Ukraine conflict: Sinopec says Russian investments ‘going well’ amid Western sanctions, reports doubled net profit for 2021

- No risk of assets impairment from Russian invasion of Ukraine ‘for the time being’, Sinopec chairman says

- Refiner posts a 115 per cent jump in net profit for last year, its highest since 2012

China’s largest oil refiner has put on a brave face with its Russia investments amid Western sanctions, after its 2021 net profit more than doubled to its highest level in a decade.

The Beijing-based company’s “projects and operations in Russia are going smoothly, and there is no risk of [assets] impairment for the time being,” Ma Yongsheng, Sinopec’s chairman, said in a briefing on Monday.

Western countries have imposed unprecedented economic sanctions against Russia and its businesses after the country’s invasion of Ukraine on February 24, covering merchandise and energy trading, flights and financial dealings. The sanctions have resulted in a spike in inflation and eroded consumers’ buying power.

The plant in Russia’s Amur region, just across the border from China’s northeastern-most Heilongjiang province, has been billed as what would be the world’s largest basic polymer production facility, with the capacity to produce 2.3 million tonnes of polythene and 0.4 million tonnes of polypropylene. It will mainly target the China market.

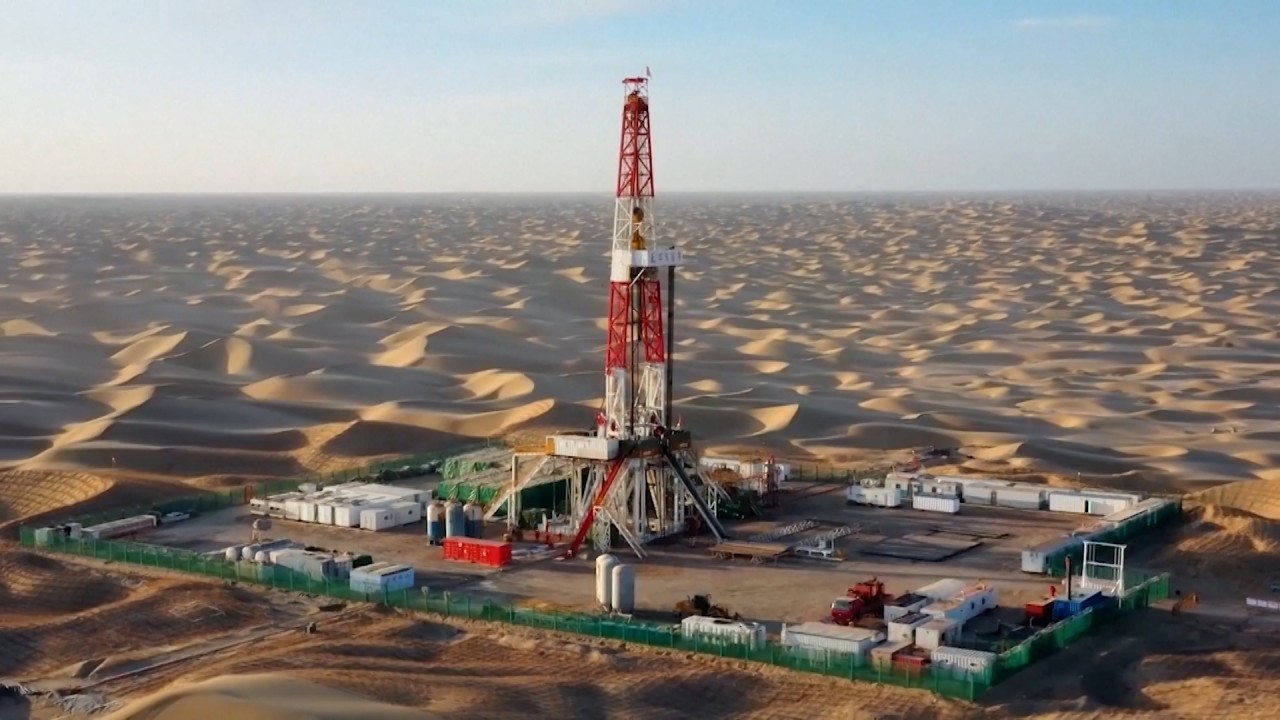

China’s Sinopec begins building world’s largest green hydrogen plant

Sinopec would continue to follow its strategy of procuring oil and gas from diversified sources internationally, Ma said on Monday, without commenting on the Reuters report or whether the refiner would buy more Russian products that were discounted heavily because of international sanctions.

The company had bought some crude oil and liquefied natural gas (LNG) from Russia last year, he said, adding that product grades, prices, logistics costs and supply stability had all been considered.

Sinopec on Sunday posted a 115 per cent jump in net profit to 72 billion yuan (US$11.3 billion) for last year – its highest since 2012. It was slightly lower than the 73.2 billion yuan average forecast by analysts polled by Bloomberg.

Sinopec to spend 30 billion yuan over five years to get off fossil fuels

This was thanks largely to higher oil and gas prices that saw Sinopec book 30 billion yuan of gains on its inventories’ value, partly offset by a 6 billion yuan loss on imported LNG.

Its refining and chemicals operations, which contributed 73 per cent of last year’s operating profit, have faced profit margin pressure amid high oil prices in the past two months, Ma said. Sinopec will seek to offset this by procuring more crude oil that offers value for money, producing more high-value-added products and boosting its oil and gas output, he added.

The refiner planned to raise oil production by 0.5 per cent this year to 279.8 million barrels and gas output by 4.8 per cent to around 35 billion cubic metres.

Sinopec’s shares closed the morning session 5.1 per cent higher at HK$3.9, after it said it would pay 80 per cent of its 2021 profits to shareholders through a final dividend of 31 fen per share. Its annual payout will now amount to 47 fen. The payout ratio in 2020 was 73 per cent.

The company will also seek approval from shareholders to repurchase its shares. Details about the scale, timing and price would be announced later, vice-president Huang Wensheng said on Monday.

As part of its goal to achieve carbon-neutrality in its operations by 2050, Sinopec aims to cut its methane emissions intensity by half by 2025 from 2020, Ma said. Methane is the main component of natural gas. Sinopec will enhance the detection and repair of methane leakages and increase its recovery and utilisation of vented gas. It recovered 717 million cubic metres last year, up nearly 20 per cent from 2020.