The pre-pandemic approaches to supply chains were conditioned on the assumption that global links were reliable, predictable and cost-effective. Covid-19, geopolitics and labour market dynamics are driving firms and countries to look to new locations such as India, Mexico and Southeast Asia for diversification.

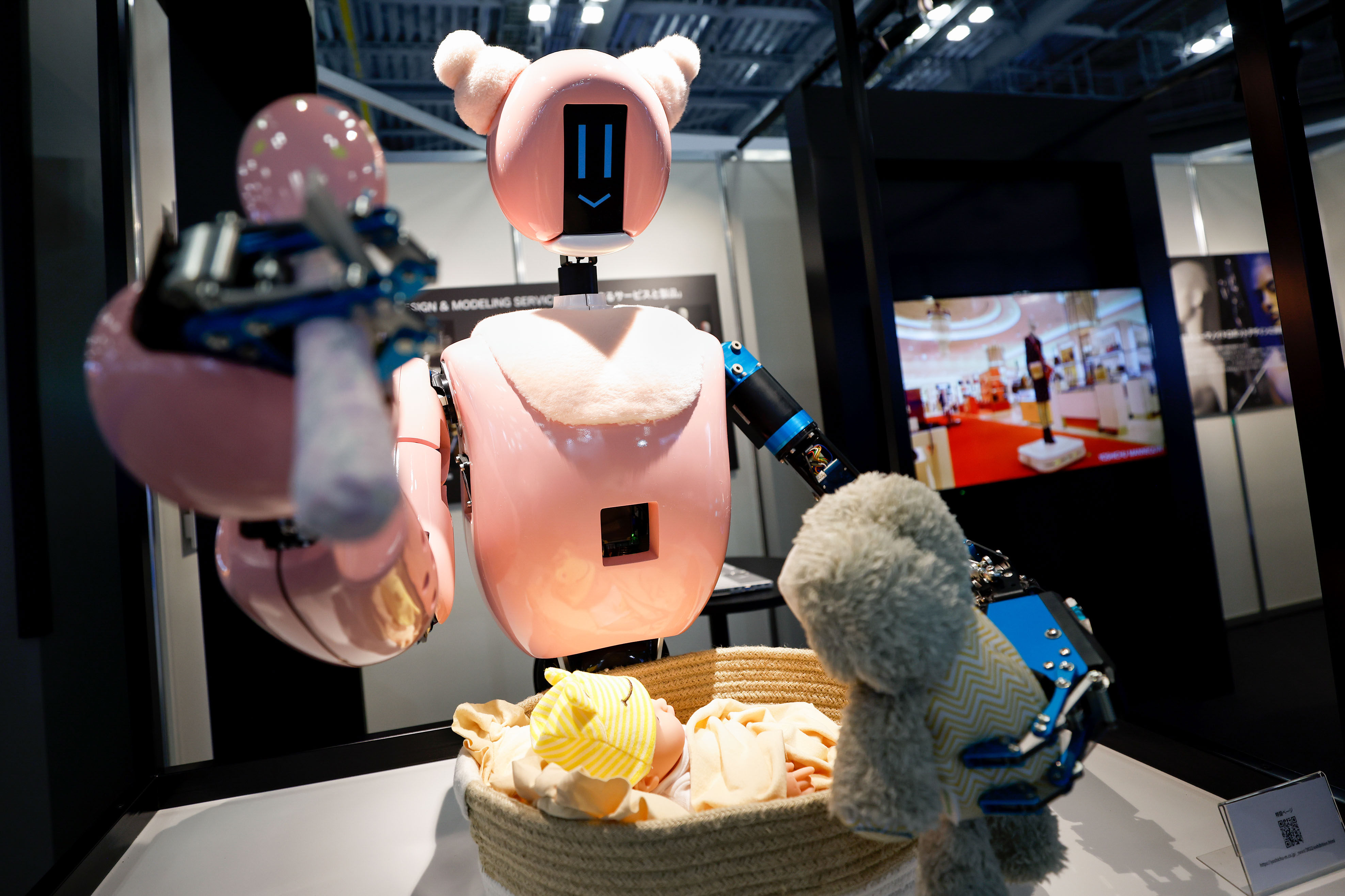

Asia stands to benefit from each stage of AI development given its advantages in manufacturing components and putting them into use. With the adoption and investment in AI set to continue to rise in Asia, the technology has the potential to transform the regional economy.

While policies aimed at influencing fertility warrant attention, more urgency should be applied to increasing women’s labour force participation rate. Female education is a vital source of support for long-term economic growth, and that growth feeds into a virtuous cycle that can benefit everyone.

Asia’s eager tech adoption is changing its economy in manufacturing, banking, healthcare and e-commerce, creating opportunities across the digital ecosystem.

Southeast Asia is becoming a vital alternative to Chinese supply chains and manufacturing. Its massive need for renewable energy, coupled with huge reserves of critical minerals and resources, also means huge opportunities

For cautious investors who don’t want to hold money in low-interest-paying bank accounts, money market offerings like government bonds are attractive. But with interest rates set to peak, those seeking returns may have to venture into riskier assets.