New | The only way is down for the euro against the dollar

A bailout extension for Greece is not enough to boost the unit as the ECB is about to launch quantitative easing and dollar demand remains huge

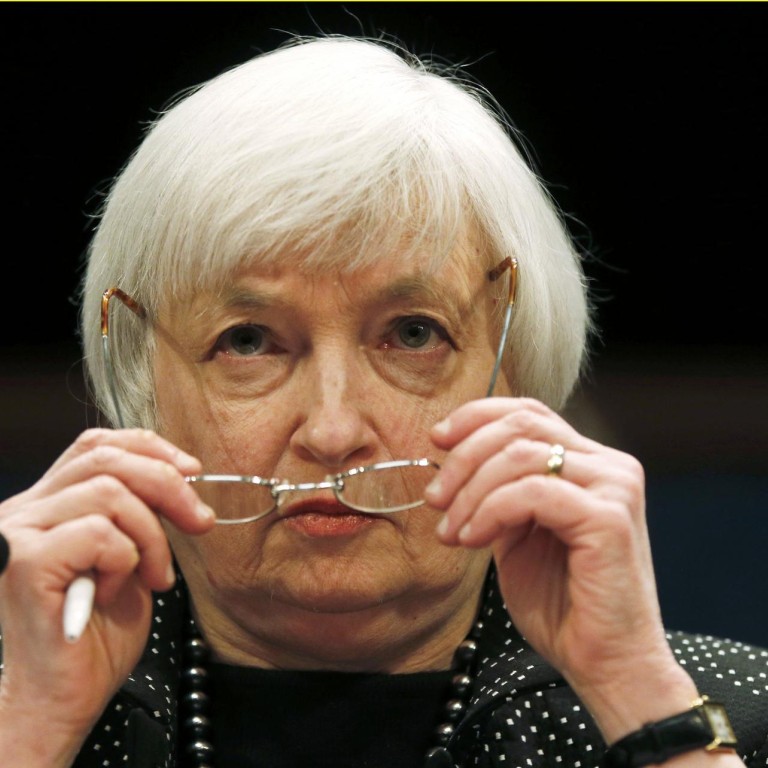

The fact that US Federal Reserve chairman Janet Yellen failed to give a clear indication that US rates would rise in the immediate future, and the securing by Greece of a four-month extension to its bailout, do not necessarily favour a stronger euro or, more particularly, a weaker US dollar.

The opposite conclusion could easily be drawn.

The bailout extension for Greece "averted an immediate crisis", the European Union's commissioner for economic affairs, Pierre Moscovici, said last week, but the reality of the matter is quite simple. Greece still has to find a way to repay all the €240 billion it has borrowed from euro-zone governments and the International Monetary Fund.

But for markets, out of sight is out of mind. Greece's four-month lifeline parks that problem for a while, enabling traders and investors to refocus on the next major event in the euro zone, namely the European Central Bank's commitment, beginning this month, to a €60 billion monthly asset purchase plan that will be worth almost €1.1 trillion over 18 months.

That is a material addition to the central bank's already ultra-accommodative monetary policy at the very moment when the Fed is recalibrating its own approach to either leaving policy unchanged - albeit with arguably a slight bias towards tightening - or actually moving to increase rates.

Given that the latest Fed policy statement specifically mentioned its future deliberations would take into account "international developments", any cautious optimism on Greece, and by extension the globally important euro-zone economy as a whole, if only for four months, could be seen as taking away one possible source of international concern that would stay the Fed's hand.

No treasurer ... will wait for an actual increase in US rates before hedging at least some of that dollar exposure

In truth, when Yellen spoke before Congress on Tuesday, she actually freed the Fed's hand to a great degree.

The market might have been disappointed not to have received a clearer steer on the timing of an increase, but traders now know the US central bank will drop the word "patient" from its statement in due course and move to a meeting-by-meeting evaluation of America's economic situation.

While Yellen has given no timetable for making such adjustments, traders have to think ahead, and the only certainty from her testimony is that change is on the Fed's mind. This must affect market behaviour in the here and now, even if, ultimately, the Fed decides that US economic data does not justify a change or nothing-more-than-token tightening of policy.

No treasurer, in any institution with US dollar-denominated liabilities that need to be funded, and who is paid handsomely to second guess what the Fed will do, will wait for an actual increase in US rates before hedging at least some of that dollar exposure.

To do so would be to close the stable door after the horse had bolted.

And there are a lot of horses in the stable.

A recent working paper from the Bank for International Settlements, often referred to as the central banks' central bank, made the point that "since the global financial crisis, banks and bond investors have increased the outstanding US dollar credit to non-bank borrowers outside the United States from US$6 trillion to US$9 trillion".

That's US$9 trillion of debt, held outside the US, taken on over a period of years when the Fed was loosening policy and the dollar was seen as weakening.

Times have changed, but that US$9 trillion has to be serviced and repaid.

So here we are. The Greek drama may have reached an interval but the final acts are yet to be played out. The ECB is about to launch quantitative easing. And the world's need for dollars remains as great as ever even as the Fed continues to edge towards tightening monetary policy, or at the very least stands still.

The market's knee-jerk response was to buy the euro against the dollar on Tuesday, partly on relief that Greece got its loan extension, partly because Yellen's message on tightening was not as clear as traders had hoped for.

But knee-jerk reactions often prove ill-judged when analysed in the cold light of day.

The euro has subsequently lost ground against the dollar in the past few days. That should continue.