The West fears a reverse of economic reforms, sees a lack of political progress and accuses Beijing of becoming aggressive and provocative, particularly on Taiwan. Yet America’s China-bashing is closely linked to its domestic politics, and accusations of Chinese sabre-rattling must be seen in the context of US provocations.

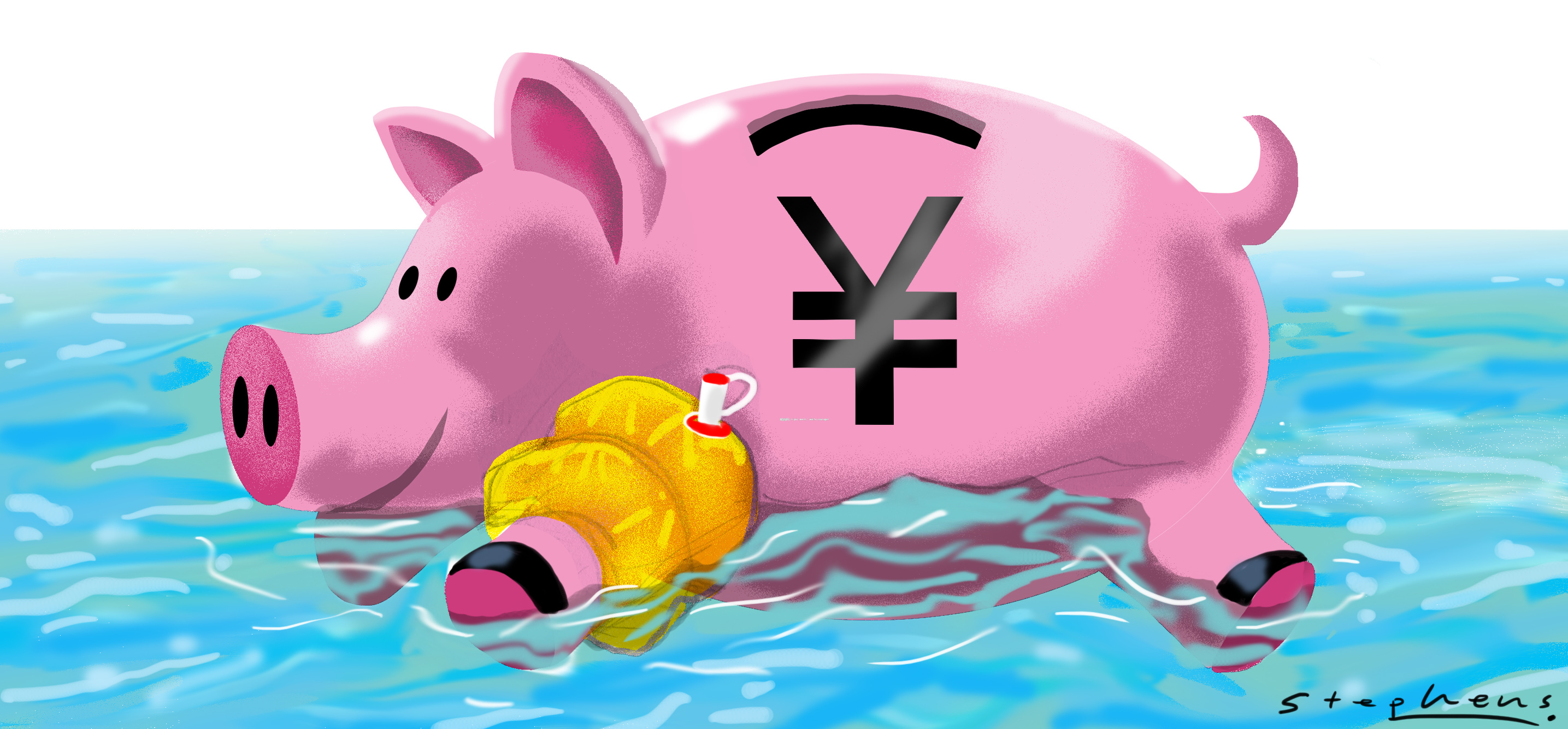

Sanctions on Moscow show that foreign reserves held by central banks are never truly ‘safe’, which is bound to make Beijing uncomfortable. Yet when it comes to shifting away from Western currencies, the alternatives – gold, the yuan and foreign infrastructure investment – struggle to match up.

Population growth is almost irrelevant to economic growth for a developing country. Besides, China has millions of rural workers, who can partially offset any potential labour shortage. It also has the option of raising the retirement age.

The recent prediction of a ‘cataclysmic recession’ triggered by high private-sector debt fails to take into account Hong Kong’s role as a global financial centre. Moreover, debt levels alone are a poor measure of financial risk.

