China’s solar panel makers to enjoy brighter outlook as plant shutdowns, scrapped expansions ease overcapacity crisis

- Producers have delayed or cancelled capacity expansion plans and even curtailed production, partially addressing overcapacity issues

- Companies including a dairy firm and a medical devices maker, which had drawn up unrelated diversification plans, have abandoned their projects

Several solar panel producers have delayed or cancelled capacity expansion plans and curtailed production entering 2024, with analysts expecting the trend to further accelerate this year, amid hopes it will solve the industry’s overcapacity issues.

“Considering the recent accelerated clearing of production capacity, we believe that the supply and demand situation of the photovoltaic industry could be corrected for the better in 2024,” said Wu Bohua and Cao Haihua, analysts at Changjiang Securities this month.

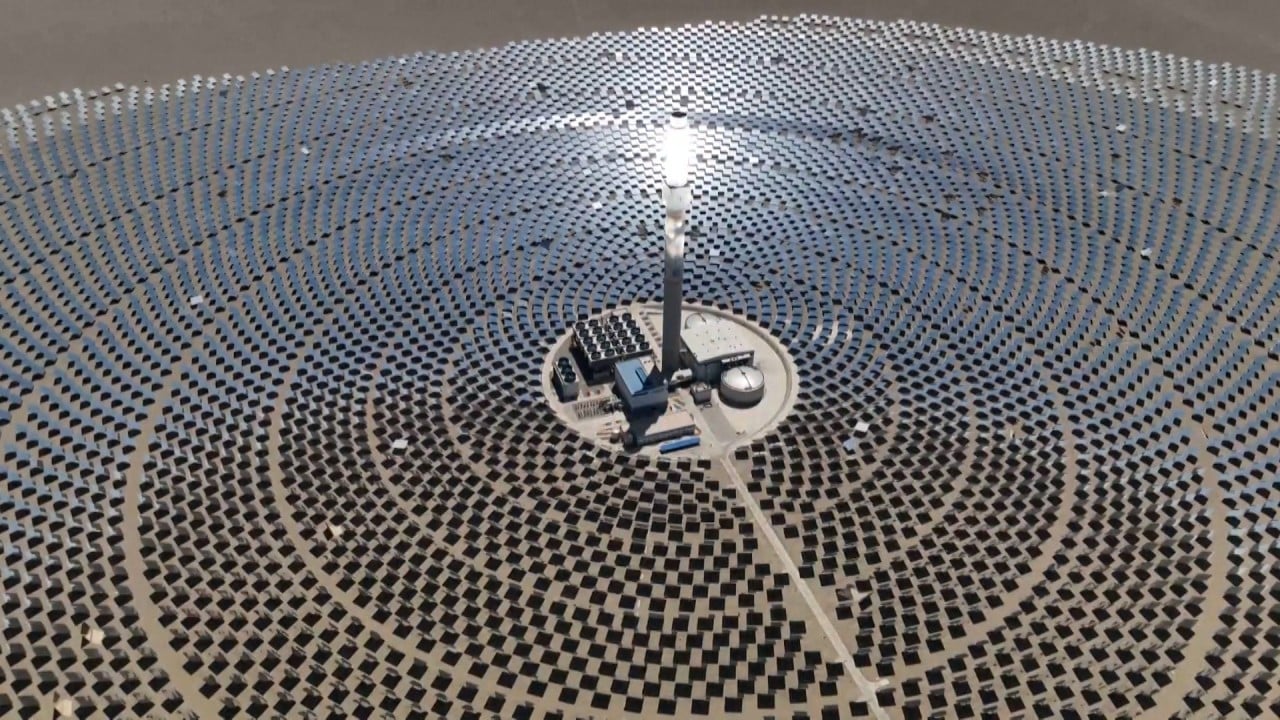

China’s installed solar electric power generation capacity rose by 55.2 per cent in 2023, adding over 216 gigawatts (GW) of solar power, data released by the National Energy Agency showed. Powered by this furious pace of expansion, the country is expected to meet its 2030 target of 1,200GW of renewable capacity five years ahead of schedule, according to analysts’ forecasts.

But the panel makers have added capacity at a faster pace with the result that despite the country’s record-breaking installation of solar energy under its 2060 carbon neutral target, China’s solar panel sector is grappling with overcapacity. This has unleashed a brutal price war, forcing many players to down their shutters.

According to a report from industry portal Century New Energy Network released this month, among the 58 listed Chinese solar PV enterprises that have issued earnings estimates for the year 2023, nearly half, or 25 companies, expect to report lower profits or even losses, a contrast to the rosy picture painted by China’s solar power installation sector.

Leading silicon wafer producer TCL Zhonghuan Renewable Energy Technology estimated a year-on-year decline of between 29.6 per cent and 38.4 per cent in its net income in 2023, compared with the 70 per cent growth posted a year ago. Top PV company Daqo Energy has also estimated its net profit in 2023 may have declined by around 70 per cent year on year, after the near trebling it reported in 2022.

Both companies attributed the estimated decline to the bruising price war and massive overcapacity in the solar energy industry.

These profitability challenges come at a time when financing problems have intensified in China’s troubled capital markets, and a combination of these factors could drive solar panel makers to reduce production this year, according to Changjiang Securities.

Last month, Jiangsu-based solar panel maker Changzhou EGing Photovoltaic Technology announced it would put the expansion at its TOPCon solar cell manufacturing base in Anhui province on hold because of the “rapid changes” in the solar PV market.

Moreover, the country is expected to slow down the pace of installations this year relative to the rest of the world. China is likely to install around 220GW of solar power this year, the same level as 2023, while global installations will rise 18 per cent to 450GW, said Founder Securities in a report last month.