The Hong Kong-based entrepreneur is teaming up with PayPal’s co-founder Peter Thiel again to tap the market for another blank-cheque company.

The start-up’s IPO would make it one of the first major technology-backed companies to go public in Jakarta.

The Indonesian unicorn is likely to attract sovereign wealth funds and global financial institutions with a final round of fundraising to anchor what is likely to be Jakarta’s largest ever initial public offering later this year.

The world’s second-largest private-equity firm has bet US$2 billion on China’s fast-evolving consumer market. It sees a host of exit opportunities this year, via IPOs and mergers and acquisitions.

Gojek’s Andre Soelistyo will lead the combined business as CEO, while Tokopedia’s Patrick Cao will serve as president.

Hong Kong’s struggling flag carrier has raised US$650 million by selling a US-dollar bond by convincing fixed-income investors to help finance its operations through the coronavirus pandemic.

A flood of capital raising by SPACs at the start of 2021 slowed to a trickle by April, raising the question whether one of the hottest trends in finance has run out of steam before Asia reaches the starting line?

Grab, the Singapore ride-hailing, food delivery company, is expected to be the biggest listing ever by a Southeast Asian tech firm.

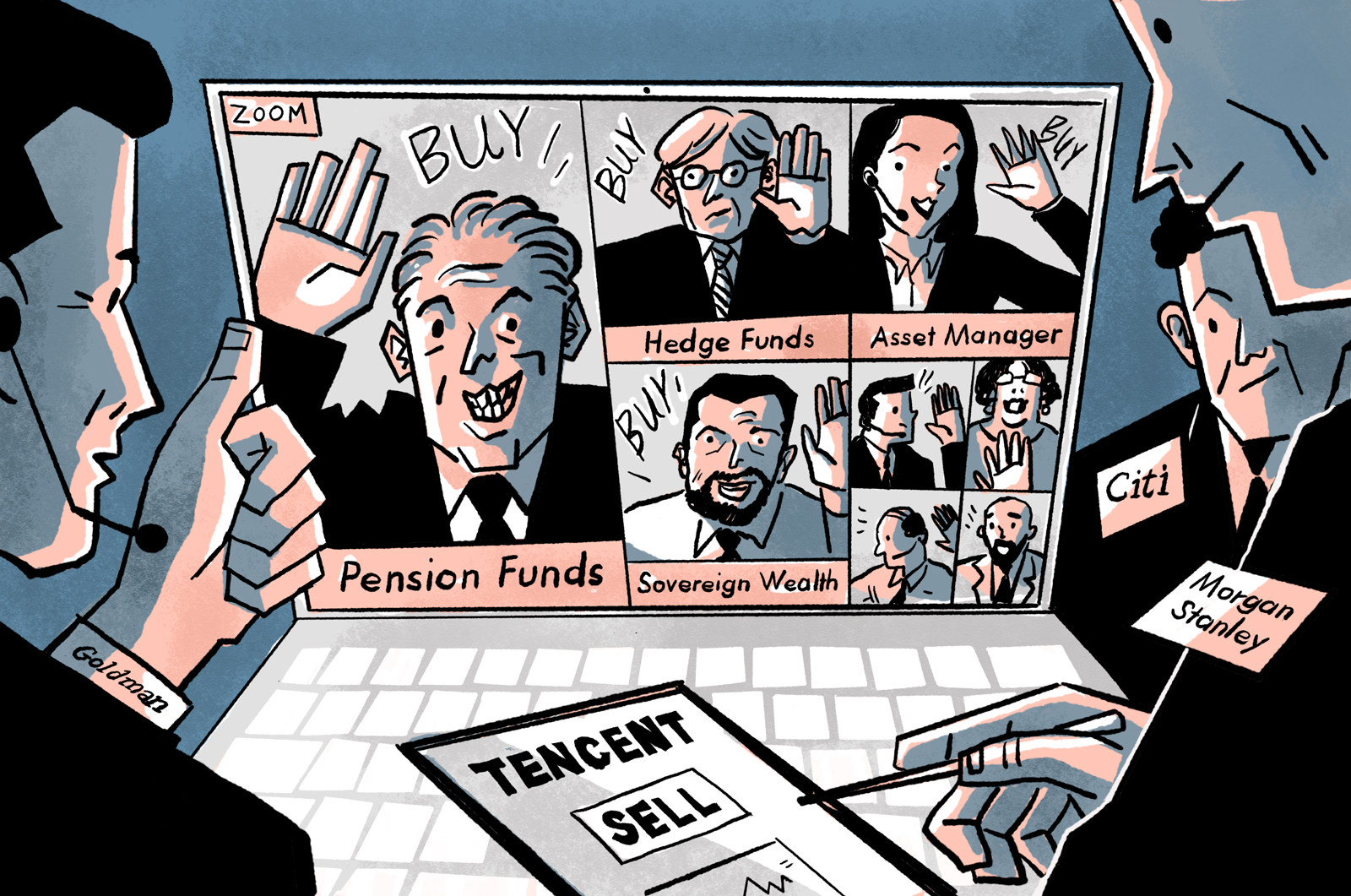

Buoyant trading in the aftermath of the world’s largest overnight block trade shows Hong Kong’s stock market is now deep and liquid enough to rival US and European markets when it comes to digesting big trades in China’s technology champions.

The food-delivery giant sold roughly US$10 billion worth of stock and bonds as investors’ appetite for China technology exposure outweighed fears of an antitrust crackdown.

China’s largest food-delivery platform will use proceeds from the bumper share sale for research and development in areas such as autonomous vehicles and drones.

The deal to acquire Grab, Southeast Asia’s most valuable tech unicorn, would be the biggest acquisition by a special purpose acquisition company (SPAC), and marks a high point in one of the hottest fundraising trends globally since early 2020.

China has tamed the world’s largest fintech and industry disrupter. Here’s how.

China is the world’s second-biggest home for unicorns, as the privately owned companies worth over US$1 billion are called, after the United States.

Airwallex, which counts Tencent and Sequoia among its backers, plans to use the funds to accelerate its global expansion, explore new partnerships and product and engineering innovation.

