The company, which is selling 247.7 million shares between HK$17 and HK$19.60 each, will become the first listing of 2026 on January 2.

22 Dec 2025 - 3:28PM videocam

The moves will remove the entry barrier for retail investors and prepare the city’s exchange for a single board lot unit structure.

The reforms are meant to boost liquidity and attract high-quality companies, reinforcing the overall competitiveness of the capital markets.

Bondholders will vote on the revised plan from Thursday to Monday, and it requires over 90 per cent of the total voting rights to take effect.

17 Dec 2025 - 10:50PM videocam

The firm, one of 11 licensed virtual asset trading platforms in Hong Kong, raised US$206 million in the city’s first crypto-native IPO.

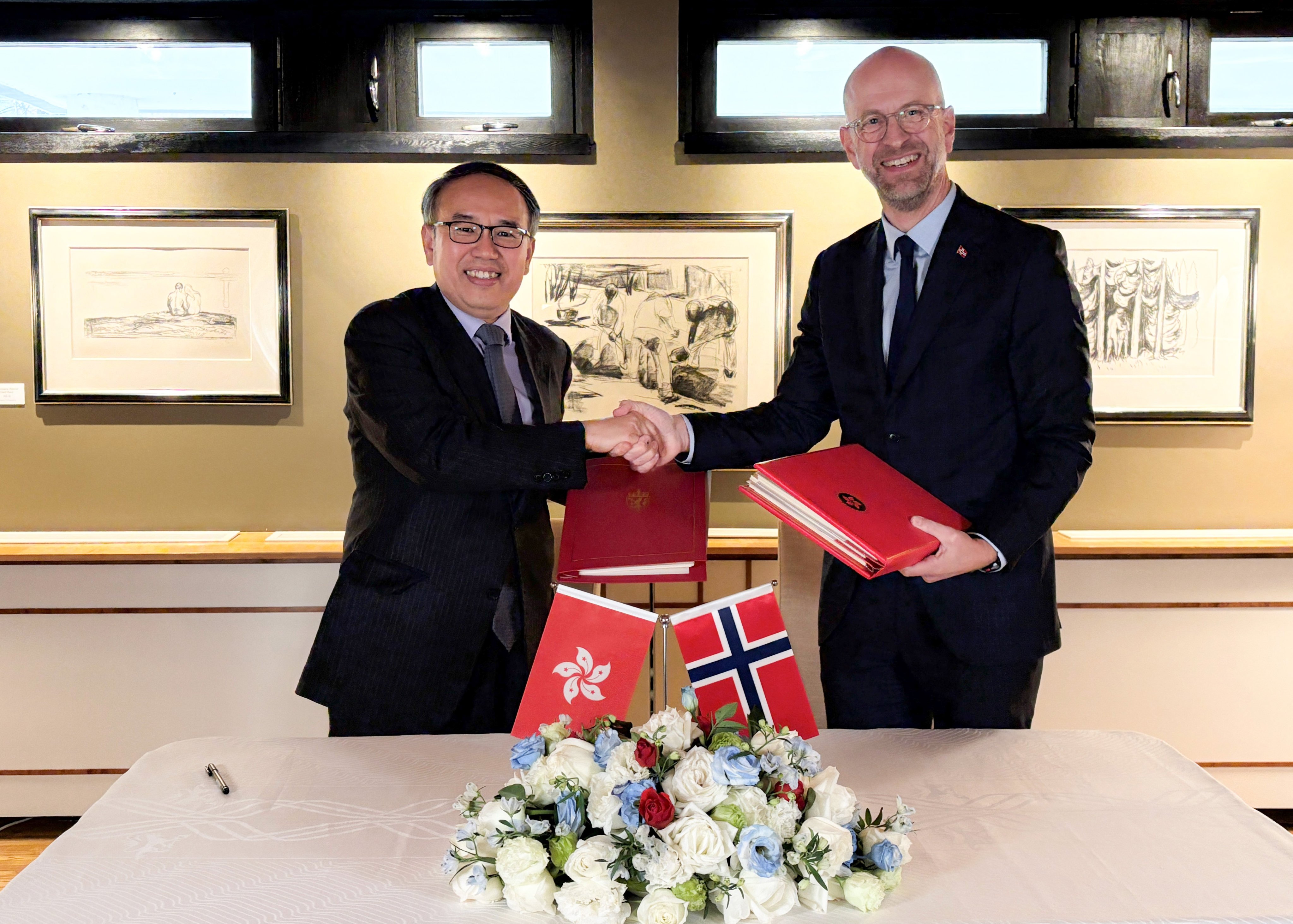

Treasury chief Christopher Hui said the government plans to begin CDTA negotiations with Slovenia and Oman early next year.

