Chinese buyers retreat from global property market as Beijing restricts deals

Tough new controls on outbound investment expected to create headwinds for prices in Hong Kong, the US, Britain and Australia

Cash-rich Chinese firms – the big spenders in the global property market in the past four years – are getting cold feet as Beijing tightens controls on outbound investment.

“Requests for overseas acquisitions are already drying up,” said Paul Guan, a partner with global law firm Paul Hastings who advises Chinese institutional investors on overseas real estate.

“Business owners all know the Chinese government has sent a clear signal this time that they want to curb overseas investment in the property sector,” Guan said.

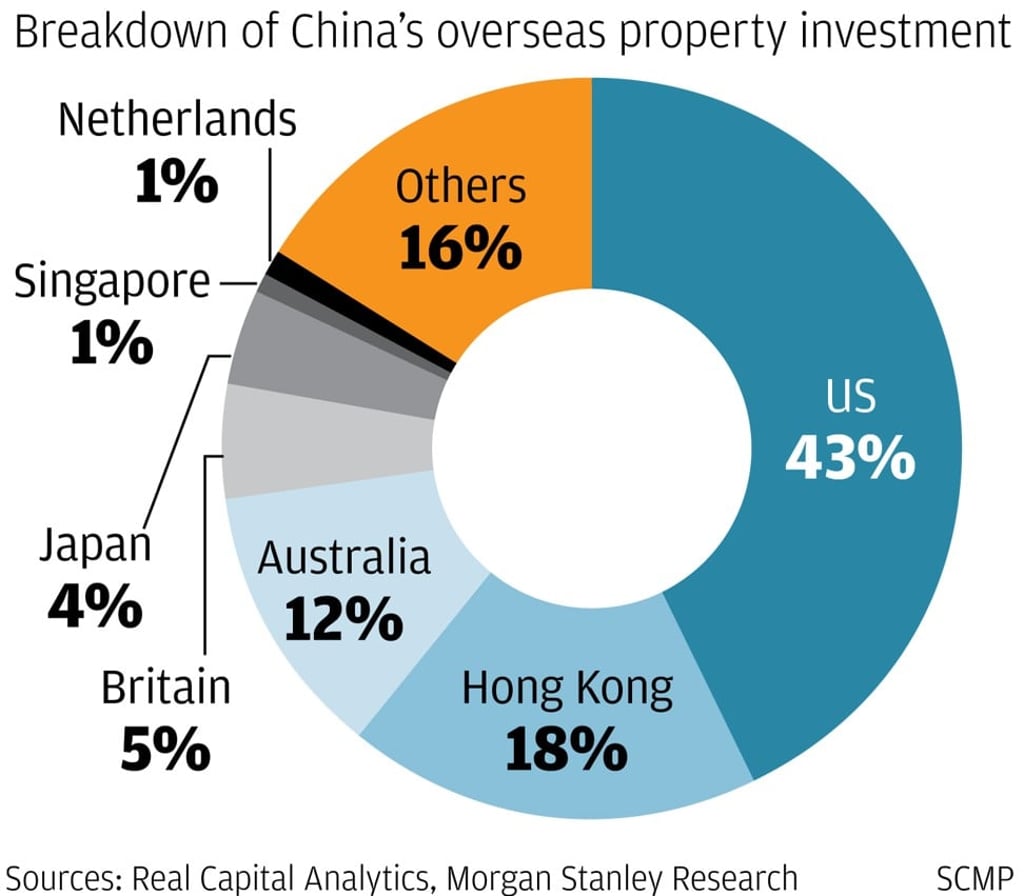

The move will put pressure on prices in key property markets from New York to London. The top three overseas destinations for Chinese property investors in 2016 were the United States, Hong Kong and Australia, while pending deals have accumulated mainly in Britain and the US over the past six months, according to Real Capital Analytics.

Chinese were the biggest foreign investors in US and Australian real estate last year, accounting for 25 per cent of deals in the US and 26 per cent in Australia.

They also accounted for 25 per cent of all central London commercial property acquisitions in 2016, while some 80 per cent of residential land sold in Hong Kong so far this year was bought by Chinese firms, according to data from Morgan Stanley. Chinese investment in the city has quadrupled since 2012, the financial services firm said.