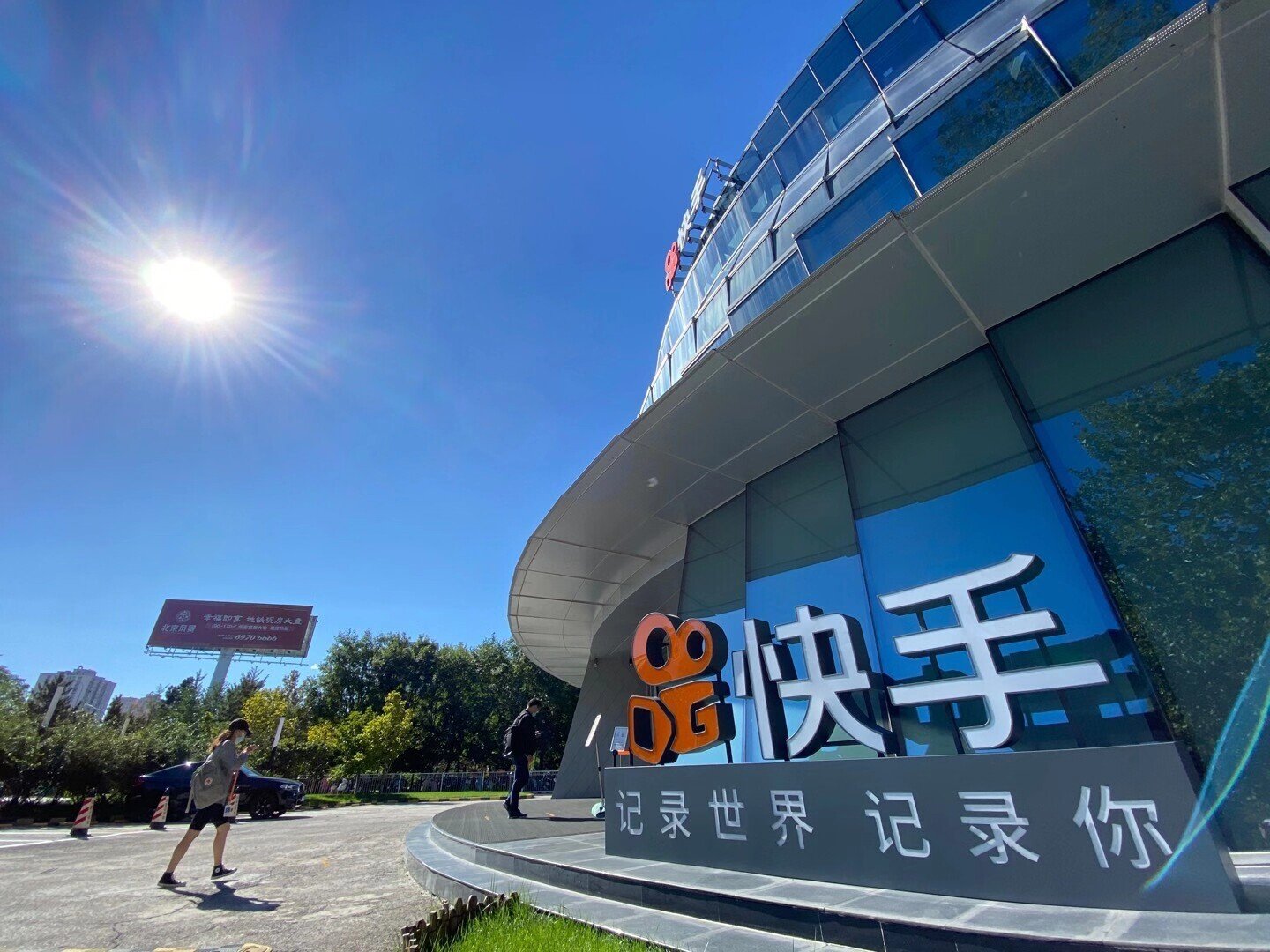

The Chinese version of YouTube raised US$2.6 billion from the stock sale to load more content and boost its ability to make money from gamers on its platform.

French luxury conglomerate Kering has bought about 5 per cent of Vestiaire Collective, boosting the value of the online reseller of Chanel jackets and Prada handbags to more than US$1 billion.

We flag the biggest upcoming fundraising drives by Chinese electric car companies in 2021 and point out the new entrants to watch in the booming industry.

We rank the capital-raising records of major players in China’s electric vehicle market.

The next boss of the world’s most valuable bourse operator will have to navigate between HKEX’s ambitions to be a global marketplace and Beijing’s policy directions.

The appointment comes at a time when new listings and investment funds flowing south from mainland China have swelled the city’s market value to HK$54 trillion (US$7 trillion).

The overwhelming demand for Alibaba’s long-dated bonds is a vote of confidence from fixed-income investors that the firm will emerge relatively unscathed from an antitrust investigation.

Retail investors have bet serious money on the world’s flashiest technology this year, sending in HK$1.3 trillion (US$165 billion) to oversubscribe the IPO by 1,200 times. That’s more than double the cash in circulation in the city.

The bond sale comes after the e-commerce giant reported a 37 per cent surge in revenue for the quarter ended December, lifted by its extended Singles’ Day campaign last year and handily beating analysts’ estimates.

An agreement between Ant Group and the regulators would lift a cloud of uncertainty hanging over the company and from across the financial technology industry.

The e-commerce behemoth is selling up to US$5 billion in debt to investors as analysts brush off the impact of an antitrust crackdown.

The Swiss lender’s Asian arm had a blowout year in 2020, but that may not translate into Wall Street-topping bonuses, says regional boss.

As air travel to one of Asia’s biggest aviation hubs dries up, Cathay Pacific is turning to investors for financial support.

PBOC governor Yi Gang said there needs to be more international cooperation on regulating fintech, particularly regarding the ownership of consumer data.