Hong Kong’s New World, Far East slash prices at Pavilia Forest I flats to 8-year low

- The first 60 flats of Pavilia Forest I are on offer for as little as HK$16,008 per square foot, with discounts of up to 18 per cent from new launches in the neighbourhood

The first 60 flats of the Pavilia Forest I project are being offered for as little as HK$16,008 (US$2,050) per square foot, with discounts of up to 18 per cent from the prices of new launches in the same neighbourhood, according to Midland Realty. The first flats on offer, ranging between 234 and 512 sq ft (47.6 square metres), are priced from HK$3.86 million to HK$9.87 million.

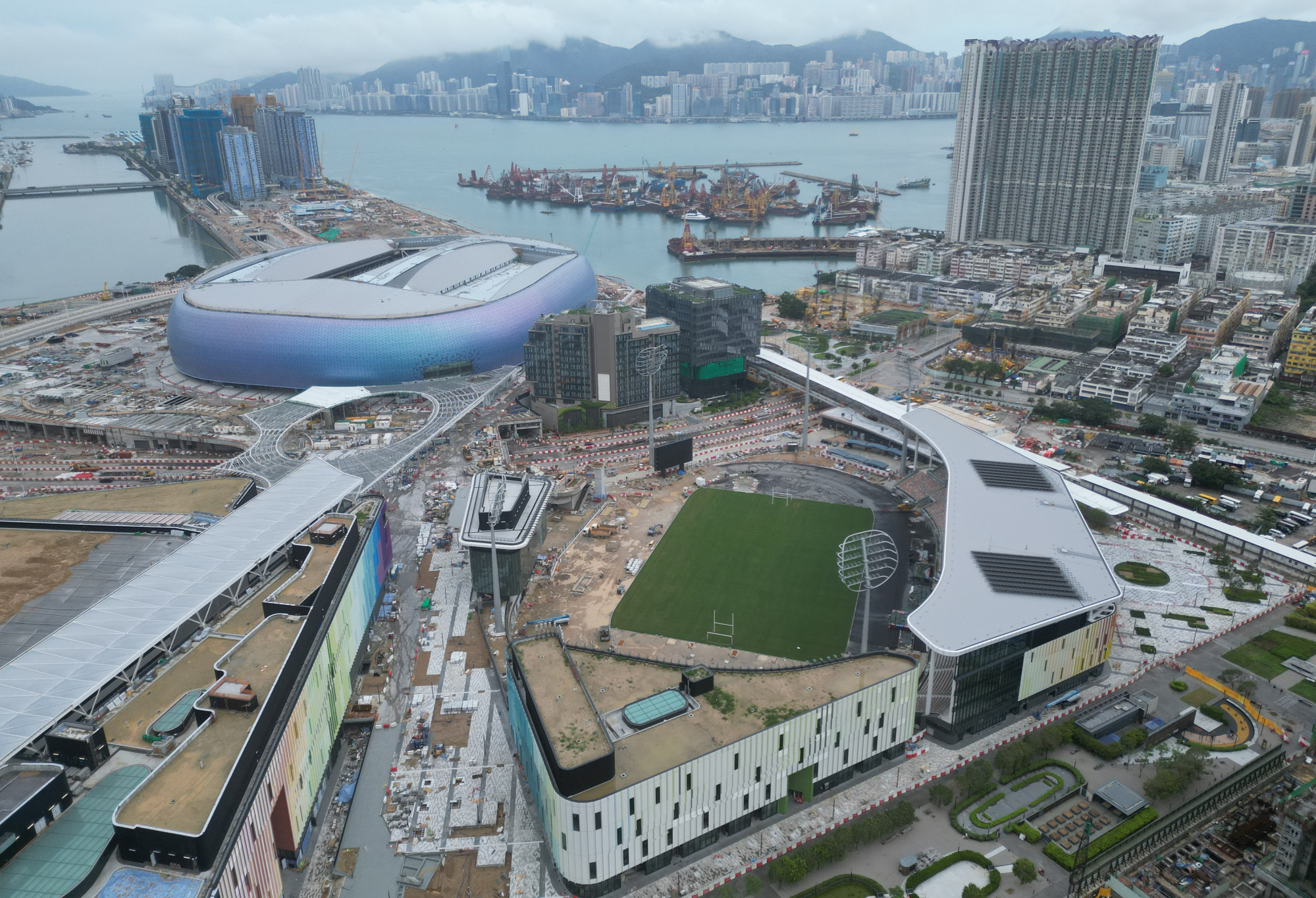

The project’s pricing is “aggressive” because “the discount on the first batch of units is a new low in eight years in the Kai Tak area, and a discount of nearly 30 per cent compared to the price of leftover units in the same area,” said Sammy Po, the chief executive of Midland’s residential division.

Pavilia Forest I comprises 291 apartments in two residential towers. There are 28 one-bedroom flats in the project, 205 two-bedroom units and 46 three-bedroom apartments. The remaining 12 homes are larger, more expensive “special units” that come with balconies and rooftop space, the developer said.

The average price of a new class A unit in Yau Ma Tei on the Kowloon peninsula, defined as a flat smaller than 431 sq ft, was launched in May at HK$20,346 per square foot, 10.6 per cent less than 2015. The average price in Kennedy Town on the western fringe of Hong Kong Island has fallen by 6 per cent to HK22,022, from HK$23,424 per square foot in 2015.

“It makes sense for some developers to price their flats for sale at 2015 levels since secondary prices have [returned] to the late-2016 level,” said Will Chu, senior research analyst for Hong Kong and China property at CGS International Securities. “In an uptrend, developers priced their flats at a premium to the prevailing secondary prices. That was why in 2015, developers priced their flats at a premium to secondary prices in 2015 – quite close to 2016 secondary prices in hindsight.”

Transactions of residential units fell 30.5 per cent in June from a month earlier to 3,856 deals, while the total sales value shrank by 35 per cent to HK$34.5 billion, according to data released by the Land Registry on Wednesday. Residential property deals fell 35 per cent in May from April.

Overall property transactions – including shops, car parks, industrial spaces and office units in addition to homes – dropped 28.7 per cent in June from a month earlier to 5,245 units, with total value sliding 34 per cent to about HK$42 billion. Overall sales volume contracted by 25 per cent in May.

Property deals may shrink by another 20 per cent in the second half, compared to the first six months of the year because interest rates are stuck unchanged at a 23-year high, according to Ricacorp Properties. Home prices are also tipped to slip by another 3 per cent.