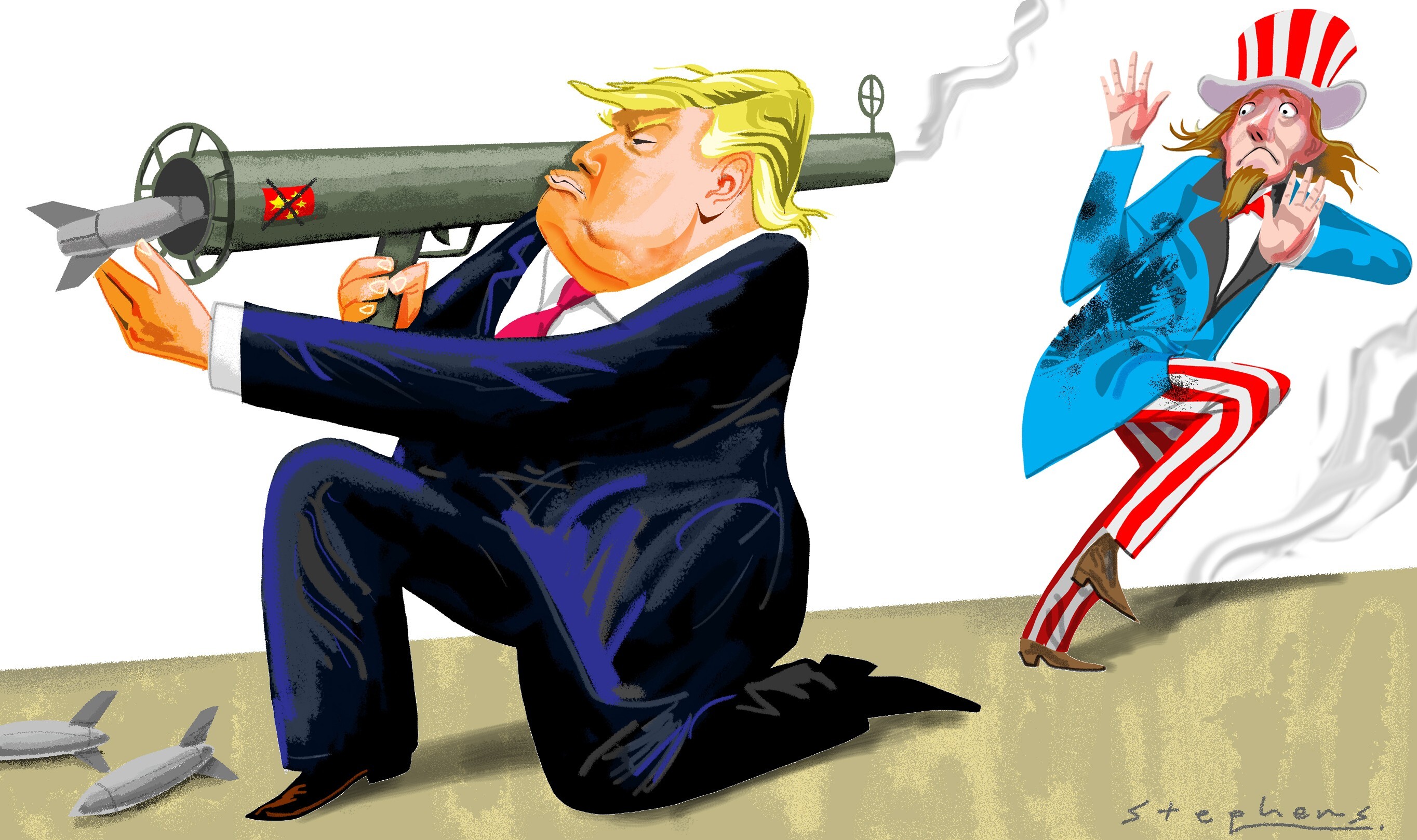

Rather than a cohesive strategy, America is taking aim at China’s economy based on a mix of short-term thinking, parochial calculations, and fear of Chinese competition. Most of its attacks are missing the mark, and some are likely to boomerang on US interests instead.

Trade tariffs, tech bans or cancelling US debt obligations to China are all unlikely, given their enormous cost to the US economy. As for backing Taiwan independence? Not if it meant outright war with China.

With state-owned enterprises soaking up the bulk of bank loans, the economy is in fact underleveraged. Many private businesses depend on freely flowing credit to survive and thrive. If the government truly wants to build a competitive financial system, it must allow banks to run like banks.

