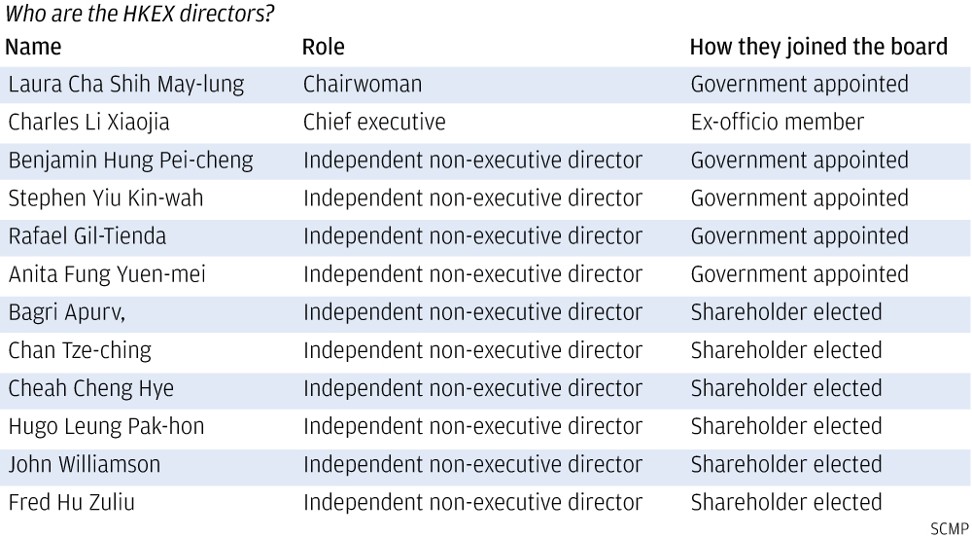

Hong Kong’s government, while owning only 6 per cent of HKEX’s shares, appoints half of the exchange’s board members, while the remainder half are approved by shareholders. The chairperson of the exchange - currently held by former Securities and Futures Commission’s Deputy Chairman Laura Cha Shih May-lung - needs the approval of the city’s Chief Executive.

HKEX shares declined by 3.5 per cent on Thursday, giving back the previous day’s 0.3 per cent gain after the exchange operator announced its bid. LSE shares traded at £72.1 in early trading on Thursday, after soaring by as much as 16 per cent to £79.22 after receiving the bid.

“HKEX’s offer is more likely to face regulatory challenges versus LSE’s proposed Refinitiv acquisition,” said Christian Kuendig, Senior Director of EMEA Non-Bank Financial Institutions at Fitch Ratings in an emailed note.

“Global regulatory authorities are increasingly concerned about competition in the FMI [financial market infrastructure] space, blocking some major mergers and acquisitions, including the proposed merger between LSE and Deutsche Boerse in 2017, while triggering divestitures related to other acquisitions, such as the sale of Trayport by ICE to TMX Group in 2017.

“Increasing control by Chinese authorities over Hong Kong could also raise UK and US regulators’ concerns about data and information security.”

The London exchange, established in 1698, is a venerable institution that the UK government is unlikely to allow to fall into foreign hands, according to British media reports. For its part, the UK government said it would scrutinise the offer closely.

“The London Stock Exchange is a critically important part of the UK financial system, so as you would expect, the government and the regulators will be looking at the details closely,” a UK government spokesman said in response to query by the Post. “We cannot comment further on commercial matters.”

Rolet, who served as the LSE’s chief executive from 2009 until his retirement in 2017, carried out 25 successful acquisitions during his tenure, including the 2013 purchase of the LCH and the 2011 takeover of the FTSE Group’s indices and data businesses. Those deals boosted the LSE group’s value by 18-fold from £800 million to £14 billion.

€

The deal will require the shareholders of LSE to vote down its owns US$27 billion to take over data company Refinitiv which it announced on August 1, which Rolet said to make it harder for LSE shareholders to accept the offer.

“The share price of the London Stock Exchange is trading below the HKEX offer price, which showed investors are sceptical on whether it can get approvals by the regulators,” Rolet said.