EU will lose more than it gains by raising tariffs on Chinese EVs

- If the European Union moves forward with tariffs on Chinese electric cars, it could prompt Beijing to retaliate against Europe’s aviation and agricultural sectors

- Instead of undermining world trade, the EU should talk to China to find solutions acceptable to both parties

Officially launched in October to address what the EU has framed as a market distortion resulting from China’s state subsidies, the investigation is widely expected to impose more duties on Chinese EVs.

These tariffs are seen in Brussels as necessary to protect Europe’s automobile industry. However, tariffs are likely to have unintended consequences that outweigh the benefits expected by those who are pushing for them.

Apart from potentially slowing the EU’s switch from gas-reliant vehicles to low-emission alternatives, the tariffs are an invitation for Beijing to retaliate. The bloc is not as innocent as it would like the world to believe when it comes to providing financial support to its industries.

As one of the largest agricultural subsidy programmes in the world, for example, the EU’s Common Agricultural Policy is known for its generosity towards the bloc’s farmers. Between 2014 to 2020, the policy had a budget of €408 billion (US$439.5 billion). For the 2021-27 period, €387 billion has been allocated to the programme.

The generous subsidy has enabled the EU’s agriculture sector to become an export machine. Last year, the bloc exported €14.6 billion worth of agri-food to China, against Chinese imports worth €8.3 billion.

The list of EU products susceptible to China’s retaliation in kind would not be a short one. People who live in glass houses should not throw stones. “There is always some sort of retaliation”, as Volkswagen brand chief Thomas Schäfer pointed out.

Beijing has opposed the EU’s EV sector probe. But when Chinese carmakers are subjected to punitive duties, trade policymakers may feel they have no choice but to retaliate.

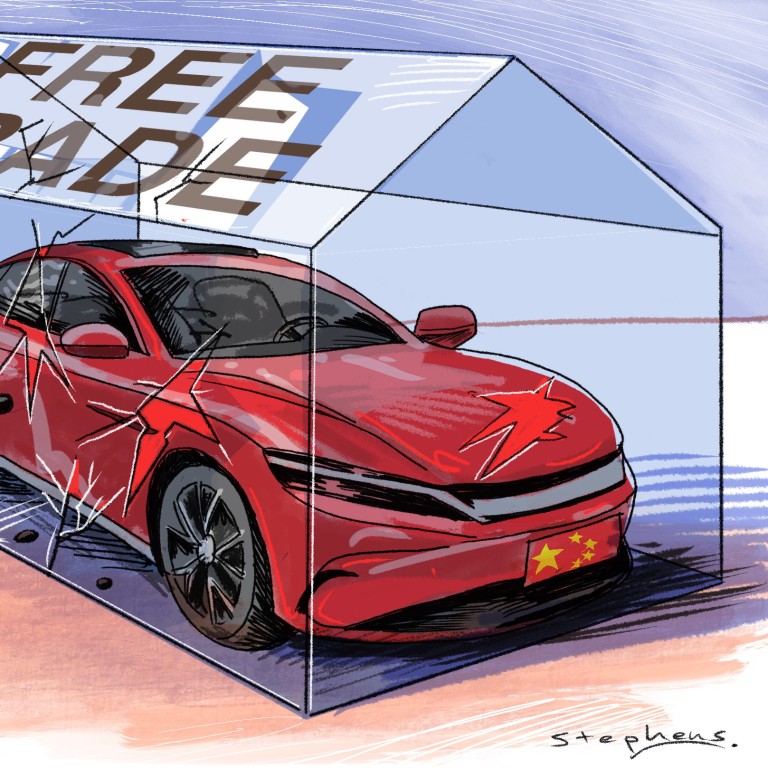

Moreover, imposing tariffs on Chinese EVs would tarnish the EU’s image as an advocate of free trade, not to mention undermine the multilateral trading system.

EU investigations of Chinese companies fall under its foreign subsidies regulation (FSR), which differs from WTO anti-subsidy mechanisms in important ways.

The FSR was designed to make up for supposed deficiencies in the WTO’s rule book and defines subsidies more broadly than the WTO does. Consequently, it is questionable whether some FSR provisions are in line with the WTO’s rules.

In addition, China’s position is that the anti-subsidy probe has failed to follow both WTO procedures and the EU’s own. China was not properly consulted before the investigation began. The exporters included in the EU probe are far from representative, with Tesla, the biggest exporter of EVs from China to the EU, having been excluded.

Moreover, according to the China Chamber of Commerce to the EU, demands were made that proved difficult or impossible for the companies under investigation to meet. Tight deadlines were set for data submission, with requests made for some documents that were beyond companies’ ability to acquire or that would have involved the disclosure of what they might consider sensitive commercial information such as those on suppliers.

As a result, it came as little surprise to many that the EU concluded that there was “sufficient evidence tending to show that imports of the product concerned from [the People’s Republic of China] are being subsidised”, and that there was a risk of EU carmakers suffering injury that is “difficult to repair”.

For its part, China is expected to take the case to the WTO. It is highly likely that the world’s top trade body will rule that the EU’s probe contravenes WTO rules. In that eventuality, the EU’s image on the world stage would be dented.

The EU’s conduct also undermines the integrity and credibility of the WTO. The EU’s growth largely depends on external demand. As a provider of predictability for global trade, the WTO is critical to the EU’s prosperity. Undercutting the multilateral trading system, therefore, threatens to shake the bedrock of the bloc’s future prosperity.

The EU’s concerns for the future of its automobile industry are legitimate and understandable. But Brussels could have addressed them just by sitting down with Beijing to find solutions that are acceptable to both parties.

The good news is that Beijing is prepared to work together with Brussels to settle the trade dispute. The world is now watching to see how the EU will steer its fortunes as well as its economic and commercial ties with China.

Zhou Xiaoming is a senior fellow at the Centre for China and Globalisation in Beijing and a former deputy representative of China’s Permanent Mission to the United Nations Office in Geneva