Dirty money alarmism just doesn't wash

PwC's on-the-cheap survey says less about any real issues with money laundering in our neighbourhood and more about pleasing regulators

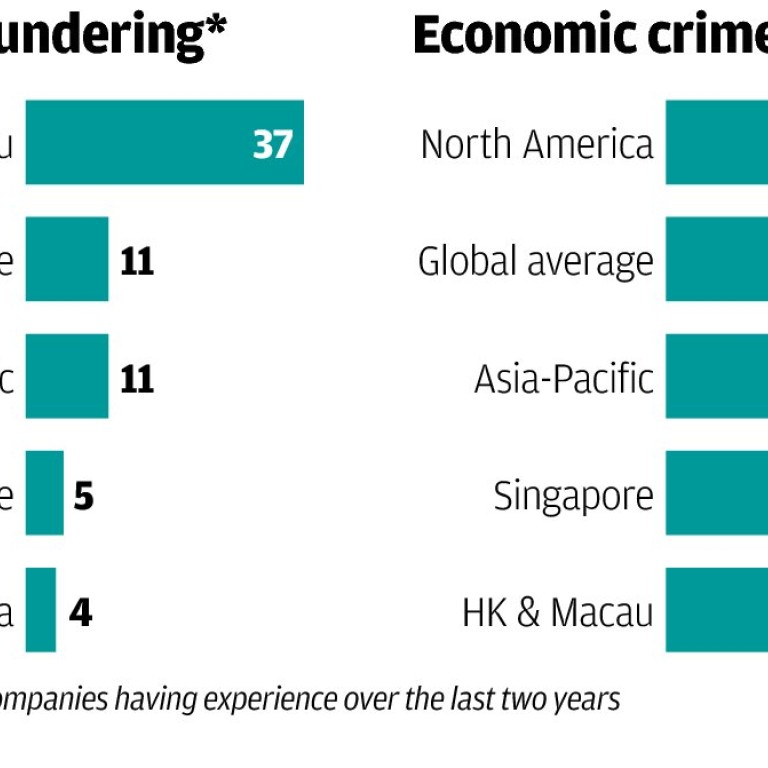

Today a tale of two charts. The first one on the prevalence of money laundering was given some prominence in this newspaper on Sunday and shows us in a bad light indeed. Tsk, tsk ... we'll have to clean up our act.

The second one on the prevalence of general economic crime, which was taken from the same survey by this big accounting firm, shows us in a very good light indeed. Hey there, New York, you better clean up your act.

It's a matter of definition, of course, and PwC could define economic crime only by listing examples - fraud, corruption, cybercrime, etc (you know, like, bad stuff, like). Let it be. Our topic is the money laundering charge.

There are three things to take note of here. First is that bit in the excerpt above about "... and casinos". Why is Hong Kong to be lumped in with Macau when we have gone out of our way to keep casinos out? No way would Hong Kong come in at 37 per cent with casinos excluded.

Then there is the glaring anomaly that says only 4 per cent of companies in China, in contrast, have experienced money laundering in the past two years.

What?

Come again?

Is this planet earth?

Throw this survey's whole section on money laundering into the bin, I say. Hey, you people at PwC, did you know that it takes two to tango? With whom did you think Hong Kong was doing this dance then?

That's right. You can go to prison in Hong Kong for a long term, 10 years or more in some cases on record, because you looked shifty-eyed and didn't directly answer when you were asked: "Where did you get your money?"

It's true. Ask any lawyer. In money laundering you're guilty here unless proven innocent, a huge breach of civil liberties but one that produces big numbers in money laundering cases. Most, of course, consist only of commercial transactions that go around Beijing's capital flow restrictions.

Let's return to the PwC survey, however.

The presentation is as

glitzy as anything of this kind comes but dig a bit and you find the confession that in substance it "consisted of a globally accessible web-based questionnaire on a secure

site. Executives wishing to respond …"

They did it on the cheap. There was no control of the survey population, no way to determine response rate. This is a distinctly unprofessional way to conduct a survey and invalidates all the results.

But it is sure to please supervisory regulators. In school we used to call that sucking up to the teacher.