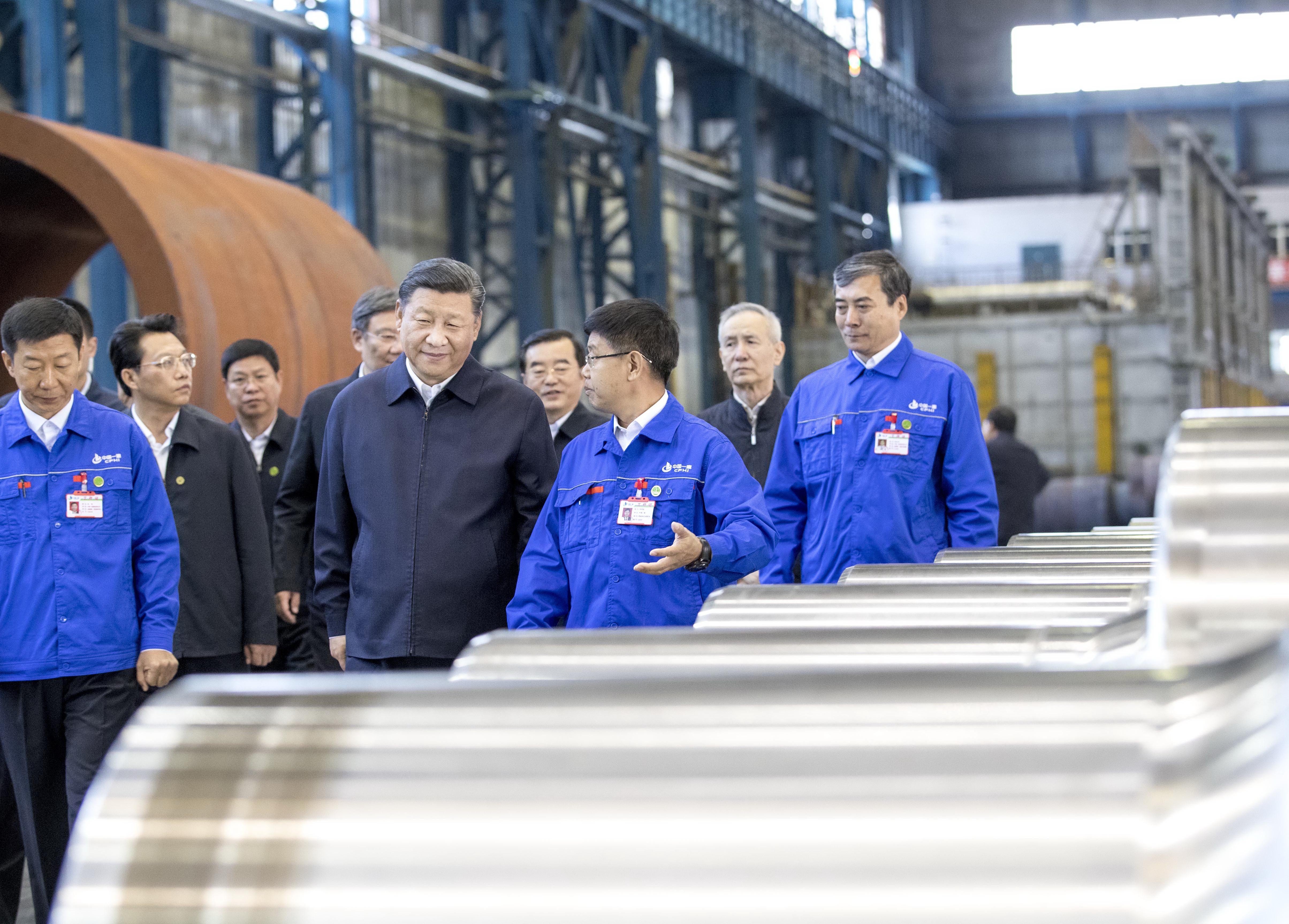

Those disappointed by China’s economic data must put the facts in perspective, as higher income levels go hand in hand with lower growth rates. Industrialising the rest of China’s huge rural labour force will provide enough momentum for productivity gains in the years ahead.

Imagine what happens if China commits to wiping out its share of the US trade deficit – a chain reaction of stronger US dollar, higher US interest rates, and a redistribution of Chinese imports could bring pain to the rest of the world.

Beijing has embraced the mistaken view that China’s economy is overleveraged. A large part of China’s high debt-to-GDP ratio is actually cheap credit given to the state sector. In fact, the private economy is underleveraged.

the repeated cycle of monetary tightening followed by stimulus is largely driven by Beijing’s flawed deleveraging policy, and the drop in stock prices is just the latest phase.

Beijing should think twice before taking populist retaliatory measures against Washington. Instead, it should focus on increasing domestic spending

Beijing has shown a trend towards tightening liquidity and credit at unfortunate times, leading to the 2015-16 market slump that forced leaders to drastically reverse course.