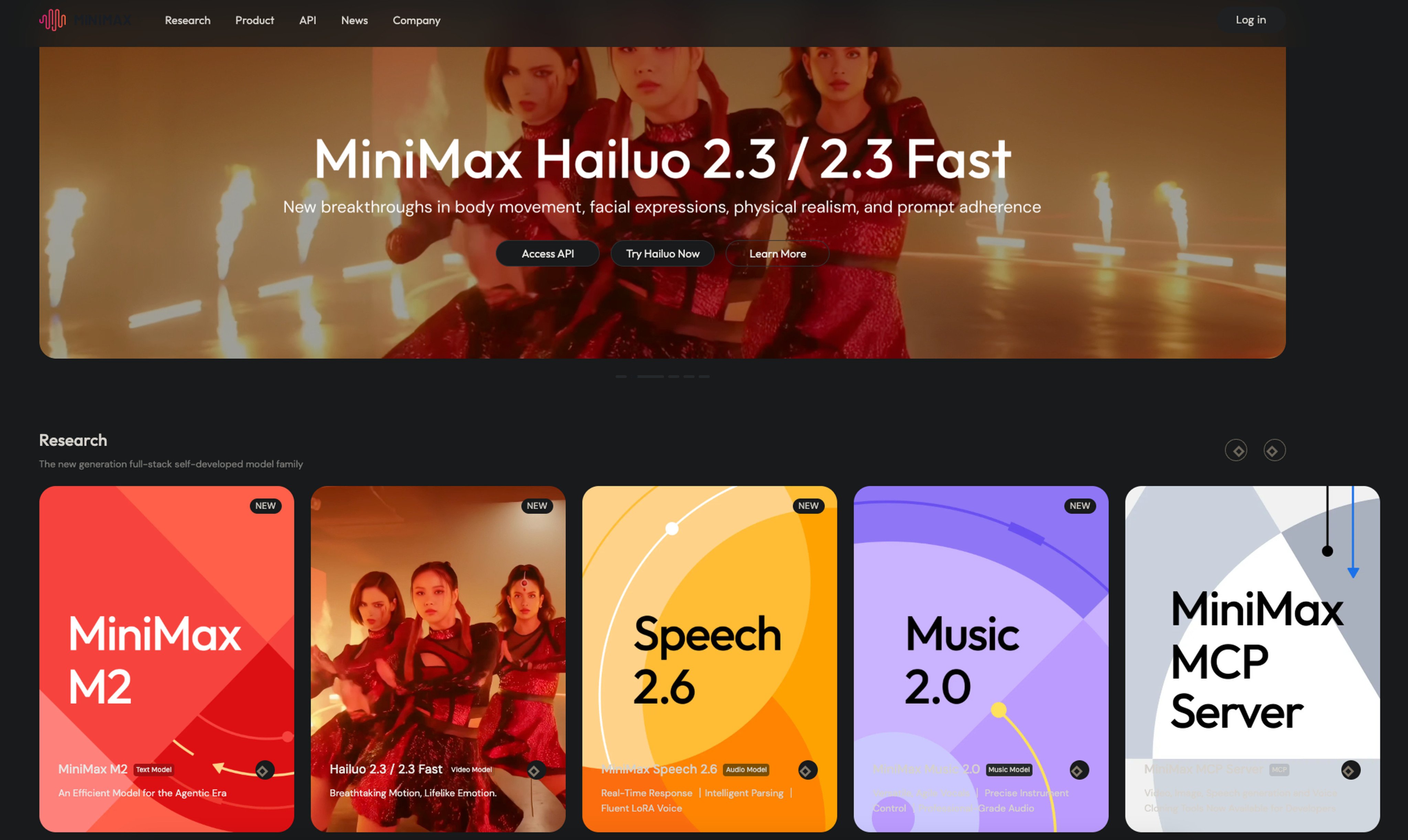

Hong Kong equity market offers platform for mainland Chinese AI firms seeking international investors amid intensifying domestic competition.

By using the ISO 20022 messaging standard, the partners say they can make tokenised deposits interoperable with legacy systems.

It will be a pivotal year for hi-tech listings, which will help cement Hong Kong’s place at the top of global markets, auditing firm says.

JD.com’s latest Hong Kong investment – a half stake in China Construction Bank Tower – will ease balance sheet pressure at Lai Sun.

Asia-Pacific private equity managers are forecasting higher returns and fewer geopolitical risks than peers elsewhere, a new survey finds.

HashKey could raise around US$300 million this month amid Hong Kong’s push to develop its digital asset sector.

Tokenisation provides value, but the interest of multilevel marketers raises ‘genuine concerns’, forum speaker says.

City’s deep, liquid market and low inflation attract issuers amid a structural shift away from the US dollar, analysts say.

Sixth fundraising this year will aid push into industrial manufacturing, a ‘historic opportunity for humanoid robots’, company says.

25 Nov 2025 - 4:22PM videocam

‘World’s first’ global-grade AI infrastructure tokenised fund gives investors access to growing demand from Asean: Tykhe and Skyvast.

Tokenisation could increase the efficiency of corporate treasury centres, which help clients manage global finances, market players say.

AI stock rally is sustainable and tech shares will be driven by application-focused growth, chief China equity strategist Kinger Lau says.

Nearly 20 per cent of Hong Kong businesses preferred Saudi Arabia for supply chain diversification, followed by China at 14 per cent.

Oversubscribed issuance reflects confidence in Beijing’s assets as investors seek rare Asian sovereign exposure, industry players say.

Beijing’s state-led strategy is among governance models shaping AI competitiveness worldwide, think tank Deep Knowledge Group says.

Upbeat equity markets have increased demand for finance professionals, with hiring set to rise by up to 15 per cent next year.

China’s largest private aluminium producer to sell up to 400 million shares for HK$29.20 each, representing a 9.6 per cent discount.

‘Investors hold a lean-forward sentiment because they are underexposed in their portfolios to AI trends in China,’ Mark Fiteny says.

‘We want to be closer to both our investors and the investment opportunities that are presenting themselves here,’ managing partner says.

Listing draws commitments from 18 domestic and international investors and highlights the city’s buoyant market.

The United Arab Emirates is a growing hub for people who come to work, set up family offices and start businesses, bank’s wealth CEO says.

Live transfers of tokenised deposits signal Hong Kong’s shift from proof of concept to production-grade digital-asset settlement.

Fintech-friendly regulations have convinced the bank to anchor its digital-asset ventures in the city, Bill Winters says.

Money mongers at the Global Financial Leaders’ Investment Summit forecast AI would bring massive but uneven benefits for investors.