Jake's View | How the export invoicing trick works

Illicit capital flows into the mainland from Hong Kong through over-invoicing, so says Global Financial Integrity, a Washington-based research and advocacy group. Tick the boxes - name, geographic base and description. Yes, we have angels here again, far removed from Planet Earth.

So says Global Financial Integrity, a Washington-based research and advocacy group. Tick the boxes - name, geographic base and description. Yes, we have angels here again, far removed from Planet Earth.

The angelic argument in this case is that mainland exports to Hong Kong shot up last year while overall mainland export growth was soft. This must have been, they say, because these exporters inflated the payments they received for their goods.

Right, let's work out how this over-invoicing works. You ship goods to Hong Kong and you bill your customer for more than you said you would and then you take the money back across the border and invest it in China.

Now, first of all, how does your customer stay in business if he keeps paying too much this way? Assuming that it was actually your own money, why would you expose yourself to the Beijing taxman by taking money you had hidden away from him abroad and bringing it back in as corporate profits?

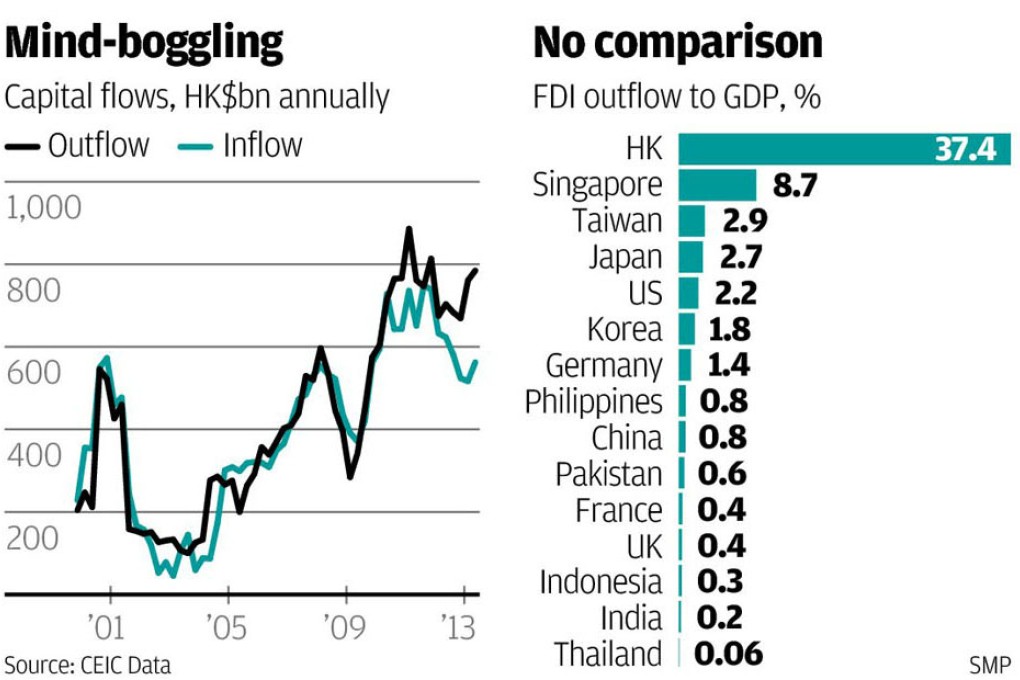

And anyway, why should Beijing object to Chinese citizens investing in China, particularly at a time when the balance of payments showed an unwelcome outflow of private capital?